Last Updated on: April 8th, 2025

Reviewed by Kyle Wilson

When considering life insurance, one of the most important factors to understand is how much it will cost. Life insurance premiums can vary widely based on several factors such as age, health, lifestyle, and the type of coverage you choose. For those looking to secure financial protection for their family or cover final expenses, knowing the cost upfront is essential for making an informed decision. In this guide, we’ll break down the factors that influence life insurance costs and provide insights on how to find the best coverage for your budget.

Get Free Quotes

Customized Options Await

When considering life insurance, it’s important to understand the cost structure before making a decision. Life insurance premiums are typically paid on a monthly or annual basis, and the amount you’ll pay depends on several factors. Understanding how these premiums are determined can help you choose a policy that fits your budget and needs.

Life insurance premiums are the amount you pay to keep your policy active. These premiums are influenced by a variety of factors, including the type of coverage you choose, your age, and your health. Generally, the younger and healthier you are when you apply, the lower your premiums will be. It’s also important to consider how premiums are paid (monthly or annually) and how they may change over time.

The price of life insurance can vary based on multiple factors. Some of the most common elements that affect the cost include your age, health status, lifestyle habits, the type of policy, and the coverage amount you select. For example, a term life policy will typically cost less than a whole life policy, and larger coverage amounts or longer policy terms can result in higher premiums. Understanding these factors can help you estimate how much life insurance will cost based on your specific situation.

When choosing life insurance, it’s crucial to understand the different types and how their costs vary. Each type of life insurance offers different coverage options, and the premiums can fluctuate based on factors like your age, health, and the type of policy you choose.

Term life insurance is one of the most affordable types of life insurance because it provides coverage for a specific period, usually 10, 20, or 30 years. The premiums for term life insurance are typically lower compared to whole life insurance, making it a great option for those looking for affordable coverage. Factors that influence the cost include the length of the term, your age when applying, and any additional riders you choose.

Whole life insurance offers lifelong coverage and includes a cash value component that grows over time. Because of the added benefits, such as cash accumulation and guaranteed death benefits, the premiums for whole life insurance are significantly higher than for term life insurance. The cost is influenced by factors like your age, the amount of coverage, and any dividends or policy features you choose to include.

Universal life insurance is a flexible permanent policy that combines a death benefit with a savings element, which can grow based on interest rates. The cost of universal life insurance varies depending on the amount of coverage, the premiums you choose to pay, and the performance of the policy’s cash value. While it offers flexibility, the premiums tend to be higher than term life insurance but can be adjusted over time based on your financial situation.

Cash value life insurance, which includes both whole and universal life insurance policies, allows you to build up a cash value over time. This policy type generally comes with higher premiums than term life insurance due to the added investment component. The premiums you pay go toward both the cost of insurance and the accumulation of cash value, which you can borrow against or use for other financial needs.

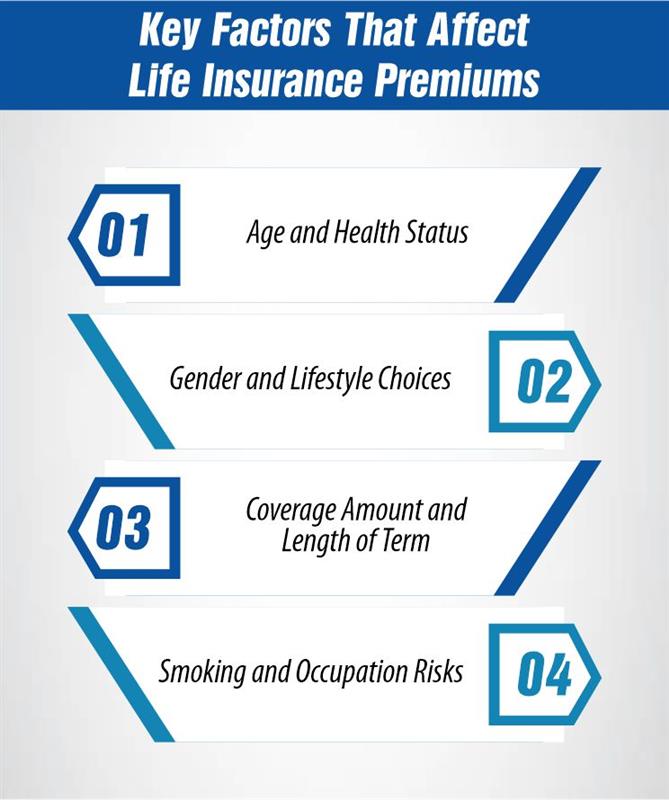

Understanding the factors that affect life insurance premiums can help you better anticipate the cost of your policy. Insurance companies assess various elements to determine your risk and the associated premium. Here are the key factors that influence your life insurance rates.

Age plays a significant role in determining your life insurance premiums. Generally, the younger and healthier you are when applying, the lower your premiums will be. Insurance providers view younger individuals as less risky, which translates to more affordable premiums. Additionally, your health status, including any pre-existing conditions, can increase your premiums. The better your overall health, the lower your rates are likely to be.

Insurance companies consider your gender when calculating premiums. Statistically, women tend to live longer than men, so women may pay lower premiums. Lifestyle choices such as regular exercise, a balanced diet, and moderate alcohol consumption can help lower your premiums. On the other hand, habits like smoking or heavy drinking can significantly raise your premiums due to the increased health risks they pose.

The amount of coverage you choose directly impacts the cost of your life insurance policy. The higher the coverage amount, the higher the premium will be. Similarly, the length of the term for term life insurance policies also affects premiums. Longer-term policies often have higher premiums because they provide coverage for a more extended period. Balancing your coverage needs with your budget will help you find an affordable premium.

Smoking is one of the most significant factors that can increase your life insurance premiums. Smokers are at higher risk for many health issues, so they tend to pay higher rates. Additionally, your occupation can also impact your premiums. High-risk jobs, such as those in construction or mining, may result in higher premiums because of the increased risk of accidents or injury.

The cost of life insurance can vary depending on several factors, including your age, health, and the type of policy you choose. Understanding the average cost can help you plan accordingly and choose a policy that fits your budget. Here’s an overview of the typical costs associated with life insurance.

Age plays a major role in determining the cost of your life insurance. Generally, the younger you are, the lower your premiums will be. For example, someone in their 20s or 30s can expect to pay significantly lower premiums compared to someone in their 50s or 60s. As you age, the risk to the insurer increases, which results in higher premiums. Understanding how premiums increase with age can help you plan ahead and lock in lower rates early.

Different types of life insurance come with varying costs. Term life insurance, which provides coverage for a set period, is typically the most affordable option. Whole life insurance, which covers you for your entire life and includes a cash value component, usually costs more. Universal life insurance offers flexible premiums and death benefits, making it more expensive than term life insurance but more affordable than whole life. Comparing the costs and benefits of each policy type is essential to finding the right coverage for your needs and budget.

The cost of life insurance can also vary based on where you live. Insurance providers take into account the regional risks, such as local healthcare costs, average life expectancy, and other demographic factors. For example, life insurance may be more expensive in urban areas due to higher living costs and healthcare expenses. Understanding regional differences can help you estimate your premiums more accurately when shopping for life insurance.

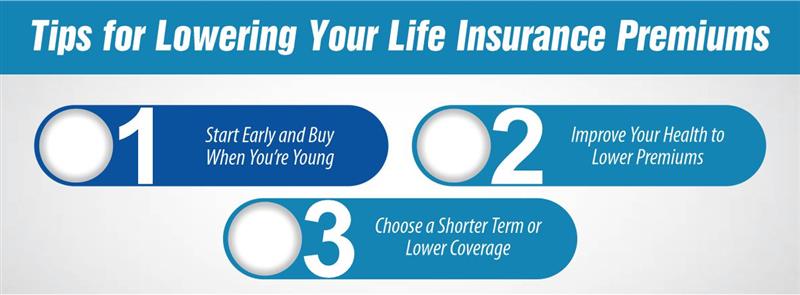

Life insurance premiums can be expensive, but there are several ways to lower your costs without compromising on coverage. By making informed choices and taking proactive steps, you can save money on your life insurance policy. Here are some useful tips to help you reduce your premiums.

One of the best ways to lower your life insurance premiums is to purchase a policy while you’re young and healthy. Insurance companies typically offer lower rates to younger individuals, as they are considered less risky. By securing a policy early, you can lock in lower premiums for the long term. This strategy can help you save significantly over time.

Your health plays a major role in determining your life insurance premiums. Insurance companies often offer lower rates to individuals who are in good health. If you have any existing health conditions, taking steps to improve your health, such as quitting smoking, exercising, or managing chronic illnesses, can lead to lower premiums. A healthier lifestyle reduces your risk and shows insurers that you are less likely to file a claim.

Selecting a shorter-term policy or opting for lower coverage can help reduce your premiums. Term life insurance, for instance, typically costs less than whole life insurance. If you’re looking to save on your premiums, consider choosing a shorter term, such as 10 or 20 years, instead of a 30-year term. You can also adjust your coverage amount to align with your budget and needs, without overpaying for unnecessary coverage.

Life insurance costs can vary significantly depending on your age, family status, and other demographic factors. Understanding how life insurance premiums differ for various groups can help you choose the right policy that fits both your needs and your budget. Here’s how costs break down for different demographics.

For seniors, life insurance premiums tend to be higher due to the increased risk associated with age. However, there are still affordable options, such as final expense or guaranteed issue life insurance. It’s important for seniors to shop around for the best rates and find a policy that provides the coverage they need without exceeding their budget.

Young adults generally benefit from lower life insurance premiums because they are considered low-risk by insurers. If you’re in your 20s or early 30s, you can secure affordable coverage, particularly if you’re in good health. Purchasing life insurance at a young age allows you to lock in a low rate for the future, ensuring long-term financial security for your loved ones.

For families with children, life insurance costs depend on several factors, including the number of dependents and the coverage amount needed to protect your family financially. While term life insurance is often a cost-effective option, families may need higher coverage to ensure their children’s future is secured. By comparing quotes and choosing the right policy, families can find affordable coverage to protect their loved ones.

Understanding how life insurance costs are determined and the factors that influence premiums can help you make more informed decisions when choosing a policy. By evaluating your personal situation and exploring different types of coverage, you can find a plan that fits your needs and budget. Whether you’re a senior, young adult, or family, shopping around and comparing rates will ensure you get the best value for your life insurance.

Yes, life insurance premiums generally increase with age. As you get older, the risk of health problems or other issues that could affect your life expectancy rises. This leads to higher premiums. That’s why it’s often recommended to buy life insurance at a younger age to lock in lower rates for the long term.

Yes, there are ways to lower your life insurance premiums over time. If your health improves, such as quitting smoking or losing weight, you can request a policy review to potentially lower your premiums. Additionally, paying premiums consistently or reducing your coverage amount can also reduce costs.

The cheapest life insurance policy typically depends on your age, health, and coverage needs. Term life insurance is often the most affordable option, especially if you're young and healthy. For those seeking permanent coverage, options like guaranteed issue or final expense insurance may also offer lower premiums, depending on your specific circumstances.

Yes, getting life insurance at an older age can still be worthwhile, particularly if you want to ensure your family is financially protected or cover final expenses. While premiums may be higher for older individuals, policies like term or whole life insurance can still provide valuable coverage.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes