Last Updated on: April 5th, 2025

Reviewed by Kyle Wilson

If you’re looking for a simple, fast, and reliable way to protect your family from the financial burden of funeral costs, no medical exam burial insurance could be the answer. Many families want peace of mind without the hassle of medical tests or long approval times. This type of insurance offers quick coverage and is especially helpful for seniors or those with health conditions. In this blog, we’ll explain why no medical exam burial insurance is essential for every family and how it can provide security during one of life’s most difficult moments.

Get Free Quotes

Customized Options Await

No medical exam burial insurance is a type of policy designed to help families cover funeral and end-of-life expenses without the need for a medical check-up. It’s simple to apply for, fast to get approved, and gives peace of mind to those who want to leave their loved ones with financial support.

This type of insurance means you can get coverage without going through any physical exam or medical tests. Instead of detailed health screenings, insurers typically ask basic health questions or none at all. It’s a practical solution for people who want quick approval and don’t want to deal with medical appointments.

Traditional burial insurance often involves a longer application process and may require a medical exam to assess your health. No medical exam burial insurance skips that step, making it faster and easier to qualify. While premiums may be slightly higher due to the added risk for insurers, the speed and convenience make it a preferred option for many families.

Most people, including seniors and individuals with health conditions, can qualify for no medical exam burial insurance. Eligibility requirements vary by provider, but many policies accept applicants between the ages of 50 and 85. It’s especially helpful for those who may have been denied coverage elsewhere due to health issues or age.

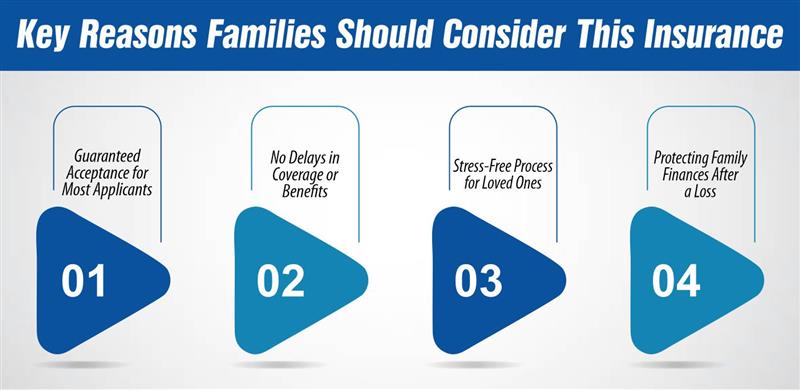

No medical exam burial insurance is more than just a convenient policy—it offers real value for families looking to plan ahead and avoid financial stress during emotional times. Here’s why it’s a smart choice for many households.

One of the top reasons families choose this type of insurance is because it offers guaranteed acceptance. In most cases, applicants are not turned away due to age or health. This gives peace of mind to people who may have been denied coverage elsewhere. It’s especially helpful for seniors or those with serious health issues who still want coverage.

Since there’s no medical exam or lengthy approval process, coverage often starts quickly. Some policies even provide full benefits from day one. This fast approval helps families feel secure, knowing help will be there when it’s needed most. Immediate coverage can make a big difference in times of sudden loss.

This insurance helps remove the burden from family members during a very difficult time. With clear coverage and no complicated steps, loved ones can focus on grieving and healing rather than dealing with paperwork or financial concerns. It simplifies everything during an emotional moment. Families appreciate the ease and clarity it brings during a challenging experience.

Burial expenses can add up quickly, often costing thousands of dollars. Without proper planning, these costs can become a financial strain. Having a policy in place means your family won’t have to dip into savings or go into debt to cover funeral costs. It ensures your loved ones aren’t left with unexpected bills.

Choosing no medical exam burial insurance comes with several important advantages. It’s designed to make things easier, faster, and more accessible—especially for families who want to plan ahead without the stress of medical tests or long approvals. Here are the main benefits that make this type of insurance a smart choice.

One of the biggest benefits is how fast and simple the application process is. There are no medical exams or long forms to fill out. You only need to answer a few basic questions or sometimes none at all. This makes it perfect for people who want hassle-free coverage without long waits or doctor visits.

Many policies offer immediate coverage, meaning your loved ones are protected from day one. This removes the stress of waiting periods and ensures help is available when it’s needed most. Knowing your family won’t be left with financial pressure after your passing provides a strong sense of peace and security.

This insurance is especially helpful for seniors and those with health issues who might not qualify for traditional policies. Since there’s no exam or strict medical screening, it offers a chance to get coverage when other plans may turn you away. It gives people with health concerns an affordable and reliable way to prepare for final expenses.

Determining how much burial insurance coverage your family needs is an important step in planning ahead. The right amount should cover funeral costs, unpaid bills, and provide support for any unexpected expenses. Here’s how you can figure out the coverage amount that works best for your situation.

Funeral expenses can vary depending on where you live and the type of service you choose. On average, funerals in the United States can cost anywhere from $7,000 to $12,000. This includes the funeral service, casket, burial plot, and other related costs. Having enough insurance to cover these expenses ensures your family won’t face financial stress during a difficult time.

Besides funeral costs, other unexpected expenses may arise. These could include unpaid medical bills, credit card debt, or travel costs for family members attending the service. Including a buffer in your policy for these extra expenses can help your family stay financially stable after your passing.

To choose the right coverage amount, add up your estimated funeral costs and any other financial obligations you want to cover. Consider your family’s current needs and how much support they might require. It’s always better to slightly overestimate than to leave them short. An insurance agent can also help you decide on the best amount based on your budget and goals.

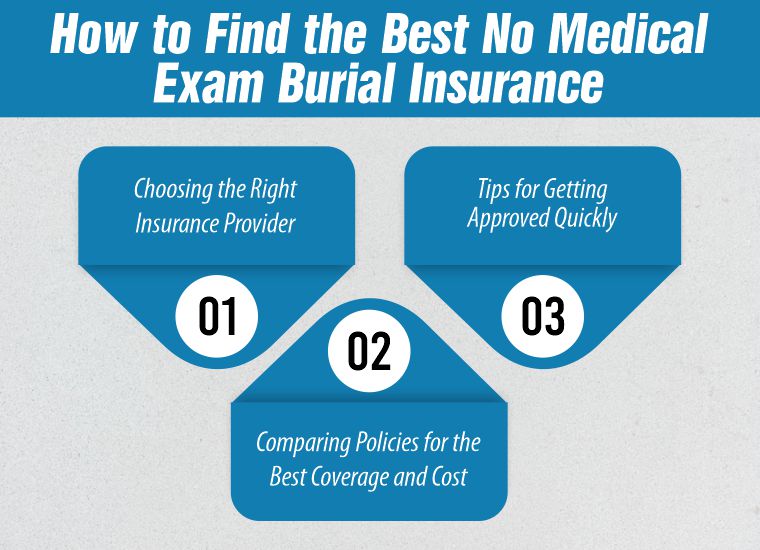

When it comes to finding the right burial insurance policy, not all options are the same. Each insurance company offers different features, pricing, and coverage terms. It’s essential to compare various policies to find the one that meets your family’s needs and fits your budget. Here’s what you should consider when comparing policies.

When reviewing burial insurance policies, you should pay attention to a few key aspects:

Not all insurance providers offer the same quality or pricing for burial insurance. It’s essential to compare the top providers in the market to find the best fit for your needs. Look for reputable companies with a good track record of customer service and timely payouts. Reading online reviews, checking customer satisfaction ratings, and asking for recommendations can help you choose a reliable insurer. Also, consider whether they offer flexibility in premiums, coverage, and ease of the application process.

When purchasing burial insurance, it’s important to avoid some common mistakes that could cost you in the long run:

Taking the time to compare policies and avoid these mistakes will help ensure your family is financially protected when the time comes.

The timing of your burial insurance purchase can significantly affect the premiums you pay and your eligibility for coverage. The earlier you apply, the better your chances of securing affordable rates and comprehensive benefits. Waiting too long can increase the likelihood of facing higher premiums or limited options. Here’s why timing is so important when buying burial insurance.

Delaying the purchase of burial insurance can have serious financial consequences. As you age, the cost of premiums typically increases due to the higher health risks associated with older age. Additionally, waiting too long might limit your options for coverage, especially if your health starts to decline. The longer you wait, the more you may have to pay for the same coverage, or you might find yourself ineligible for certain policies.

Buying burial insurance at a younger age allows you to lock in lower premiums for the duration of the policy. Premiums are often determined by your age and health at the time of application. By applying earlier, you can take advantage of lower rates and avoid price hikes as you get older. This can result in significant savings over time, making it more affordable to maintain your coverage throughout your life.

As you get older, your health may change, and pre-existing conditions can become more prominent. If you wait too long to buy burial insurance, you may face health-related exclusions, higher premiums, or even denial of coverage. By purchasing burial insurance while you’re still in relatively good health, you can avoid these medical surprises and ensure that your family will be protected without additional hurdles or costs.

No medical exam burial insurance offers a fast and stress-free way for families to secure essential coverage without the need for medical exams or health questionnaires. It’s an ideal solution for seniors, individuals with health conditions, and those who want to avoid long waiting periods for benefits. With guaranteed acceptance, quick approval, and flexible coverage options, no medical exam burial insurance provides peace of mind for families, ensuring they won’t have to face unexpected financial burdens during difficult times.

Yes, no medical exam burial insurance often provides coverage for individuals with pre-existing conditions. Many policies are designed to offer protection regardless of your health status. However, the terms and premiums may vary depending on the insurer and your specific health history.

Yes, some insurance providers offer no medical exam burial insurance for seniors over 80. However, the coverage options and premiums may be limited as age can be a factor in determining eligibility. It’s important to compare different policies to find the best fit for your needs.

If you miss a payment, your policy may go into a grace period, during which you can still make the payment without losing coverage. However, if the payment is not made within the grace period, the policy may lapse, and you could lose your coverage. Always check your policy’s terms and stay on top of payments to ensure continuous coverage.

Coverage for no medical exam burial insurance typically lasts for the lifetime of the policyholder, as long as premiums are paid on time. Some policies may offer a limited-term coverage option, but most are designed to provide protection for the duration of your life, offering peace of mind to you and your family.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes