Last Updated on: March 18th, 2025

Reviewed by Kyle Wilson

It is always important to plan for the end of life expenses and this is one of the events that most people do not really like to discuss. Burials and funerals themselves are often quite expensive and may cost a few thousand dollars. Burial insurance is one way of preparing for these events. However, most people have no idea where they can find the best burial insurance policy that fits their needs.

Are you thinking about getting burial insurance and wondering if Mutual of Omaha is the right choice for you? Let’s explore the mutual of omaha burial insurance reviews to help you make an informed decision.

Customized Options Await

Mutual of Omaha’s final expense insurance is a whole life insurance policy with coverage that ranges from $2000 up to $50,000. It provides a tax-free cash payment to your beneficiaries or the funeral home, bills, creditors, or any other expenses you might have during the final moments of your life. Furthermore, your beneficiaries will also be entitled to the remaining money after all the costs are incurred.

In mutual of omaha burial insurance reviews there are three plans you can qualify for depending on your health and how you apply:

The following are the general features of all plans:

No medical examination is required. In whole life insurance, there is a guarantee that the policy will be valid for an entire life, the premium for the policy will not change and the amount of coverage being offered will not be reduced. It also accumulates cash value from which the policy owner can make a withdrawal at any given time.

United of Omaha’s final expense policy for seniors committing to cover all natural or accidental death from the first day is named “Living Promise. ”

When it comes to health ratings, Mutual of Omaha Living Promise has two; the level death benefit and the graded death benefit.

The level benefit has no waiting period since you are instantly covered for natural or accidental death on the day the first premium is paid.

To be able to take part in the level plan you must be able to answer no to all the following health questions and be within the following height/weight ratios.

You cannot directly purchase this policy at Mutual of Omaha Life Insurance Company. It is only available through contracted Mutual of Omaha agents such as the company called Burial Senior Insurance.

The graded plan is modified whole life insurance coverage, therefore, if you die during the first two years (other than from an accident), you will get 110% of the premium amount refunded by Mutual of Omaha. It is also more expensive than the level benefit option.

If you have any of these health conditions, you will be offered the graded plan.

The level benefit is the lowest cost plan, age of 45 to 85 and there’s no waiting period. That means you’d be 100% insured for natural or accidental death the day you make your first payment.

You have the option to add an accidental death rider (which costs a few dollars more) that would cause Mutual of Omaha to pay out 200% of the death benefit if you die from an accident.

You can get a dying benefit from $2,000 to $forty,000. You’re included from the first day. It’s one of the maximum low-priced options accessible.

Why Consider It?

Ideal For

Need Immediate Coverage? Check mutual of omaha burial insurance reviews this plan has you covered right away. Looking for Low Costs? This is one of the most affordable plans. Can Answer Health Questions? If yes, consider this plan.

Think about the Level Benefit Plan from Mutual of Omaha if you want an affordable, immediate one.

The guaranteed acceptance option does not have health questions, and can’t be turned down for any pre-existing conditions. But, just like any other guaranteed issue life insurance policy, there is a waiting period of two years.

The offer that you get in the mail or directly from the Mutual of Omaha Website is the guaranteed acceptance policy offer.

If you have a health condition that makes you eligible for the no-waiting-period option with Mutual of Omaha, you should get it today. It’s because Mutual of Omaha is one of the cheapest and available at low cost most of the time and you can purchase a fairly high amount of coverage as compared to other insurance companies.

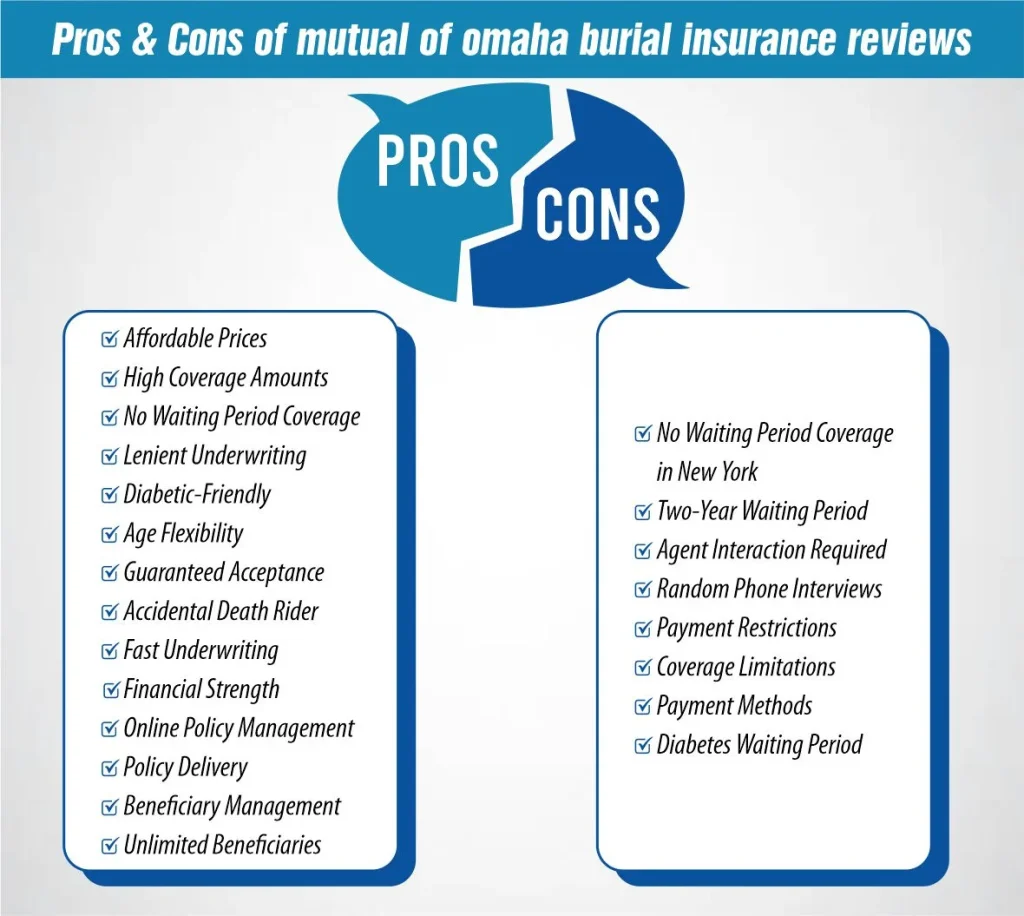

However, in this mutual of Omaha burial insurance reviews let me remind you that there are no companies with the best product for everyone (including Mutual of Omaha).

It would be best to compare the premiums offered by different insurance companies for burial insurance policies. No insurance company has the perfect product that is best suited for everyone.

It’s also important to note that almost all of the funeral insurance policies are only sold through licensed agents.

Companies that sell their products directly to the public without the use of an agent provide immediate as well as the standard guaranteed issue life insurance plans where you only get coverage after two years. Some of the most well-known ones include Colonial Penn, AAA, and USAA.

From the above list, one can purchase those options online. However, they all are guaranteed acceptance plans but will take at least two years of waiting time.

Consulting with a reputable independent agency representing numerous companies is the soundest way to find the best permanent life insurance to cover funeral expenses.

When shopping for burial insurance, consider the mutual of omaha burial insurance reviews. Consulting with a reputable independent agency can help you find the best permanent life insurance to cover funeral expenses.

Mutual of Omaha Living Promise is not a guaranteed acceptance policy. While there is no medical exam to qualify for a Living Promise policy, you must answer health questions. If approved, there is no waiting period.

Truthfully, you should let an agent diagnose whether you’ll qualify. The underwriting is simple, but there are nuances that only an agent will know. That said, look at these health questions. If you have any of those conditions, you will not qualify for the no-waiting period option.

A final expense policy can offer peace of mind and ease the financial burden on your family while they’re grieving. And since it usually doesn’t require a medical exam, it’s a good option if you have a pre-existing condition that prevents you from getting a traditional term or whole-life policy.

References:

https://choicemutual.com/blog/mutual-of-omaha-burial-insurance-review/

https://burialinsurancepro.org/mutual-of-omaha-burial-insurance-review/

https://www.usnews.com/insurance/life-insurance/mutual-of-omaha

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes