Last Updated on: March 14th, 2025

Reviewed by Kyle Wilson

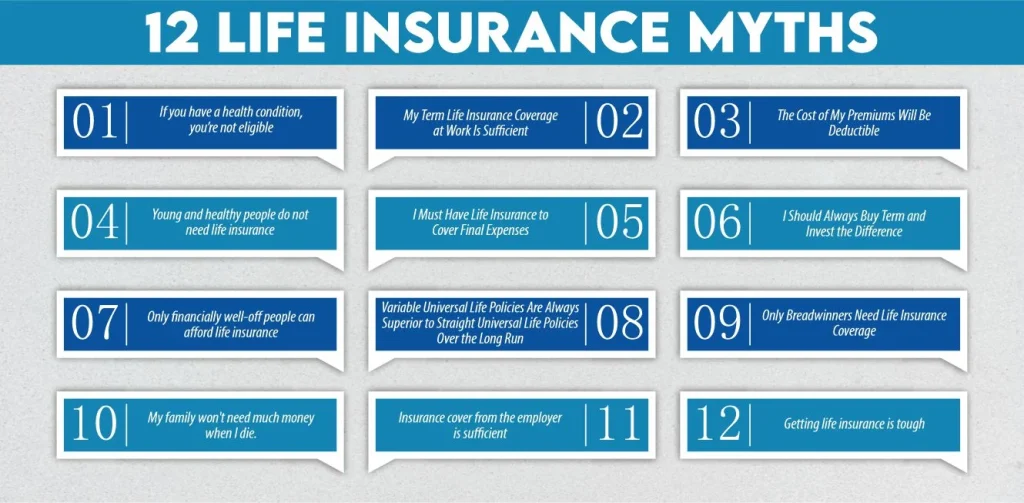

Have you ever heard that life insurance is too expensive or only necessary for older people? Life insurance can be tricky to figure out with its complex rules and choices among competing opportunities. With the wrong information, you could end up with the wrong policy which wastes your money and doesn’t properly protect your loved ones. This article will briefly examine the top 12 misconceptions surrounding life insurance to help make your road to coverage a little smoother.

Customized Options Await

Here are 12 Life Insurance Myths and misconceptions we should avoid:

Many people believe that if they have a pre-existing condition, they can’t get life insurance. Insurers generally use your health to calculate rates and coverage amounts, but it doesn’t mean you’re ineligible if you have a health condition. If you’re concerned about your health being an issue, “simplified issue” or “guaranteed issue” life insurance is also available, often through employer-provided coverage. The applications used for this type of policy typically contain a shorter list of questions, which may be the same for each applicant, and decisions are made based on very limited criteria.

For a single person of modest means, employer-provided term coverage may actually be enough. However, if you have dependents like spouse, children, or other relatives, or if you think that more money may be required for paying estate taxes after your death, then more coverage is required.

The reasons for recommending employer-paid or employer-provided term insurance are that it offers simple guaranteed coverage that is affordable. However, it will only be available while you are still with your employer and it does not offer you lifetime coverage. It may also be beneficial if you have a separate policy in other areas of your life to ensure that your protection is not taken away from you as soon as you stop working.

This is not true in most cases. The cost of personal life insurance is never deductible unless the policyholder is self-employed and the coverage protects the business owner’s assets. In this scenario, premiums are deductible.

Life is unpredictable in this sense that one cannot know what will happen next. When it comes to the probabilities of an accident, a young and healthy person may be cut down in the very prime of his youth. During one’s early working experience, one cannot save adequately enough to build a good corpus throughout one’s life history. But life insurance guarantees that your family does not experience this problem of the lack of funds. Also, young people get to pay a lower amount of premium than they are likely to when they are older. It’s more advisable to purchase life insurance in your formative years when you are just beginning to earn an income. This way, you can target a wider audience and you will get good coverage at a cheaper cost.

For many people, this is often true. However, those with sizable assets may be better off self-insuring. When you self-insure, you use your own savings to cover your medical and funeral costs while providing for your loved ones. You save money by self-insuring as you aren’t paying for the cost of setting up a policy.6 However, you might still decide to buy a policy to create a larger inheritance or as a backup in case you spend down your savings more quickly than expected.

This is not necessarily true. Term life starts out less expensive than permanent life insurance, which gives you more money to invest. However, terms get more expensive over time and can become prohibitively high in later years. Permanent policies like whole life do not increase your premium as you get older. The total premium outlay for a permanent policy may actually end up less than what you’d spend on term coverage that keeps getting more expensive over time.

Term coverage eventually ends as insurers set a maximum age limit for renewals. Those who know for certain they must be covered at death should consider some amount of permanent coverage.

Insurance policies today offer extensive coverage at reasonable prices. You can research online for customized plans that suit every budget. You can start with a lower sum assured and then build up additional coverage as your income increases. You can also opt for a term life plan.

In theory, the long-run investment return of a variable universal life policy (VUL) should outearn a straight universal life policy but that’s not guaranteed. Your cash value growth in a VUL depends on the performance of your investments. Poor market performance may result in a a lower cash value than someone with a straight universal life policy. If you prefer to keep it safe, universal life policies with no risk of losses could be the better option.

Nonsense. The cost of replacing the services formerly provided by a deceased stay-at-home can be higher than you think, so insuring against the loss of a partner who does not work outside the home may make sense. Stay-at-home spouses provide daycare, transportation, cleaning, meal preparation, and many other quality services that can be difficult and expensive to procure outside the family.

This won’t be true, unless you’ve made provisions to have the mortgage paid off, the utilities paid every month, food delivered free to their doorstep and one-size-fits-all clothing that will last until your children are fully grown and out of the house. You should expect your survivors will have an income need of at least 60% of the household income before you die.

Insurance covers provided by employers are available only until you remain in their service. If you change jobs or retire, your policy may be terminated. Moreover, the life-cover that your employer offers may not be sufficient for your family’s future needs. It is recommended to have a life insurance cover of at least ten times your annual income. You must also factor in inflation. Consequently, investing in an insurance policy privately can prove much more advantageous in the long run.

The internet has simplified every aspect of life today, including purchasing insurance. You need not depend on agents or wait for appointments from your insurer. After you compare insurers online, all you need to do is visit the web portal of the insurance provider of your choice. You can calculate the premium that you have to pay using online calculators. Then you have to answer some straightforward questions about your health conditions as well as your personal preferences and profession. After that, you can upload your KYC documents and securely make an online payment to buy your term insurance easily from the comfort of your home.

These are just some of the more prevalent misunderstandings concerning life insurance. You probably should not leave life insurance out of your budget unless you have enough assets to cover your expenses after you’re gone. For more information, consult your life insurance agent or financial advisor, and be sure to do your research to determine which of the best life insurance companies is right for you.

Most people with dependents need life insurance. If you’re single and have enough money to cover your final medical and funeral costs, life insurance coverage may be optional. If you have considerable savings, like at the end of your career, you could also self-insure to provide for your family rather than buying a life insurance policy.

A quick rule of thumb says you need at least ten years of your annual salary. The exact answer for most people is more complicated. Some people need more, some less, and some don’t need life insurance at all.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes