Last Updated on: February 12th, 2025

Reviewed by Kyle Wilson

Burial insurance provides financial security during end-of-life by covering death-related expenses so family members do not inherit associated costs. Burial insurance costs fluctuate every month according to the combination of age, health condition and chosen coverage limits along with the insurance policy type. People who understand the different cost factors can make better decisions about burial insurance policies that fulfill financial protection needs and match their budget limitations.

Get Free Quotes

Customized Options Await

Burial insurance functions as a protection system to pay funeral expenses alongside medical expenses and modest outstanding financial obligations. The coverage available through burial insurance differs from standard life insurance by providing smaller benefits from $5,000 to $25,000 but they remain accessible through affordable monthly premiums. The expenses for burial insurance depend on age at application and health status as well as chosen policy type and personal lifestyle decisions.

The expense of burial insurance depends on the applicant’s risk score which insurance companies use to determine premiums. Insurance companies assess age along with health background and lifestyle patterns to establish the possibility of claiming benefits. Burial insurance costs vary according to policy structure because simplified issue policies with limited underwriting yield lower premiums compared to guaranteed issue policies that admit all potential policyholders regardless of their health condition.

Every burial insurance premium varies according to the specific risk assessment each insurer conducts for individuals. A younger policyholder who remains in good health typically obtains more affordable monthly premiums than someone who is older with health conditions already detected. Each applicant faces individual premium variations based on their gender and tobacco status alongside the chosen insurance amount resulting in completely different premium amounts.

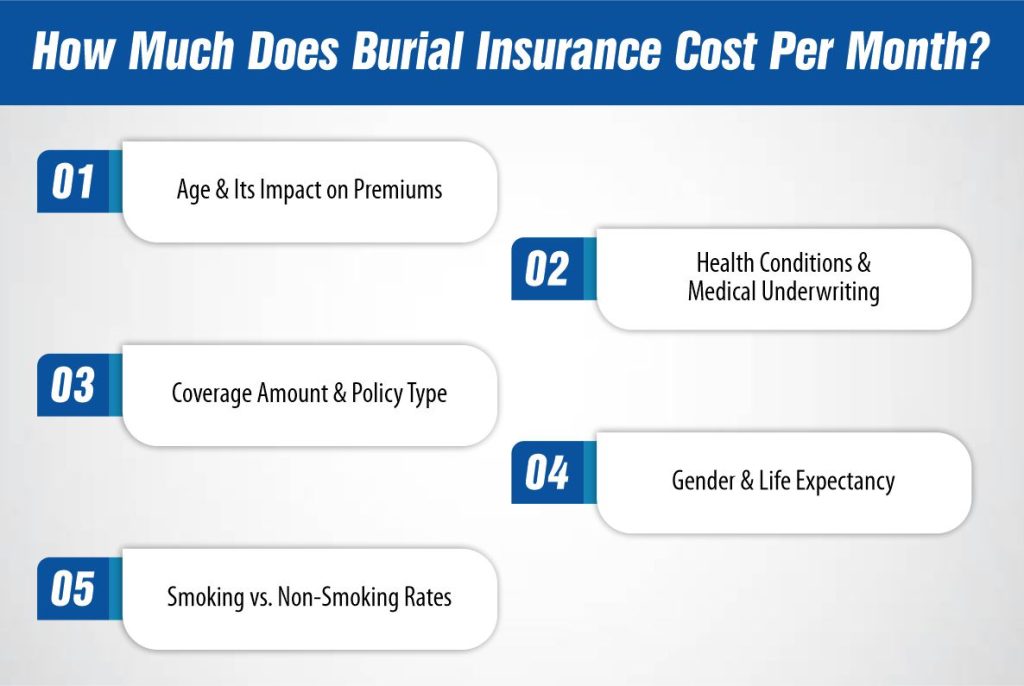

Here are some factors that affect Burial Insurance Pricing:

The age of an insurance applicant directly affects burial insurance premium rates. A younger person gets cheaper month-to-month premiums since insurers view them as less of a risk. The price of insurance benefits grows higher as individuals grow older. Getting a burial policy at a young age helps individuals establish lower long-term premium rates.

Insurance coverage for burial expenses depends significantly on the current health condition of policyholders. Basic health questions form part of certain policies but guaranteed issue policies exclude health history review in their assessment process. The cost of burial insurance depends on a person’s health status because better health equals lower premiums but poor health leads to higher premiums or delayed benefits.

Insurance coverage plans determine how much money policyholders must pay monthly. The premiums paid increase based on how high the value of coverage is selected. The type of clinical review determines the cost of coverage since simplified issue policies with basic health screenings stay more affordable when compared to guaranteed issue policies that provide immediate approval at elevated premium rates.

Burial insurance rates depend on a person’s gender according to the policy assessment methods of insurance providers. The life expectancy difference between female and male policies determines lower premiums for women because they stay active in their policies for longer durations before a claim occurs.

Smoking acts as a key factor which leads to higher premiums for burial insurance coverage. The health problems from smoking lead to greater premium rates for insurance coverage. Smokers face higher insurance premiums than non-smokers do because insurers charge separate rates to each group. The non-smokers enjoy lower cost premiums due to their health status. The death benefit premium rates for former smokers lower after they remain smoke-free for the specified time.

The expenses for burial insurance depend on personal characteristics such as age, health status, gender along with the policy coverage amount. Most Burial Insurance costs between $20 and more than $100 monthly for premiums. Premium levels for burial insurance reflect younger age, good health and paid lower rates but older applicants who have pre-existing medical conditions pay increased premiums

Burial insurance premiums increase with age, as insurers assess higher risk levels for older applicants. Below is an estimate of what seniors may expect to pay based on age:

These rates are estimates and can vary based on gender, smoking status, and the insurance provider.

The insurance cost for burial coverage varies based on gender criteria. Insurance providers lower premiums for females since they expect women to remain covered with their policies for a longer period before making claims. Male policyholders must pay average premiums that range from 10% to 20% higher than premiums paid by female policyholders for equivalent policy benefits.

Choosing a suitable coverage amount allows for better affordability. The affordable premium rates of funeral expense policies depend on maintaining policy values between $10,000 and $15,000. Raising your policy coverage value becomes essential if you want to add medical costs or debts because premium rates will automatically increase accordingly.

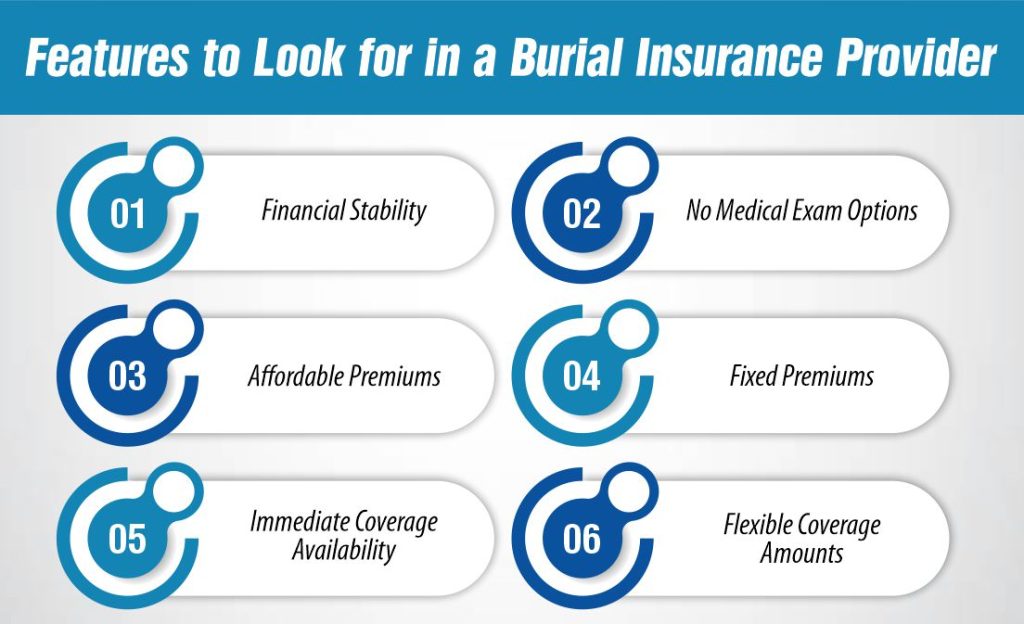

When choosing a burial insurance provider, it is important to evaluate key features to ensure you receive the best coverage for your needs. Some important aspects to consider include:

A burial insurance policy allows families to obtain accessible coverage that pays for their funeral and death-related expenses thus easing financial stress on surviving family members. Premium rates fluctuate according to factors such as customer health status, age group, gender and policy value so customers should review different provider plans before deciding. Your decision to select an insurance provider with suitable features will grant you safety from financial distress while bringing you emotional comfort.

The required policy coverage depends on estimated funeral expenses and burial or cremation costs together with additional anticipated end-of-life costs. An insurance policy amount of $10,000 to $15,000 usually covers the needs of most senior citizens.

Burial insurance premiums stay the same throughout each month because these policies provide fixed-price coverage that does not fluctuate based on age or health status.

The coverage benefits from burial insurance start after a waiting period of typically two years from policy activation. Individuals who meet the qualifications can obtain no waiting period burial insurance that starts with immediate coverage upon policy activation.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes