Purple Cross Burial Insurance: A Complete Guide to Peace of Mind

Last Updated on: March 13, 2025

Reviewed by Kyle Wilson

- Licensed Agent

- @ Burial Senior Insurance

Planning for the future is one of the most responsible steps you can take to ease the financial burden on your loved ones. Purple Cross Burial Insurance is specifically designed to cover funeral and burial expenses, providing security during an already challenging time. This guide explores everything you need to know about Purple Cross Burial Insurance, from its benefits to frequently asked questions.

Get Free Quotes

Customized Options Await

What is Purple Cross Burial Insurance?

The Purple Cross Burial Insurance is a specific creation, developed for fulfilling the burial, funeral, and other final expenses upon departure. Unlike other life insurance, which serves to pay a wide spectrum of financial needs, this plan addresses specifically the expenses involved when saying goodbye to your loved one. It presents lower coverage amounts that perfectly match those needs, so your family will not be left grappling with surprise bills. Its fixed premiums never change, coverage begins right away upon the commencement of the policy, and no medical exams are required for its purchase- Purple Cross Burial Insurance is a straightforward, reliable way to plan and provide shelter for your loved ones from economic stress at a time when they badly need it.

Key Features of Purple Cross Burial Insurance

Purple Cross Burial Insurance is a simple, hassle-free coverage of post-mortem expenses. Highly attractive features explain why it has become an ideal insurance for protecting and covering one’s loved one in case the latter bears the financial burden of the burial expense. The features are discussed as follows:

Fixed Premiums

Probably, the best feature that makes Purple Cross Burial Insurance attractive is fixed premiums. Once you activate this insurance, you will certainly know that the amount you are going to pay them will not increase with time. This means that the premium you have started with on the first purchase of your policy will remain the same even as you age or if the nature of your health changes.

Set premiums make budgeting on a policy very straightforward over time. You won’t experience any surprises in the form of increased costs. This means you can have better peace of mind and consistency of plans with finances. It is particularly valuable for seniors on a fixed income, who can count on knowing the affordability of their insurance payments.

Guaranteed Acceptance

The other major benefit of Purple Cross Burial Insurance is its guaranteed acceptance. You will not be required to undergo any medical exams or undergo extensive health-related questions to qualify for the coverage.

Provided that you fall within this age range, usually 50 years old and above to up to 85 years of age, almost everybody will get approved. It further offers individuals relief from the stress that is associated with fearing denial because of medical problems or a history of medical conditions and further denies an individual the chance of obtaining traditional life insurance.

Immediate Coverage

With Purple Cross Burial Insurance, coverage can start right away as soon as your policy is approved and issued so that your family can be financially protected right away.

Even if you die shortly after purchasing the insurance policy, the beneficiary receives the full sum assured. This is very convenient for people in situations where fast, sure insurance needs to be covered. It gives consumers peace of mind instantly because, even if something unexpected happens, your family will not have to strain to pay funeral costs.

Coverage Amounts

Purple Cross Burial Insurance covers amounts that are specifically aimed at final expenses. It usually offers policies for $5,000 and $25,000, mostly to cover the typical expenditure in funeral and burial services.

This amount is sufficient to pay for essentials like:

- A casket or urn

- Burial or cremation services

- Funeral home fees

- Cemetery plot and headstone

- Transportation and other related costs

So, for not to be a replacement for life insurance but surely supplement other more extensive coverage, the targeted insurance will always ensure there are final arrangements made without the burden on loved ones.

Cash Value Growth

Purple Cross Burial Insurance pays a death benefit upon your death but also accumulates cash value over time. Part of the premiums you pay is being put in a pool that grows at a constant rate over time.

This cash value is often seen as a savings account in your policy. Should you be faced with a financial emergency or come across some unforeseen expenses, you may be able to borrow against this. However, you would recall that the loan would decrease the death benefit unless it is being repaid.

This feature adds a further layer of financial flexibility and your policy becomes an effective tool not only for the future but also for possible requirements during your lifetime.

Portability

Life is unpredictable and may sometimes find you relocating to a different state or even another country. Here, with Purple Cross Burial Insurance, your coverage cannot be attached to where you live.

It doesn’t matter where you shift; your policy will remain active as well with the same benefits. The portability of your policy will make sure that your loved ones always have financial security, no matter where you go. The benefit is pragmatic and reassuring for those who value flexibility and long-term reliability.

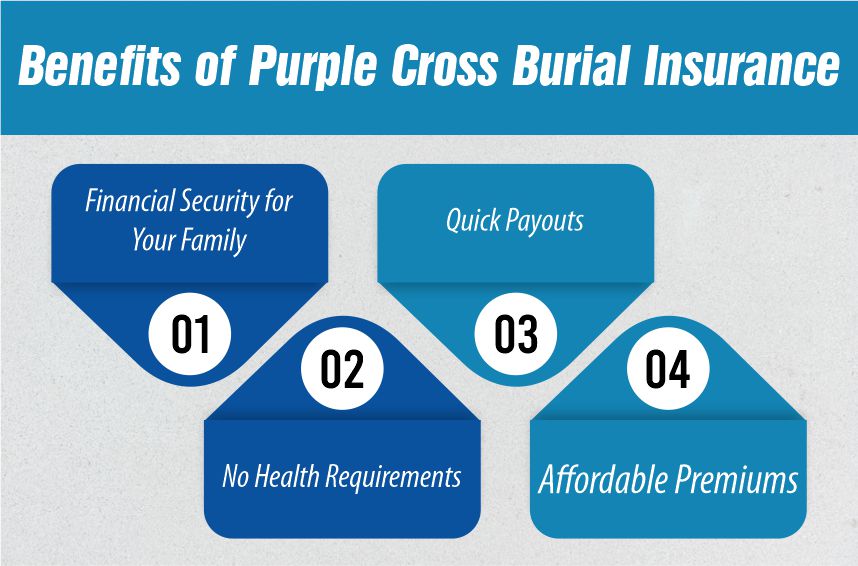

Benefits of Purple Cross Burial Insurance

Purple Cross Burial Insurance is the cheapest and most practical burial insurance around for protecting loved ones against the financial challenges that often face families in meeting funeral and burial cost requirements. Let us examine, in more detail, the key benefits of this policy:

Financial Security for Your Family

The most significant advantage of Purple Cross Burial Insurance is financial security for the family; grief over a loved one is already a heavy burden, so having unforeseen funeral costs pile up would only weigh the grieving period heavier.

As an example, funeral expenses comprise the casket and headstone, burial plot fees, transportation, flowers, and service charges. All of these add up promptly to a few thousand dollars, even for those families who don’t have much spare lying about.

With Purple Cross Burial Insurance, there’s no frantic scrounging around to find money or take out loans to pay for these costs. The policy will make sure they will have the money they need to do just that even in the absence of you-from financial stress. This provides your family the chance to focus more on mourning and how to celebrate your life without worrying about a thing.

No Health Requirements

Unlike traditional life insurance, which demands that applicants strictly adhere to set health standards or undergo medical examinations in the process, Purple Cross Burial Insurance puts things into simplicity and accessibility.

This policy caters for people who may not qualify for traditional insurance because of pre-existing health conditions. For example, suffering of chronic illness or disability or being elderly may keep people out of coverage elsewhere.

Purple Cross assures you of acceptance provided you meet the minimum eligibility requirements. Usually, if you fall within the age bracket of 50 to 85 years, then you qualify. You don’t need any medical tests or personal health questionnaires. This makes it a very convenient option for anybody who desires coverage in simple terms without complications about your health condition.

Quick Payouts

Families need the funds available immediately to handle funeral arrangements when a person dies. Purple Cross Burial Insurance ensures that payouts to beneficiaries are speedily made to avoid hassles and delays.

After the filing and approval of a claim, the funds are released immediately, and your family can cover funeral and burial costs without much hassle. This feature is very vital for those families who do not have savings for financial emergencies.

Immediate pay-out arrangements ensure that no one needs to bother about how to manage funds to make certain arrangements like reserving a funeral home, or maybe even a burial plot, to carry on after a death.

Affordable Premiums

One major advantage of Purple Cross Burial Insurance is its affordability. Its competitive premium makes it a good budget-friendly choice for those who desire reliable coverage and would not spend ridiculous amounts of money.

Premiums are fixed, which means they will never rise up to the period of life of the policy. Such a thing is very helpful for pensioners on a fixed income. They can determine their budget with certainty because their insurance premiums won’t increase.

Even with low premiums, coverage amounts are certainly enough to cover most funeral and burial expenses. From a small policy to pay basic costs to a little larger one to take care of additional expenses, Purple Cross has options that can fit different financial requirements.

Purple Cross Plans Grow in Value

In addition to offering financial coverage of end costs, Purple Cross Burial Insurance also carries a cash value that grows with age.

For the premium payments, you do provide a portion of the same amount to be kept aside and on deposit. Such cash value can be availed as a savings feature in your policy, creating extra financial flexibility. The accumulated value is utilized by you in various ways over time.

- You can take cash-value loans to borrow against the cash value in case you may need cash to meet some exigency or other expense that turns up unexpectedly.

- Cashing Out: Should you decide you do not want the policy anymore, you can usually cash out for the amount of cash accumulated in it.

One important thing to consider is that borrowing from the cash value reduces the policy’s death benefit unless repaid. However, this feature still gives you peace of mind in knowing you have a financial backup if needed.

With the cash value growth, Purple Cross Burial Insurance becomes more than a final expense plan it becomes a small financial asset growing over time with added security for you.

How These Benefits Work Together

It combines all the benefits of Purple Cross Burial Insurance, making it a good end-planning tool. The plan offers immediate and affordable coverage while it does away with barriers like medical exams or health restrictions. Its quick payouts ensure your family can smoothly manage funeral arrangements without a hitch and the feature of cash value adds long-term financial flexibility.

This policy is perfectly suited to seniors for example persons with health challenges, or anybody else seeking a hassle-free, reliable means of covering funeral costs. You’re securing your family and giving them the ability to grieve and commemorate you without added worry by choosing Purple Cross.

What to Consider Before Choosing Purple Cross Burial Insurance

In deciding whether Purple Cross Burial Insurance is the right fit for you, the benefits need to be balanced against limitations. Here are key factors to consider:

Cost vs. Coverage

Aspect | Burial Insurance (e.g., Purple Cross) | Traditional Life Insurance |

Cost Per Dollar of Coverage | Higher due to smaller coverage amounts | Lower due to larger coverage amounts |

Coverage Range | Typically $5,000 to $25,000 | Can range from $50,000 to $1,000,000+ |

Purpose | Covers funeral and burial expenses | Broader financial protection, including debts, income replacement, or legacy planning |

Affordability | Designed to be affordable for targeted needs | May be more expensive overall for higher coverage |

Suitability | Ideal for those seeking peace of mind for end-of-life expenses | Better for those needing extensive financial coverage |

Long-Term Cost-Effectiveness | Maybe less cost-effective for broader needs | More cost-effective for leaving a larger financial legacy |

Coverage Limits

The Purple Cross, among other burial insurance providers, is very narrow in scope. This type of insurance policy pays benefits only to cover final expenses such as the funeral service, burial plot, casket, and so on.

If you owe a lot of money on debt, like a mortgage or credit card balances, or if you want to leave a sizeable financial gift to those you love, this type of insurance may not be enough. It is important to consider all your financial needs and determine whether a burial insurance policy would be enough to fulfill your goals.

Waiting Periods

Many burial insurance policies, including the guaranteed issue plans from Purple Cross, have a waiting period. This is a time frame, usually 2–3 years, during which the full death benefit is not payable for non-accidental deaths.

For instance, if the policyholder dies of illness during the waiting period, the nominees may get only a refund for the amounts paid by way of premium together with some interest while the full amount under the policy is blocked.

This waiting period is often a standard requirement of most burial insurance cover; as such, this is something to pay extra attention to, especially if you have concerns about your health. If you are healthy, a simplified issue policy may be more suitable for you since it imposes fewer restrictions.

Alternative Options

While Purple Cross Burial Insurance is a straightforward way to handle end-of-life expenses, it’s not the only option available.

- Many burial insurance policies, including the guaranteed issue plans from Purple Cross, have a waiting period. This is a time frame, usually 2–3 years, during which the full death benefit is not payable for non-accidental deaths.

- For instance, if the policyholder dies of an illness during the waiting period, the nominees may only get a refund for the sums paid by way of premium along with some interest while the full amount under the policy will be locked.

- This waiting period is normally a requirement of most burial insurance coverage; hence, it is an area that should be watched keenly, primarily if you are already harboring health concerns. If you are healthy, then you might prefer the simplified issue policy since it imposes fewer restrictions on you.

Making the Right Decision

The choice of Purple Cross Burial Insurance is a personal one that bases such choice on the financial status, health, and end objectives of how your life would be when you’re gone. Understanding the cost, limitations, and choices will help you make an informed decision to give you peace of mind for you and your loved ones. You may choose Purple Cross or pursue alternatives while planning to ensure your family’s emotional time won’t burden them financially.

Why Choose Purple Cross Burial Insurance?

Affordable and Fixed Premiums

- Budget-friendly plans with predictable costs.

Simple Application Process

- There is no need for extensive documentation or medical examinations.

Flexible Coverage Options

- Choose a plan that fits your budget and specific needs.

Quick and Reliable Payouts

- Beneficiaries can access funds without unnecessary delays.

Portable Coverage

- Your policy travels with you, no matter where you live.

Funeral Costs in Florida and Other States

Funeral cost differences among states are very large, with Florida often being one of the higher-costing states due to cemetery charges and other service charges. Proper burial insurance, such as Purple Cross, allows your family not to be caught dead without the means.

Conclusion

Purple Cross Burial Insurance prepares everyone responsibly for the inevitable end-of-life costs that the members of your family would otherwise have to bear during this already challenging time of grieving. It includes guaranteed acceptance, low premiums, and cash value accumulation.

If you’re looking for a reliable burial insurance plan, Purple Cross offers flexibility, affordability, and comprehensive coverage options tailored to your needs.

First Step Today Towards a Security-Filled Future for Your Family: Purple Cross Burial Insurance.

FAQs

Unlike the former, life insurance offers broader protection in terms of income replacement and debt repayment. Funeral plans only cover final expenses, which include burials and memorial services, as in the case of Purple Cross Burial Insurance.

The cheapest funeral plans usually cover basic cremation services. Purple Cross offers affordable burial insurance plans that may fit different budgets while covering essential expenses.

The richest burials, with high-end caskets, premium cemetery plots, and elaborate services, can be as expensive as over $20,000. Purple Cross Burial Insurance can help offset these costs so your family will not need to bear such obligations.

Yes, Purple Cross policies collect cash value through time and therefore add up a financial benefit beyond paying funeral costs.

It is, therefore, possible to buy an insurance policy for a parent, grandparent, or any other family member with their consent and approval of the application process.

Resources

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.