Last Updated on: March 21st, 2025

Reviewed by Kyle Wilson

Thinking about what happens after we pass away isn’t easy, but planning ahead can save our loved ones from financial stress. If someone dies without immediate burial insurance, their family may struggle to cover funeral costs, leading to delays or unexpected debt. Funerals can be expensive, and without a plan in place, families often turn to personal savings, loans, or even crowdfunding.

Get Free Quotes

Customized Options Await

Immediate burial insurance is a type of policy that provides quick financial assistance to cover funeral and burial expenses. Unlike traditional life insurance, these policies do not have a waiting period, meaning the full death benefit is available as soon as the policyholder passes away. This ensures that families can cover final expenses without delays or financial strain.

Immediate burial insurance is a type of final expense insurance designed to pay for funeral, cremation, or burial costs without a waiting period. Unlike some policies that require a waiting period before benefits are paid out, this insurance provides instant coverage from day one. It is typically a whole life policy with smaller coverage amounts, making it easier to qualify for.

Funeral costs can add up quickly, with expenses including caskets, burial plots, transportation, and memorial services. Immediate burial insurance ensures these costs are covered so that families don’t have to rely on savings or loans. Since the payout is quick, loved ones can access funds without delay, reducing financial stress during an already difficult time.

This type of insurance is ideal for individuals who do not have savings set aside for funeral expenses or who want to protect their family from financial burdens. It is especially beneficial for seniors, people with pre-existing conditions, and those who may not qualify for traditional life insurance. By securing a policy, policyholders can have peace of mind knowing that their final expenses will be taken care of without putting a strain on their loved ones.

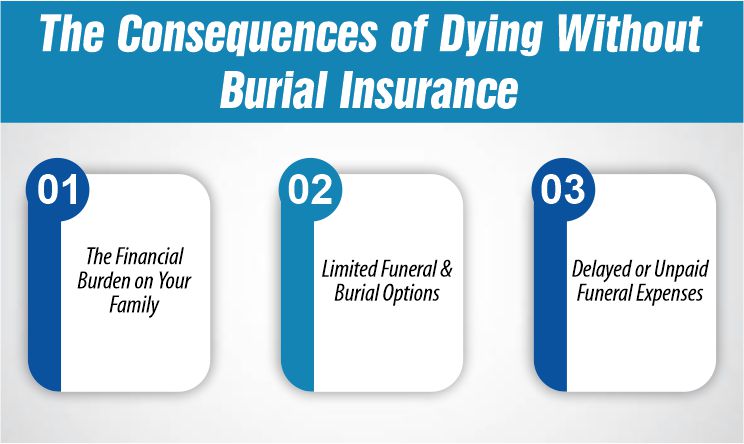

Not having burial insurance can create significant financial and emotional challenges for your loved ones. Funerals can be costly, and without a policy to cover expenses, families may struggle to afford a proper farewell. From unexpected financial burdens to limited service options, here’s what can happen when someone passes away without burial insurance.

Funeral expenses can range from several thousand to tens of thousands of dollars. Without burial insurance, the responsibility of covering these costs falls on your family. Loved ones may have to use their savings, take out loans, or even rely on crowdfunding to pay for final arrangements. This unexpected financial strain can add stress to an already difficult time.

Without burial insurance, families may have to choose lower-cost funeral arrangements due to financial limitations. This could mean opting for direct cremation instead of a traditional burial, skipping memorial services, or forgoing certain final wishes. Many families are forced to make difficult compromises that may not fully honor their loved one’s memory.

When there are no funds set aside for a funeral, families may struggle to pay for necessary services on time. Funeral homes typically require payment upfront, and if the funds are unavailable, delays can occur. In some cases, unpaid expenses can lead to legal or financial complications, making it even harder for families to find closure.

If you don’t have burial insurance, there are still ways to cover funeral expenses. While these alternatives may not be as reliable as having a dedicated policy, they can help ease the financial burden on your loved ones. Here are some common options families use to pay for funeral costs.

Some people set aside money specifically for funeral costs in a savings account. While this can be a helpful approach, it requires careful planning to ensure there are enough funds when needed. Additionally, unexpected expenses or medical bills could reduce these savings over time, leaving your family with a financial gap.

Many families turn to relatives for financial support when funeral expenses arise. However, not all families have the means to contribute, and asking for help during an emotional time can be stressful. Crowdfunding platforms like GoFundMe have become a popular way to raise money for funerals, but success is not guaranteed, and it may take time to collect enough funds.

In some cases, government programs and nonprofit organizations provide financial assistance for funeral expenses. Social Security offers a small death benefit to eligible survivors, and certain states have burial assistance programs for low-income families. Additionally, some churches and charities may provide financial support or low-cost burial options. However, these programs often have strict eligibility requirements and may not cover the full cost of a funeral.

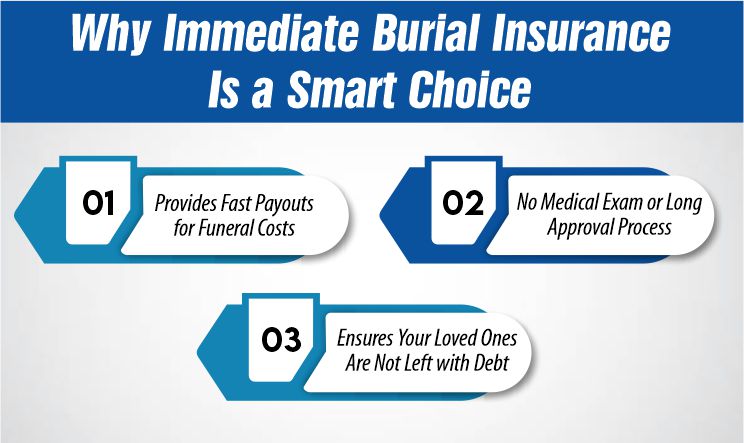

Choosing immediate burial insurance is a responsible way to ensure that your loved ones are not burdened with funeral costs. This type of insurance offers quick financial support, making it a practical solution for those who want to plan ahead. Here’s why it’s a smart choice:

Immediate burial insurance is designed to pay out quickly, often within days of the claim being filed. This ensures that funeral expenses, such as burial, cremation, and service costs, are covered without delay. Families won’t have to struggle to come up with funds or wait for lengthy insurance processes.

Unlike traditional life insurance, immediate burial insurance does not require a medical exam. Many policies offer guaranteed acceptance, meaning even those with pre-existing conditions can qualify. The application process is simple, with approvals often granted within a few days. This makes it an ideal option for seniors or individuals with health concerns.

Funeral expenses can cost thousands of dollars, and without proper planning, these costs can fall on family members. Immediate burial insurance provides financial security by covering these expenses, ensuring that your loved ones don’t have to take out loans, use credit cards, or deplete their savings to pay for your final arrangements.

Planning ahead for funeral costs can help your loved ones avoid financial stress. Immediate burial insurance provides a quick payout to cover expenses, ensuring your family isn’t left with debt. Here’s how to secure a policy before it’s too late:

Start by researching insurance companies that offer immediate burial insurance. Look for providers with strong customer reviews, high financial stability ratings, and a history of fast claim payouts. Comparing different insurers can help you find a reliable option with the best coverage.

Funeral insurance policies vary in cost based on coverage amounts, age, and health status. Choose a policy that covers essential expenses without exceeding your budget. Opting for a smaller coverage amount or selecting a policy with flexible payment plans can help keep premiums affordable.

Since immediate burial insurance often comes with no medical exam requirements, the application process is simple. To avoid delays, ensure you have all necessary documents ready, such as identification and payment information. Working with an insurance agent can also speed up the process and help you find the best deal.

Dying without burial insurance can leave your family struggling to cover funeral costs, adding emotional and financial stress during an already difficult time. Without a policy in place, loved ones may have to rely on personal savings, loans, or crowdfunding to manage expenses. Immediate burial insurance is a simple and affordable way to ensure your final expenses are covered. It provides fast payouts, helping your family avoid financial hardship. Taking action now can give you and your loved ones peace of mind, knowing that everything is taken care of when the time comes.

If your family cannot afford a funeral, they may have to seek assistance from government programs, charities, or crowdfunding. In some cases, local authorities may arrange a basic burial or cremation.

Yes, certain government programs, such as Social Security benefits and local assistance programs, may offer financial aid for funeral expenses. However, these funds are often limited and may not cover the full cost.

Alternatives include setting up a funeral savings account, prepaying for funeral services, or using crowdfunding platforms. However, these options may not provide the immediate financial support that burial insurance offers.

No, many insurance companies offer guaranteed acceptance burial insurance, which does not require a medical exam. These policies may have higher premiums but provide essential coverage for those with health conditions.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes