Last Updated on: March 6th, 2025

Reviewed by Kyle Wilson

Planning for final expenses is a crucial step in securing your family’s financial future, yet many overlook the cost of burial insurance until it’s too late. How much does senior burial insurance cost, and is it worth it? The answer depends on several key factors, including age, health, and coverage amount. Without proper planning, funeral expenses can create a heavy financial burden for loved ones. This guide will break down the costs, influencing factors, and ways to find the most affordable burial insurance policy.

Get Free Quotes

Customized Options Await

Multiple factors influence the cost of senior burial insurance through both age and health condition and policy amount and selected insurance provider. The specific purpose of burial insurance differs from standard life insurance because it offers affordable coverage options that skip medical examinations for senior citizens.

The purpose of senior burial insurance is to provide whole life insurance that pays out specifically for funeral arrangements and burial costs alongside last expenses. The policy delivers a minimal payment which allows families to pay expenses through a stress-free experience. Seniors benefit from burial insurance through its basic underwriting process and limited coverage which enables coverage for all individuals regardless of their health condition.

The purpose of Senior burial insurance is to allow seniors to obtain whole life protection for their necessary funeral expenditures. This insurance policy generates a minor but crucial payment to assist grieving families through financial expense management. The simplified underwriting process of burial insurance makes this coverage accessible to all seniors despite their health condition. It also features lower coverage amounts than traditional life insurance policies.

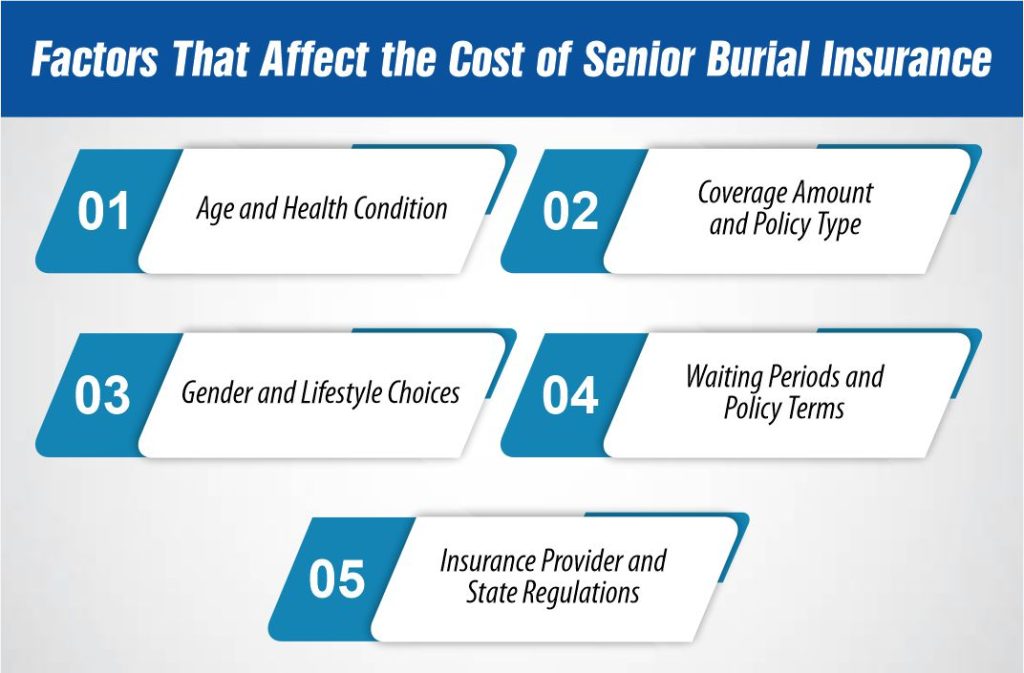

The price of senior burial insurance coverage depends on different factors which determine payment rates and insurance affordability. Senior citizens need to understand these different factors to pick the most suitable policy which combines both financial affordability and proper coverage benefits.

The age of an individual strongly influences the costs of burial insurance premiums. Individuals who choose burial insurance coverage as seniors will pay more premium costs. The costs of burial insurance are determined by health conditions but most policies do not need a medical checkup to begin coverage. Individuals who present severe pre-existing medical problems could get either more expensive premiums or fewer coverage options available to them.

Coverage amounts you choose determine the premiums you will pay each month. Death benefits directly influence the insurance premium so higher payments result in increased coverage. The cost structure varies between guaranteed issue policies which accept all applicants regardless of health and simplified issue policies that only request minimal health-related questions.

The statistical fact that women survive longer than men leads insurance companies to charge female applicants slightly reduced premiums for burial coverage. The prices of burial insurance increase when consumers select risky lifestyle behaviors including smoking and dangerous recreational activities because insurers see them as higher risk individuals.

Insurance policies for burial need to pass through a waiting time period before providing complete benefits. The waiting period within guaranteed issue policies normally exceeds two years but premiums accumulate during this time. The policy beneficiaries will get only partial compensation or a refund if the insured individual dies while the waiting period remains active. Immediate coverage from burial insurance policies comes with increased policy costs.

Each insurance provider sets its own policies for pricing together with underwriting rules and insurance benefits. The evaluation of several providers enables policyholders to obtain insurance which strikes an optimal combination of affordability and coverage benefits. State inspection regulations function as a factor that determines both premium amounts and availability limitations for burial insurance coverage.

The price of senior burial insurance depends on different elements such as age, health condition, coverage amount and chosen insurance provider. Seniors need to understand average coverage costs together with payment choices along with affordability tools before they choose their burial insurance.

Burial insurance premiums increase with age. Below are estimated monthly costs for a $10,000 policy based on different age groups:

The costs remain approximate yet differ based on health conditions and policy selection choices and gender factors. The absence of medical underwriting drives Guaranteed issue policies to have higher premium costs.

Burial insurance policies allow policyholders different ways to pay premiums. Most policyholders choose monthly premium payments but some insurers offer the alternative of yearly premium payments with a nominal price reduction. Those who have the resources for a one-time payment will find annual premium payments lower the long-term expenses so it represents an economical choice.

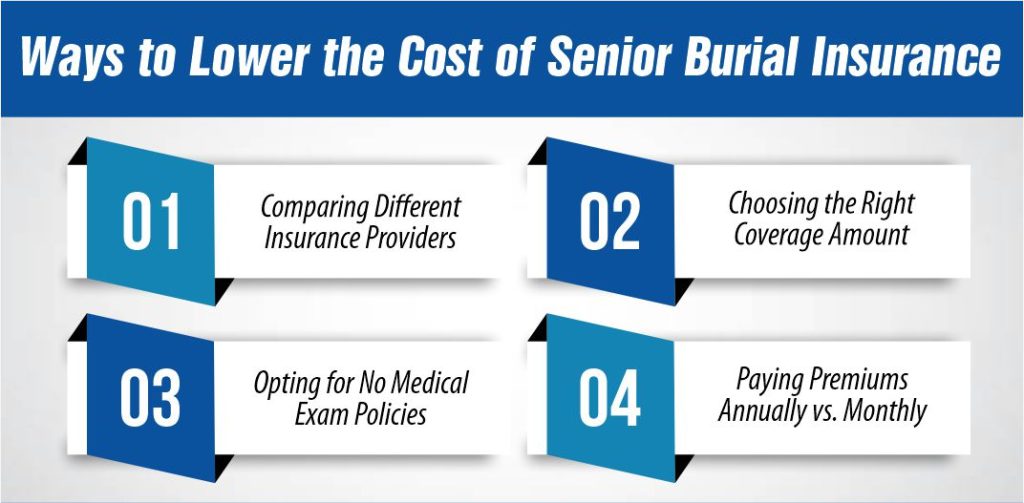

Finding an affordable senior burial insurance policy requires careful comparison and planning. Here are some tips:

Everything involved in the decision process helps seniors obtain burial insurance coverage that fulfills their financial requirements and offers protection to their family members.

The process of obtaining affordable senior burial insurance depends on detailed planning and insurance policy comparison. To find the appropriate policy at an affordable price seniors should review multiple providers while modifying coverage parameters and picking economical payment methods.

Insurance rates and benefits can vary significantly between providers. To find the best deal:

The amount of coverage selected directly affects the premium cost. To keep expenses manageable:

Some burial insurance policies require medical underwriting, while others do not. No medical exam options can benefit seniors in the following ways:

How premiums are paid can impact the total cost of burial insurance:

Several incorrect ideas about burial insurance costs for seniors stop people from selecting their policies wisely. Knowledge of facts enables senior citizens to select appropriate insurance coverage that avoids financial problems.

Many assume that burial insurance is costly, but this is not always the case. The actual cost depends on several factors, including age, coverage amount, and health status. In reality:

Another common misconception is that burial insurance is strictly for funeral expenses. While this is a primary use, policy payouts can often be used for other costs, such as:

Many seniors worry that pre-existing conditions will prevent them from qualifying for burial insurance. While some policies have medical requirements, there are options available:

Senior burial insurance allows people to find a financially viable solution for end-of-life costs. Senior policy seekers can avoid cost overruns by mastering insurance expenses and learning about typical misinterpretations of coverage. Choosing suitable insurance providers along with finding appropriate coverage and reviewing policy terms will create financial security for policyholders and their family members.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes