Last Updated on: March 18th, 2025

Reviewed by Kyle Wilson

There are several options when it comes to paying for your end-of-life plans. Worried about your funeral cost? Do you need to learn about the most effective strategy in regards to funeral/burial costs?

As we don’t want to burden our loved ones with end-of-life expenses. Here the prepaid burial insurance plan comes, it’s essential to consider your financial situation, long-term goals, and preferences. Keep reading and learn more about prepaid insurance and how to plan prepaid burial insurance.

Customized Options Await

A prepaid burial insurance is just what it sounds like – funeral expenses you pay in advance when you’re alive and healthy. It involves making arrangements for funerals while waiting for your turn or that of a family member to die.

The most compelling reason some people prepay for a funeral is so that you won’t have to worry that someday your family will be dealing with both a heavy emotional and financial burden while grieving. You might also be very organized and see this as a way of staying on top of things.

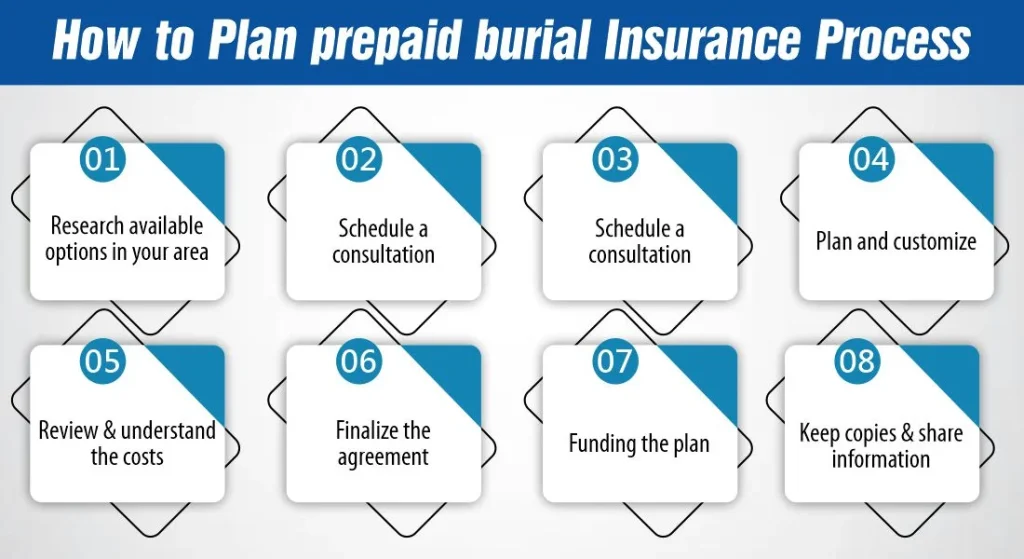

But how to plan a prepaid burial/ funeral? Essentially, if you’re working with a funeral home, you have one step: Contact the place where you’d like your future funeral to be, and ask if they offer preplanning or prepaying services. You probably don’t even have to call and ask. Chances are, the information will be on the website.

Many people have this question; “Are Prepaid burial expenses Tax Deductible?” It is an important question. Most funeral costs are not tax deductible for individuals, but under the circumstances, where the estate pays for the burial costs, a different situation occurs. The IRS has stated that for instance if the estate pays for funeral costs such as using a prepaid burial insurance plan, the estate can then use these expenses as a tax deduction. It is important to especially approach a tax specialist for any input as to what may be tax-deductible.

Many people have this question; “Are Prepaid burial expenses Tax Deductible?” It is an important question. Most funeral costs are not tax deductible for individuals, but under the circumstances, where the estate pays for the burial costs, a different situation occurs. The IRS has stated that for instance if the estate pays for funeral costs such as using a prepaid burial insurance plan, the estate can then use these expenses as a tax deduction. It is important to especially approach a tax specialist for any input as to what may be tax-deductible.

When it comes down to planning and the day of the funeral not only do the funeral directors and their team provide direction and support for the family but the funeral director and or their staff could be on stand-by 24/7. They ensure that everything is well coordinated including flowers, clergy, speakers, music, and meals, to procuring permits and copies of death certificates among other things.

Transportation to the funeral home and facilities provided for the beloved. In the case of death, the funeral home will pick that person from home or a health facility and then proceed to take that person through the necessary processes that will include dressing or even cremation before burial. The leading funeral homes have set down strict custody measures that will reduce the chances of errors or confusion.

If choosing the traditional burial or having a traditional service before cremation, selecting a casket is a critical decision. Caskets are generally made from either wood or metal and can range in terms of quality and cost. This is a legal requirement and may be in the form of an all-wood casket or a lower-priced cardboard container.

Basic cremation involves placing ashes in a basic plastic cassette. You may also choose an elegant wooden casket, a biodegradable scattering tube, or a conventional urn for the cremated ashes. These containers differ in price and can be of wooden, brassy, metallic, or glass construction or from some other material.

A place where the funeral or the reception is going to be held. Most funeral homes have attractive chapels and contemporary reception halls which are suitable for memorials. Some have large patios, well-suited for outdoor parties, and other houses that have yards, which could accommodate a tent.

Some services include a procession to the cemetery. In those cases a hearse might also be required and transportation for the family.

When it comes to in-ground casket burial, many cemeteries will require that body to be enclosed in a burial vault or an outer burial container. The vault assists in making the cemetery appear as clean as possible after they have been stripped by storms and other disasters.

Other expenses like flowers, stationery, decorations, souvenirs for the family, and tokens for friends may also be considered in items that may be pre-paid.

Go online and search for various funeral homes or insurance companies to identify the variety of prepaid burial insurance that they offer. These points concern location, reputation, and the number and variety of services a company offers.

Do not rush into selecting the first plan that you come across. The cost of funeral arrangements varies depending on the funeral home; therefore, one should obtain quotes from different funeral homes.

Ideally, the next step would be to set a personal appointment with one of the funeral directors in any of the short-listed funeral companies.

This is the part where you should explain which aspects of the prepaid burial insurance you would want a consultation. This should involve the kind of funeral ceremony (burial or cremation), the preferred casket or urn, and any ceremony desired.

The funeral director will come up with several plan packages depending on your requirements and financial capability. Most plans can be modified to specify a certain level of service, particular features, and favorite products and suppliers.

Take time to study the plan details which highlight the items that the plan will cover, other charges, the total cost, and other aspects like cancellation policies. Now is also a good time to start asking questions regarding your payment structure.

When you find out all you want to do with the details of the funeral plan and the costs you will pay, then you are required to sign a pre-need funeral agreement which is a legal document that contains all the details of your arrangement.

Depending on your chosen payment option, you will have to make the necessary preparations to pay for the plan. This could involve a one-time payment, creating schedules of monthly payments, or even using a limited funeral trust account.

Keep the signed agreement and any plan documents for your records. It is important for your family to know the details of your prepaid burial insurance plan where you have kept all the papers and the funeral home number.

If you get services from a funeral home, they will provide you with information on how their funeral home conducts the prepaid funerals.

Sometimes there are fees related to the administration of the program or the center. The funeral home may place the money in an account where it may not be used until after the death.

It is important to know there are no two funeral homes operating in the same manner as there are several questions about it.

For example, if you are moving to a different region within the country, are you in the position to move then the funeral home will transfer funds to another funeral home? Or does your family need to return your remains to this specific area where they will pay for it?

If you choose to make this do-it-yourself kind of prepaid burial expenses, there are several options.

Open an account where you can deposit the funeral expenses money. It can be planned through advance funeral planning that involves opening an account together with a loved one to pay for a funeral when the account holder dies. Why a joint account? That way, the surviving family member has access to it to use for your funeral. Otherwise, your family members could obtain access to your checking account, but not before the estate, which may take weeks or even months, has been established.

Open a payable-on-death account. You can name someone to receive money for your funeral. If you don’t invest enough money, it might not cover all the costs, but this money is better than none. If you withdraw money for something else and don’t put it back, there might not be enough for the funeral.

Known as burial insurance or final expense insurance policy, funeral insurance assists to meet the funeral costs. They usually cost from $50-$100 every month and normally people make $10,000 cover. There is variation in your monthly cost depending on your age, sex, and health.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes