Last Updated on: March 26, 2025

Reviewed by Kyle Wilson

Have you ever considered how your final farewell could impact your loved ones? It’s not exactly a fun topic to mull over with your morning coffee, but it’s an important one. Pre need funeral insurance allows you to arrange and pay for your funeral in advance, taking the burden off your family during a difficult time. It’s about making sure everything is handled just the way you’d like, without leaving your loved ones to handle the bills or guesswork. So, why not tackle this tough topic head-on and see if pre need funeral insurance could be the right choice for you?

Customized Options Await

Have you ever considered planning your own funeral? It sounds odd, but it’s actually a practical move. Pre need funeral insurance is a way to plan and pay for your funeral before you pass away. This isn’t just about being organized; it’s about easing the load on your family during a tough time.

Here’s the straightforward scoop on pre need funeral insurance:

People Without Savings: If you haven’t set aside money for end-of-life expenses, pre-need insurance can ensure that these costs won’t fall on your family.

By paying now, you lock in prices for services that are almost guaranteed to be more expensive in the future for Pre Need Funeral Insurance. This can be a smart financial decision, protecting against the rising costs of funeral services.

Having your funeral arrangements sorted and paid for can relieve a significant emotional burden. It ensures that your loved ones won’t have to deal with these details while they are grieving.

You get full control over how your funeral will be conducted. From the type of service to the music and flowers, you can ensure your preferences are respected, making your farewell as meaningful as you wish.

The main drawback is the initial financial outlay. Depending on the services chosen of Pre Need Funeral Insurance, this could be a substantial amount, which might require savings or financial planning to manage.

Once you’ve set your plan and signed the contract, making changes can be difficult or incur additional costs. This can be problematic if your wishes or circumstances change over time.

There’s always a risk that you might end up paying more for pre-need services than they would cost at the time of need, especially if the company prices are on the higher side or if you significantly outlive the average life expectancy.

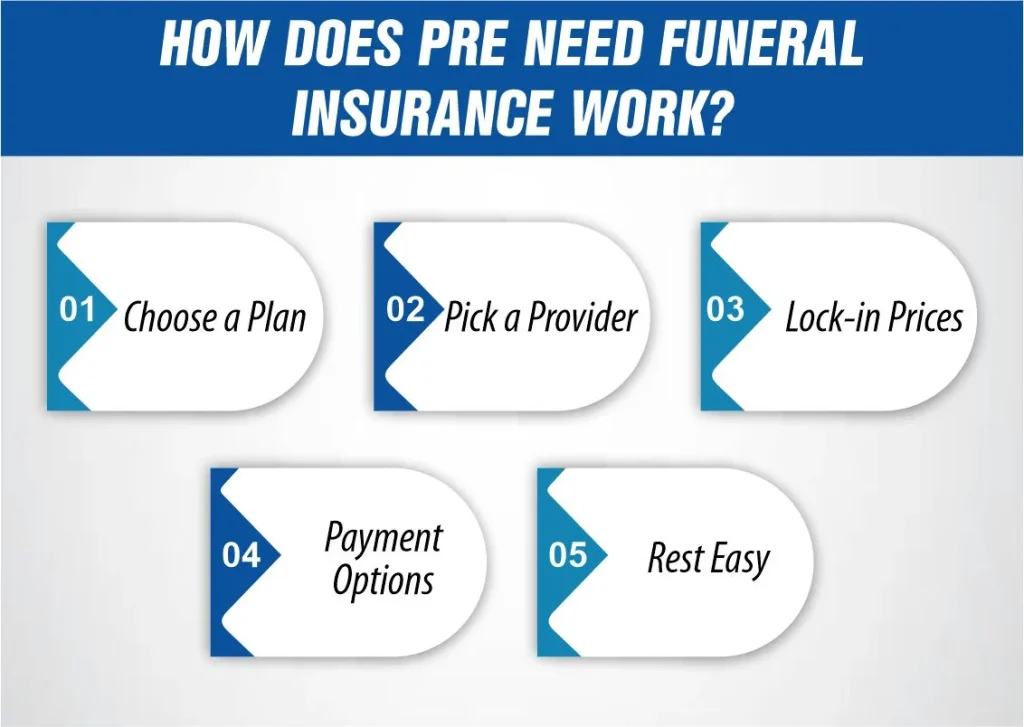

Thinking approximately sorting out your personal funeral arrangements won’t be your idea of a very good time. However, pre need funeral insurance could make it much easier. Here’s the way it works, damaged down into smooth steps:

You start by choosing the type of funeral you want. This can be anything from a traditional burial to a more contemporary cremation.

Find a funeral domestic or a specific coverage issuer that offers pre-want plans. Make certain they’re trustworthy and have precise evaluations.

Decide on all the information of your provider. Do you need a band? A unique flower arrangement? It’s all up to you.

One of the big perks here is that you pay brand-new costs for services, even if you will only want them for a few years. This can save you and your circle of relatives a whole lot of cash as prices rise.

You can pay suddenly or over the years. If budgeting is a challenge, the instalment plan could simplify this.

Once it’s ready, you don’t need to think about it anymore. You’ve taken a huge obligation off your family’s shoulders.

Simply Pre Need Funeral Insurance coverage is about taking care of factors now so your family doesn’t have to later. It’s a considerate manner of saying, “Don’t fear; I’ve been given this.”

When thinking about a pre-need plan, it’s critical to understand what you’re signing up for. Here are some key points to don’t forget:

Some services to your plan might be assured by the funeral home, meaning that no matter how costs change, what you’ve paid for is what you will get. Non-guaranteed offerings, however, might cost extra in the future if costs boom.

Remember, funeral homes set their expenses. This way, costs can vary broadly from one location to another. It’s an awesome concept to store around and evaluate what’s blanketed their pre-need plans.

Don’t be shy approximately asking questions. You’ll need to know what happens if the funeral home goes out of business, what your options are in case you pass to a distinct metropolis, and what sort of you may customize the services you’re procuring.

Understanding funeral fees is essential when considering whether preneed funeral insurance is really worth it. Funerals prices varying based totally on picks like burial vs Cremation, the form of the casket, choice of funeral domestic, plants, and reception offerings. According to the National Funeral Directors Association, right here are a few usual fees:

Caskets alone can range from $2,000 to $5,000 on average and can even go up to $10,000 depending on the material used. Given these high costs, Cremation can sometimes be a more budget-friendly option.

In essence, taking the time to invite the proper questions and knowledge of exactly what the plan covers can save you and your family from sudden destiny strain. It’s all approximately making a choice that gives you peace of mind. And don’t forget, humorousness can help ease a topic that is evidently a piece grim!

The table below illustrates the differences between Pre Need Funeral Insurance and final expense insurance.

Pre-need insurance | Final expense insurance | |

Term | No expiration | No expiration |

Death benefit | Cost of funeral service and burial or cremation expenses | $1,000 to $40,000 |

Age restrictions | Varies by provider | Varies by provider. Some insurers only allow age 45 and up; others allow all ages |

Medical requirements | None | Varies by provider. Some have no medical requirements, others require a brief health questionnaire |

Beneficiary | Funeral home you choose | Your choice: Funeral home or loved ones, but loved ones receive any balance left after funeral expenses are paid |

Best for | People who don’t qualify for term life or final expense and for whom pre-planning and pre-paying their funeral arrangements is a top priority | Older adults or people with health conditions who don’t qualify for a cheaper term life policy and can’t fund a burial with their savings |

Pre Need Funeral Insurance costs can vary a lot. The total price depends on the services you pick and where you are. Here’s a quick look at what influences the cost:

Most plans cover these basics:

Cemetery Costs include the plot, vault, opening, and closing of the grave. If you’re opting for Cremation, there might be a fee for niche placement.

Consider it if you’ve become down for very last-fee lifestyle insurance because of terminal contamination, which is uncommon but does happen, or if lower-priced period lifestyle insurance appears out of reach. Pre Need Funeral Insurance might be the way to go.

This form of coverage is likewise well worth considering if you have a selected funeral home in mind for your services or if you choose to spare your family the challenge of arranging your funeral.

For most people, very last-fee insurance is a better choice. It generally offers a better deal and greater freedom to your beneficiaries regarding how they use the death gain.

Are you still deciding between pre-need or final rate coverage? Chatting with an agent may help clarify which choice best meets your needs.

Pre-need coverage may be treasured in case you need to lock in funeral prices at contemporary expenses and ease the emotional and economic burden for your family during a tough time. It provides peace of mind, knowing the entire process is organized in advance.

Prepaid funeral plans can be a clever choice if you prefer to manipulate information yourself and avoid leaving your family to handle arrangements. However, it is critical to analyze and choose a reputable company to ensure your funding is stable.

A pre-need life coverage policy is a settlement with a funeral provider that covers the value of predetermined Pre Need Funeral Insurance services and arrangements. The coverage’s benefits are directly payable to the funeral provider provider upon the policyholder’s demise.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes