Last Updated on: March 27, 2025

Reviewed by Kyle Wilson

Are you worried about safeguarding your loved ones and ensuring their secure future? In today’s fast-paced world, protecting your family’s well-being in the USA has become more crucial. From health insurance to financial planning, the layers of family protection are vast and varied. But where do you start?

Let’s dive into our comprehensive USA family protection reviews, where we simplify the complex world of family protection. From insurance secrets to financial safety nets, we have the insights to help you make informed decisions. Let’s Join us in ensuring you can confidently secure your family’s future easily and clearly.

Customized Options Await

A USA family protection company specializes in offering services and products designed to safeguard families against various risks, ensuring their financial stability, health, and overall well-being. These companies typically provide a comprehensive suite of solutions tailored to meet the diverse needs of families at different stages of their lives. Here’s an overview of USA family protection reviews offer:

Insurance Products: These core offerings include life insurance, health insurance, disability insurance, and long-term care insurance. The aim is to protect families from the financial burdens associated with health issues, disabilities, and the death of a family member.

Financial Planning Services: Many family protection companies go beyond insurance to offer financial planning services. This can include retirement planning, education savings plans (such as 529 plans), and investment advice to help families secure their financial future.

Legal Protection: Some USA family protection reviews provide access to legal services, including estate planning, wills, and trusts. These services ensure a family’s assets are protected and passed on according to their wishes.

Emergency and Disaster Preparedness: With the increasing occurrence of natural disasters, some companies offer services and products to help families prepare for and recover from emergencies. This can include emergency savings plans and advice on physical preparedness.

Identity Theft Protection and Cybersecurity: Recognizing the growing threat of cybercrime, family protection companies often offer services to safeguard personal and financial information online. This can include monitoring services and support in case of identity theft.

Home and Auto Insurance: To protect families’ assets, these companies often provide or partner with providers of home and auto insurance, offering coverage for damage, theft, and other liabilities.

Child and Elderly Care Solutions: Some family protection companies address the specific needs of caring for young children or elderly family members. This can include advice on choosing appropriate care facilities, insurance products to cover care costs, and legal services related to guardianship.

USA Family Protection reviews aim to be a one-stop-shop for families seeking security and peace of mind. By offering a wide range of products and services, these companies strive to address the unique challenges and risks that families face today, providing tailored solutions that ensure their protection and financial well-being.

While USA Family Protection reviews may seem like an all-American company selling life insurance, they are under the Swiss Fortune 500 company Swiss Re. Swiss Re owns IptiQ, headed by Niels Keuker, who also owns USA Family Protection and Lumico Insurance. Swiss Re is headquartered in Zurich, Switzerland, and has a global presence with companies and subsidiaries worldwide. Swiss Re has been around since the 1800s, but USA Family Protection and Lumico Insurance are only 6 years old.

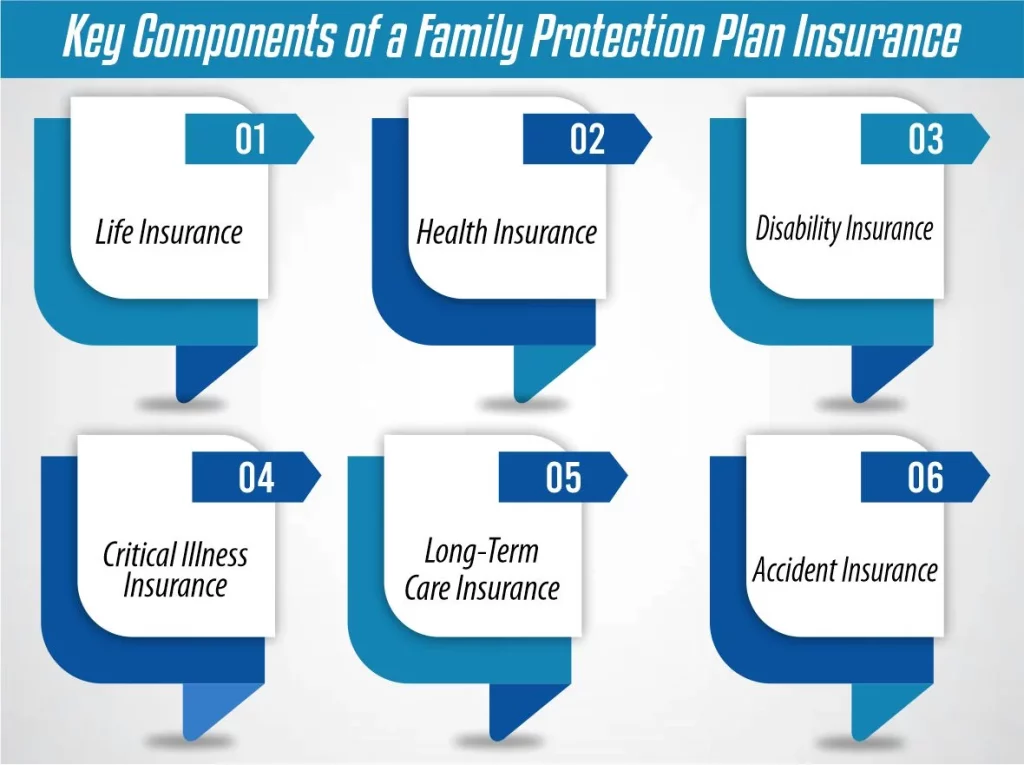

Family Protection Plan Insurance is a comprehensive insurance policy designed to offer a safety net for families by covering a range of potential risks and events that could impact their financial stability and well-being. Unlike individual insurance policies that focus on specific areas such as life, health, or property, a family protection plan takes a more holistic approach, bundling various types of coverage to address the needs of all family members. This plan is tailored to ensure that families can maintain their standard of living, manage expenses, and safeguard their future in the face of adversity.

Life Insurance: Provides financial support to beneficiaries in the event of the policyholder’s death, helping to cover living expenses, debts, and future needs like education.

Health Insurance: Covers medical expenses for illnesses, injuries, and preventive care, ensuring families can access healthcare without significant financial burden.

Disability Insurance: Offers income replacement if a family member cannot work due to a disability, maintaining the family’s financial flow during difficult times.

Critical Illness Insurance: Provides a lump sum payment upon diagnosis of certain critical illnesses, helping to cover out-of-pocket medical costs and lost income.

Long-Term Care Insurance: Covers the cost of long-term care services, which may be needed due to age, illness, or disability, protecting family assets from being depleted by these expenses.

Accident Insurance: Offers additional coverage for expenses arising from accidental injuries, supplementing health insurance benefits.

Final Expense Insurance, often a critical component of a comprehensive family protection plan in the USA, is designed to alleviate the financial burden of end-of-life expenses. This type of insurance policy specifically aims to cover costs that arise at the time of a person’s passing, including funeral expenses, outstanding medical bills, and any other debts that traditional life insurance policies might not cover. Here’s a detailed look at Final Expense Insurance and its significance for families in the USA:

Final Expense Insurance is a type of whole life insurance policy with a smaller coverage amount, typically $2,000 to $50,000. Unlike traditional life insurance policies that may require a medical exam and extensive health questions, Final Expense Insurance often has a more straightforward application process, with many policies offering guaranteed acceptance for individuals within specific age brackets.

Simplified Issue: Most Final Expense Insurance policies do not require a medical exam, making it accessible for older adults or those with health issues.

Fixed Premiums: Premiums usually remain constant throughout the policy’s life, ensuring affordability and predictability for policyholders.

Cash Value: As a form of whole life insurance, these policies can accumulate cash value over time, which can be borrowed against if needed.

Immediate Payout: Beneficiaries typically receive the death benefit promptly, allowing for quick payment of funeral and other final expenses.

USA family protection plans, encompassing a range of insurance and financial products designed to safeguard families from various risks, offer several advantages and disadvantages. Here’s a concise overview:

USA family protection plans offer substantial benefits, particularly in terms of comprehensive coverage and financial security, but they also have drawbacks, including strict underwriting and customer service issues. When considering a family protection plan, it’s crucial to research providers, read policy details carefully and consider your family’s specific needs and circumstances.

The rating of USA Family Protection vary widely depending on the specific insurer, the type of protection plan, and the criteria used for evaluation (such as customer service, financial stability, and coverage options). It’s essential to consult specific rating agencies like A.M. Best, Standard & Poor’s, or customer review platforms for up-to-date and accurate ratings.

A Family Income Policy provides beneficiaries a steady income after the policyholder’s death, aiming to replace lost earnings. In contrast, a Family Protection Policy offers a broader range of coverage, including life, health, and possibly other insurances, to safeguard against various risks affecting the family’s financial stability.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes