Last Updated on: March 12, 2025

Reviewed by Kyle Wilson

Open Care Senior Expense Insurance is one of the most popular options for seniors when covering end-of-life expenses. It is specifically a type of life insurance known to cover funeral, burial, or cremation services so that the needy do not bear the costs of your passing. Here’s everything you need to know about Open Care Senior Expense Insurance: its costs, benefits, and a few drawbacks.

Get Free Quotes

Customized Options Await

Final Expense Open Care Insurance is specially designed to pay final expenses and provide for your funeral. That will decrease many of the financially staggering burdens left to your family, as they won’t be burdened with paying your funeral costs, medical bills, or other end expenses at such a hard time in your grieving period.

Open Care Senior Expense Insurance provides several valuable benefits that place it as one of the most popular among seniors and families.

This policy is great for seniors who want to pay off funeral costs, grave expenses, and other final expenses without leaving their families in dire financial situations. If you seek an uncomplicated, reasonably priced life insurance that is easy to qualify for, Open Care Senior Expense Insurance might just be what you need.

Designed with an easy-to-understand and accessible structure, Open Care Senior Expense Life Insurance can cover burial and final costs. The application process is simple and stress-free, which especially comes in handy for seniors or those with pre-existing health conditions, who may find it difficult to pass traditional life insurance policies.

There are two main forms of coverage options available under Open Care’s final expense insurance: both are suited for different needs and health situations, respectively.

While both types of coverage make sure your final expenses are covered, the plan best for you is based on your health and age. The guaranteed issue plan provides peace of mind to those who may have difficulty qualifying for other forms of life insurance, while the simplified issue plan gives a more immediate solution for those with better health. Be it plan A or B, Open Care Senior Expense Insurance will ensure that the family is provided with financial assistance at the right moment.

This policy is great for seniors who want to pay off funeral costs, grave expenses, and other final expenses without leaving their families in dire financial situations. If you seek an uncomplicated, reasonably priced life insurance that is easy to qualify for, Open Care Senior Expense Insurance might just be what you need.

Basic Coverage Starting at $7.49 a Month The prices for Open Care Senior Expense Insurance range as low as $7.49 a month, so you could get this product as a means of covering many aged people. This basic coverage will ensure that you can begin protecting your family from the financial cost of final expenses, no matter how great or little the burden is on your wallet.

Price Variations Based on Personal Factors While premiums may start low, the price you pay could increase depending on certain factors, including:

A premium tends to be cheaper than the guaranteed issue plan, as there is less risk to the insurance firm.

Once you enroll in Open Care Senior Expense Insurance, your premiums will not change for the life of the policy. Therefore, although the premium might be higher since you age or if you increase the coverage, the premium does not increase once you enroll.

While the policy is generally costlier than many of the other final expense policies available on the market, it offers greater flexibility in underwriting. This makes it ideal for seniors or individuals with health concerns who may have difficulty qualifying for other life insurance policies. For those eligible for traditional plans, other insurers are likely to offer cheaper plans, but Open Care’s loosened eligibility criteria make an important trade-off for those who need it.

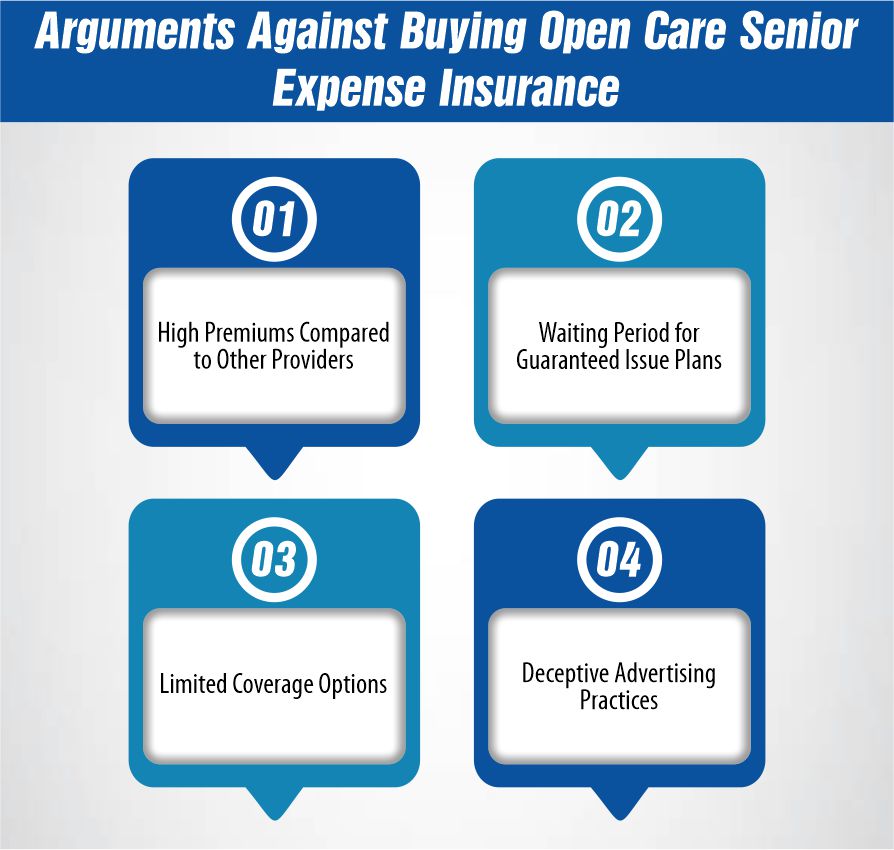

As beneficial as Open Care Senior Expense Insurance can be to some seniors, it is certainly not the best for everyone. Here are several reasons why you might want to reconsider before committing to this policy:

Differences in Cost for Comparable Coverage Although Open Care guarantees acceptance and does not require a medical exam, the benefits come at a cost. More than likely, other insurers will provide the coverage for less in many instances, particularly if you’re in decent health and qualify for other types of life insurance policies.

Let’s take a closer look at the advantages and disadvantages of Open Care Senior Expense Insurance:

Finally, Open Care Senior Expense Insurance is a good option for seniors who are looking for an easy way of saving for the burial cost. It is relatively cheap and carries no requirement for a medical exam, which is a major convenience for many seniors. However, one must take pains to compare the costs with other providers before settling on one of these plans.

If you don’t have any health issues, you can then have a better deal by paying for a policy that does not have a waiting period, which can offer more flexible coverage options. You also should meet with a licensed agent to explain your options and get the right policy for you.

Open Care Senior Expense Insurance allows the elderly to get coverage on end-of-life expenses using relatively easy terms and no medical exam. Of course, it may seem more costly than some other providers and has limits, so when anyone qualifies with difficulty for traditional life insurance, this will be a good choice. Remember to always shop around and compare rate quotes for the best pricing and most suitable coverage.

Open Care Senior Expense Insurance is actually another type of life insurance that can pay for end expenses upon your death, which could include funeral costs, medical bills, and other final expenses. This insurance provides comfort for families knowing that a death benefit will be available to pay for all final expenses.

Generally, most policies depend on your age and your health status. Mostly, individuals between the ages of 50-85 are covered. Most policies do not require medical checkups to be covered. However, serious health conditions can influence the premium or even necessitate medical underwriting.

Coverage amounts can vary, but most policies offer death benefits ranging from $5,000 to $25,000. The amount of coverage you choose depends on your personal needs and financial situation.

Premiums for Open Care Senior Expense Insurance are usually fixed, meaning that they stay the same throughout the life of the policy. However, some plans will have different structures, so it's always a good idea to review the fine print before buying any coverage.

The death benefit of a Final Expense Open Care policy can be used on any expense that your beneficiaries need to pay for medical bills, debts, or other costs-they don't necessarily have to be related only to funeral expenses.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes