Last Updated on: March 14th, 2025

Reviewed by Kyle Wilson

Losing a loved one is never easy, and the financial burden of funeral expenses can add unnecessary stress during an already difficult time. Immediate burial insurance provides a fast and reliable way to cover these costs, ensuring that your family isn’t left struggling to pay for end-of-life arrangements. Unlike traditional burial insurance, this policy offers instant coverage with no waiting period, giving your loved ones immediate financial support when they need it most. If you want peace of mind knowing your final expenses are taken care of, understanding how immediate burial insurance works is essential.

Get Free Quotes

Customized Options Await

End-of-life expenses can create financial stress for families, making immediate burial insurance a vital solution. This type of insurance ensures that funeral costs are covered without delays, providing peace of mind to policyholders and their loved ones. Understanding how it works and who benefits most from it can help individuals make informed decisions about their final expense planning.

Immediate burial insurance is a type of final expense policy designed to provide instant coverage with no waiting period. Unlike traditional burial insurance, which may have graded benefits or waiting periods, this policy ensures beneficiaries receive the full payout as soon as the policyholder passes away. It is particularly useful for individuals who want quick financial support for their funeral and burial expenses.

This insurance policy functions like a standard life insurance plan but with a specific focus on funeral costs. Once the policy is active, the insurer guarantees an immediate payout upon the insured’s passing, allowing the family to cover expenses such as:

The application process is usually simple, and depending on the provider, it may not require a medical exam. Instead, insurers assess eligibility based on answers to health-related questions.

This type of insurance is ideal for:

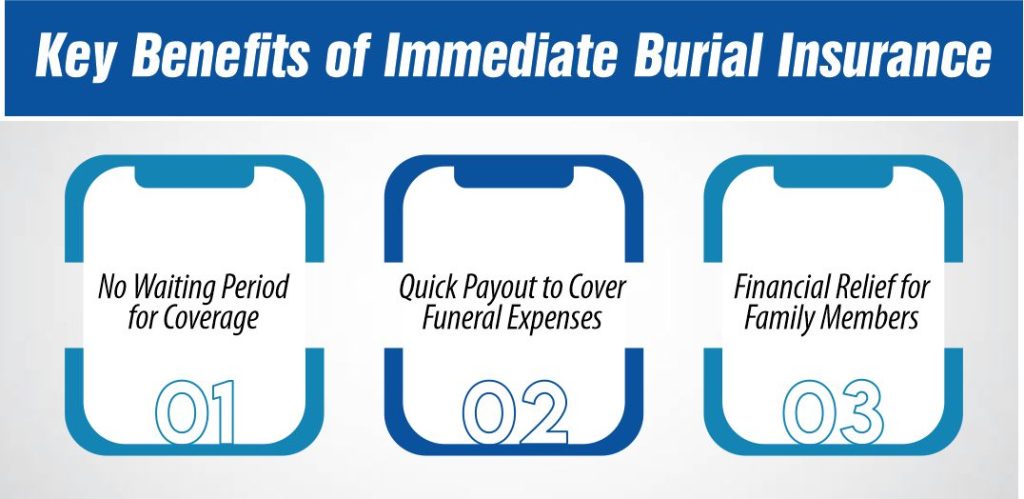

Immediate burial insurance offers crucial financial protection by providing fast access to funds for end-of-life expenses. Unlike traditional policies that may include a waiting period, immediate burial insurance ensures that loved ones receive financial support right away. Below are the key benefits of choosing this type of coverage.

One of the most significant advantages of immediate burial insurance is that coverage starts immediately. This means beneficiaries can access funds without delays, helping to manage funeral costs without financial strain. This type of policy is ideal for individuals with existing health conditions who may struggle to qualify for traditional life insurance.

Funeral costs can add up quickly, often exceeding thousands of dollars. Immediate burial insurance guarantees a rapid payout, ensuring that expenses like burial, cremation, and memorial services are covered without unnecessary delays. This quick access to funds prevents families from having to dip into savings or take on debt to handle final arrangements.

Losing a loved one is emotionally challenging, and unexpected financial burdens can make the situation even more difficult. Immediate burial insurance eliminates the stress of arranging payments, allowing family members to focus on grieving rather than worrying about costs. With a dedicated policy in place, you can ensure that your final expenses are taken care of without placing a financial strain on those you leave behind.

Immediate burial insurance stands out from other policies by offering instant coverage, ensuring that beneficiaries receive funds without any waiting period. To understand its advantages, let’s compare it with other funeral-related insurance options.

Traditional burial insurance often comes with a two-year waiting period before full benefits are available, especially for individuals with health conditions. Immediate burial insurance, on the other hand, offers instant coverage from day one, making it the better option for those needing guaranteed financial protection for final expenses.

Pre-need funeral plans are directly arranged with a funeral home, covering specific services and expenses. However, they do not provide a lump sum payout to beneficiaries. Immediate burial insurance offers more flexibility, as the funds can be used for any end-of-life costs, including medical bills and outstanding debts, in addition to funeral expenses.

Immediate burial insurance may have slightly higher premiums than traditional policies due to its no-waiting-period benefit. However, it provides peace of mind by ensuring immediate financial support. Coverage amounts can vary, so it’s essential to compare different providers and policy terms to find the most affordable plan that meets your needs.

Securing immediate burial insurance is a straightforward process, but understanding the eligibility requirements, medical criteria, and factors affecting approval can help applicants choose the best policy. Unlike traditional burial insurance, immediate burial insurance offers instant coverage, making it an ideal choice for individuals who want to avoid waiting periods.

Most immediate burial insurance policies are designed for seniors and individuals seeking fast coverage without complex underwriting. While age limits may vary by insurer, policies are typically available to applicants between 50 and 85 years old. Additionally, applicants should be legal U.S. residents and able to pay the required premiums.

One of the key benefits of immediate burial insurance is that it often comes with no medical exam. However, applicants may still need to answer a few health-related questions. While these policies are more lenient than traditional life insurance, insurers may inquire about recent hospitalizations, terminal illnesses, or high-risk conditions. Those in relatively good health may receive better rates.

Several factors can impact an applicant’s approval and policy premiums, including:

By understanding these factors, applicants can find an affordable immediate burial insurance policy that provides fast and reliable coverage for their loved ones.

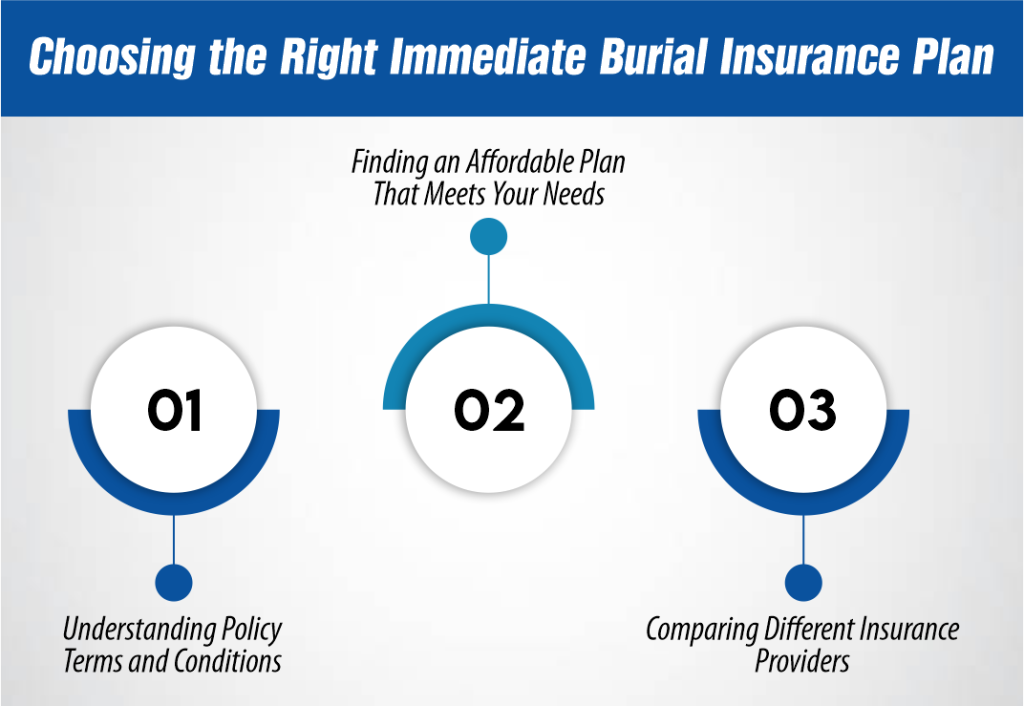

Selecting the best immediate burial insurance plan requires careful evaluation of policy terms, affordability, and provider reputation. With many options available, understanding the fine print and comparing plans can help ensure that your loved ones receive the financial support they need without delays or complications.

Before purchasing an immediate burial insurance policy, it’s essential to review the terms and conditions to avoid unexpected limitations. Key aspects to consider include:

Cost is a significant factor when choosing a burial insurance policy. To find an affordable plan that meets your needs, consider the following:

Different insurers offer varying rates, benefits, and customer service experiences. When comparing providers, consider:

By carefully analyzing these factors, you can choose a reliable and affordable immediate burial insurance plan that provides peace of mind and financial security for your loved ones.

Applying for immediate burial insurance is a straightforward process, but understanding the steps, required documents, and the role of an insurance agent can help streamline your application. Since this type of policy is designed for quick approval and payout, following the right approach ensures you get the coverage you need without unnecessary delays.

To secure an immediate burial insurance policy, follow these steps:

When applying for immediate burial insurance, be prepared to provide:

An insurance agent can help you navigate the process and find the best burial insurance provider for your needs. Here’s why working with an agent is beneficial:

Immediate burial insurance provides fast financial relief for families during a difficult time. With no waiting period and quick payouts, this coverage ensures that your funeral costs are covered without burdening loved ones. By understanding the application process, preparing necessary documents, and consulting with an agent, you can find the best policy to secure your final expenses.

The cost of immediate burial insurance depends on factors like age, health status, and coverage amount. Premiums typically range from $50 to $150 per month for a policy with a $10,000 to $25,000 death benefit.

Yes, many insurers offer guaranteed issue policies with no medical exam, making immediate burial insurance accessible for seniors with pre-existing conditions.

Yes, beneficiaries can use the death benefit for any expenses, including medical bills, outstanding debts, or living expenses, depending on their financial needs.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes