Last Updated on: March 21, 2025

Reviewed by Kyle Wilson

When someone wants to choose between the blanket health insurance and group insurance policies or may need insurance , then it comes to getting the best coverage for your business or yourself, knowing the difference between these two may solve all the confusions . Now let us describe it.

Difference between group Insurance and blanket health Policies are Group insurance and blanket health insurance are mostly the both use for different groups like for company group insurance will be the best, and for schools , universities and athletic.

Choose the ideal insurance for your organisation or yourself more easily if you are aware of these distinctions.

Customized Options Await

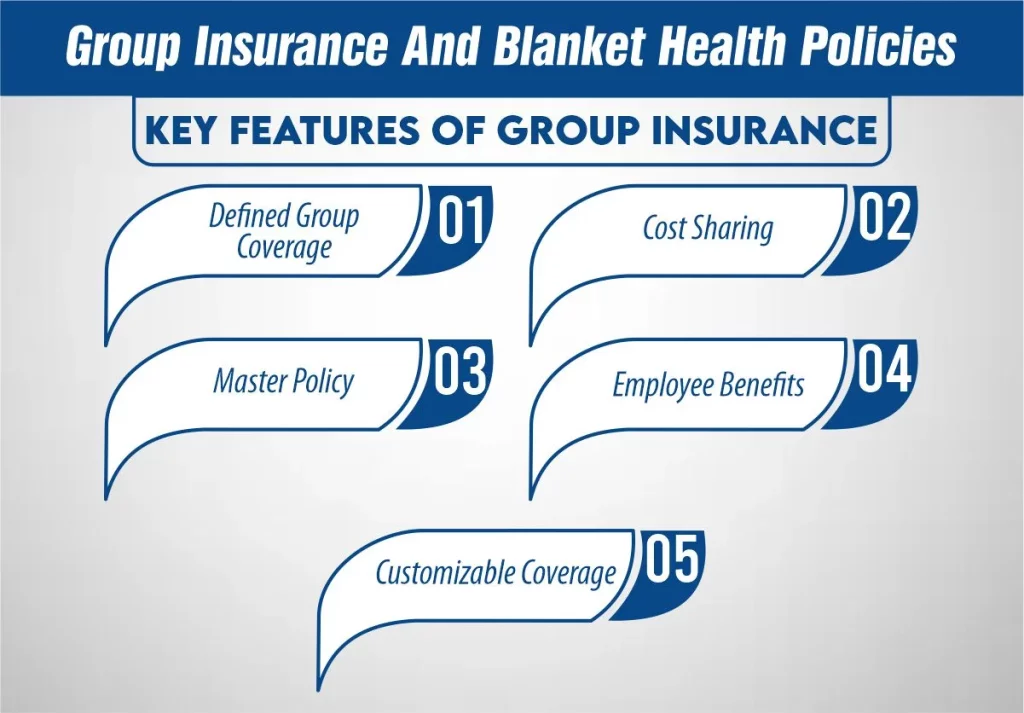

A specific set of people, usually employees or members of an organization, are protected by group insurance. This coverage is often offered by employers as a component of benefit packages for employees. Group insurance plans are made to cover a number of people under one main policy, which can save money for the addressed group as well as the insurer. Health, life, disability, and dental insurance are a few kinds of group insurance. Group insurance is a cost-effective technique to cover a large number of individuals for insurance as the employer and employees often equal the cost of the insurance.

Eligibility criteria for group health insurance plans vary by insurance company, but common requirements include:

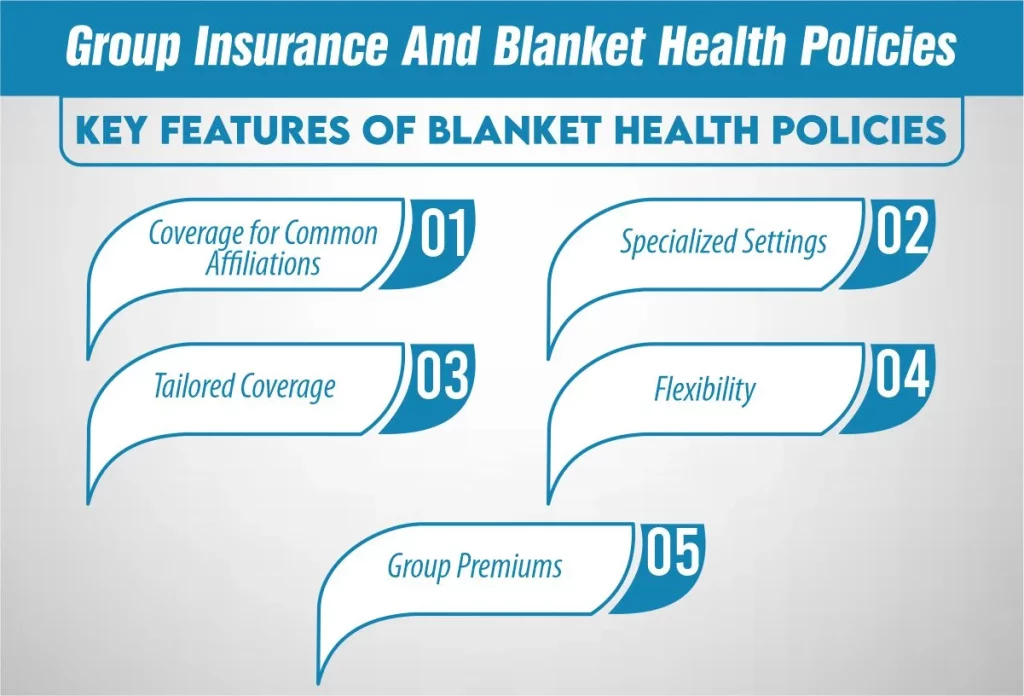

Plans of insurance called “blanket health policies” guarantee people who may not be employees of the firm or members of a company but who have a similar interest or activity. Special situations, like schools, sports teams, or travel groups, often use these rules. compared to group insurance, which usually covers workers for a single employer, blanket health policies cover people who could have various workplaces or relationships but are connected by a shared passion or activity.

Blanket health policies offer broader coverage and can include benefits such as medical expense coverage, accidental death and dismemberment coverage, and emergency medical evacuation coverage. the difference between group Insurance and blanket health Policies and These policies are tailored to the group’s specific needs and may offer coverage options and benefits flexibility. Premiums for blanket health policies are usually based on factors such as the group size, the level of coverage selected, and the nature of the activities or affiliations covered.

Eligibility criteria for blanket health insurance policies are often more flexible than group health insurance plans. Some common requirements include:

Pros

Cons

Pros

Cons

On the difference between group insurance and blanket health policies – particularly one that includes the Essential Health Benefits (EHBs) mandated by the Affordable Care Act (ACA) – does not have a dollar limit on what it will pay for care received by you and your employees while you are insured. The ACA prohibits health insurers from limiting your annual or lifetime coverage expenses for EHBs under a Group Health plan.

In addition, a Group Health policy typically covers you for a complete plan year (12 months). If you want long-term coverage, a Group Health policy may be a better choice since a Blanket Health policy may have a limited duration.

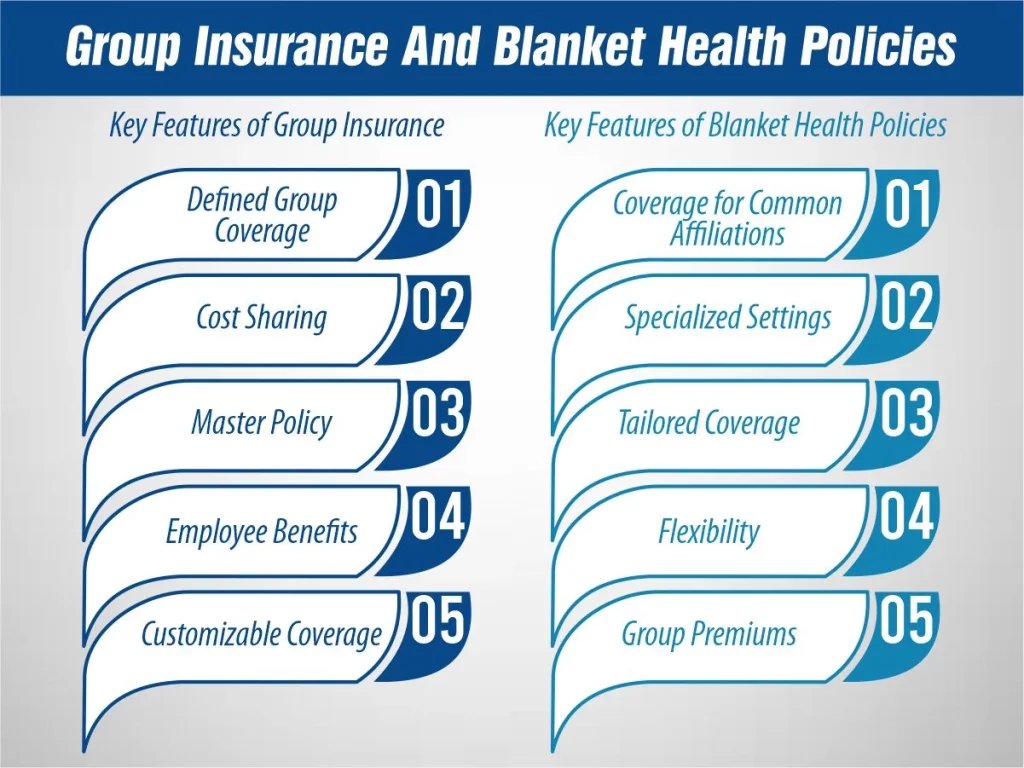

In conclusion, while group insurance and blanket health policies provide coverage for a group of individuals, the difference between group Insurance and blanket health Policies is significant in their scope and administration. Group insurance typically offers customized coverage tailored to the needs of a specific group, whereas blanket health policies offer broader coverage with less individualized attention. Understanding these differences is crucial for effectively selecting the most suitable insurance option for the intended group’s needs.

the difference between group Insurance and blanket health Policies are Group insurance always covers a defined group, like employees, offering standardised benefits. At the same time, blanket health policies provide tailored coverage for diverse groups, like students or sports teams, based on common affiliations or activities.

A blanket policy in health insurance provides customized coverage for groups with shared affiliations or activities, such as schools or sports teams, ensuring all members have access to essential health benefits.

Blanket policies are issued to groups with shared affiliations or activities, such as schools or sports teams. In contrast, group policies are typically issued to defined groups like employees of a company or members of an organisation

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.