Last Updated on: March 18th, 2025

Reviewed by Kyle Wilson

Planning for final expenses can feel stressful, especially if you don’t want your family to worry about funeral costs. Immediate burial insurance with no waiting period gives fast coverage, so your loved ones get financial help right away. Unlike other policies that have waiting times or require medical exams, this insurance provides instant benefits. It’s a good option for people with health issues or those who need quick protection. In this guide, we’ll explain how it works, its benefits, costs, and how to find the right policy for your needs.

Get Free Quotes

Customized Options Await

Immediate burial insurance with no waiting period is designed to provide fast financial relief for funeral and burial costs. Unlike traditional policies that may delay payouts due to waiting periods, this type of insurance offers instant coverage from the day the policy becomes active. It is especially useful for individuals who want to ensure their families are not burdened with expenses after their passing.

Immediate burial insurance is a type of final expense insurance that helps cover funeral, cremation, and related costs. It guarantees that a payout will be made directly to the beneficiary or funeral home upon the policyholder’s passing.

Policies with no waiting period start coverage immediately after approval and the first premium payment. This means your family won’t have to wait months or years for a payout. It’s an excellent option for individuals who want instant protection without medical exams or long processing times.

This insurance is ideal for:

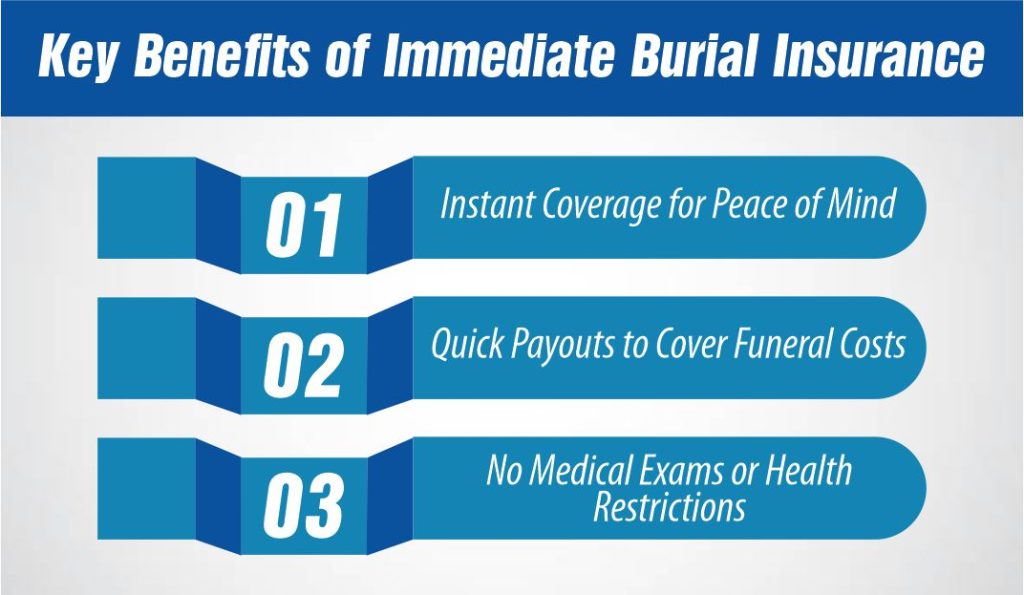

Immediate burial insurance with no waiting period provides fast financial protection for your loved ones. Unlike traditional policies, it ensures that your family receives the payout right away to cover funeral and burial expenses. Here are the key benefits of choosing this type of insurance:

One of the biggest advantages of immediate burial insurance is that coverage starts as soon as the policy is active. There’s no waiting period, which means your loved ones won’t face financial stress after your passing. This is especially important for individuals who may not have savings set aside for funeral expenses.

Funeral costs can add up quickly, but immediate burial insurance provides fast payouts to cover expenses like burial, cremation, caskets, and memorial services. Since there’s no delay in benefits, families can focus on honoring their loved one rather than worrying about bills.

Many traditional life insurance policies require medical exams and health screenings, which can make it difficult for seniors or individuals with health conditions to get approved. However, immediate burial insurance with no waiting period does not require medical exams. Approval is typically fast and hassle-free, making it an excellent option for those who need coverage without complications.

Getting immediate burial insurance with no waiting period is easier than traditional life insurance, but you still need to meet certain criteria. Understanding the eligibility requirements and the approval process can help you find the right policy for your needs.

Most insurance providers have simple eligibility requirements for immediate burial insurance. While each company may have different guidelines, common factors include:

Unlike standard life insurance, no medical exam is required for immediate burial insurance. However, some providers may ask basic health questions to assess risk. Individuals with serious pre-existing conditions may still qualify, as insurers often accept applicants with diabetes, heart disease, or other chronic illnesses. The approval process is usually fast and straightforward, allowing you to get coverage within a few days or even instantly.

When selecting a policy, consider factors like coverage amount, premium affordability, and insurer reputation. Here’s how to choose the best option:

By selecting the right policy, you can secure financial protection for your loved ones without delays or complications.

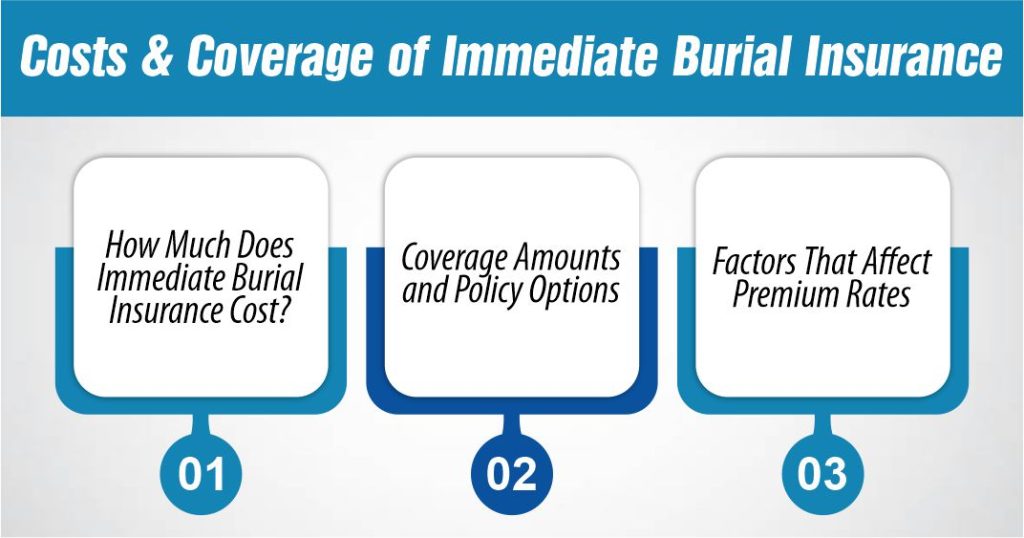

The cost and coverage of immediate burial insurance with no waiting period depend on several factors, including age, health, coverage amount, and the insurer. Understanding these details can help you find an affordable policy that meets your needs.

The price of immediate burial insurance varies, but on average, policyholders can expect to pay:

Premiums are typically fixed for life, meaning they won’t increase as you age. However, costs will depend on factors like coverage amount and policy type.

Immediate burial insurance typically offers coverage amounts between $2,000 and $50,000, with most people choosing around $10,000 to $25,000 to cover funeral and burial expenses. Policy options include:

Several factors influence how much you’ll pay for immediate burial insurance, including:

Comparing multiple insurers and choosing a policy that fits your budget can help you get the best value for immediate burial insurance.

Finding the right insurance provider is essential when looking for immediate burial insurance with no waiting period. Some companies offer faster approvals, competitive pricing, and reliable payouts. Here’s how to compare insurers and choose the best one for your needs.

When comparing insurance providers, consider:

A trustworthy insurance provider should have:

Several insurance companies offer no waiting period burial insurance with immediate coverage, including:

Applying for immediate burial insurance with no waiting period is a straightforward process, and approval can happen quickly. Here’s what you need to know to get started.

When applying, you may need:

An insurance agent can help you:

Immediate burial insurance with no waiting period is a great option for those who need fast financial protection for funeral costs. By comparing insurers, choosing the right coverage, and working with an agent, you can secure an affordable policy that gives your loved ones peace of mind.

Traditional burial insurance may have a waiting period of 2 years or more, while immediate burial insurance provides full coverage from day one.

Yes, many insurers offer guaranteed issue policies that accept applicants with pre-existing conditions without a medical exam.

Coverage limits vary by provider, but most companies offer $5,000 to $50,000 in burial insurance.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes