Last Updated on: March 18th, 2025

Reviewed by Kyle Wilson

If you’re looking for final expense insurance with limited health exams, Globe Life offers a variety of products that match this situation.

Globe Life only offers coverage with no medical exam, so if you’re healthy, you’ll pay higher rates than you would at an insurer that takes your health into account when setting prices.

Additionally, Globe Life Insurance receives far more complaints than competing life insurance companies, suggesting customers are less likely to be satisfied with the service they receive.

Let’s have a complete globe life burial insurance Review.

Customized Options Await

Globe Life was founded in 1951. Liberty National Life Insurance acquired Globe in 1980 and formed a holding company called Torchmark Corporation. In 2019, Torchmark officially rebranded to Globe Life Inc. and appeared on the NY stock exchange as “GL.”

Globe has multiple subsidiaries: Globe Life Insurance Company of New York, United American Life Insurance Company, American Income Life, Family Heritage Life, United American, Liberty National Life, and Beazley Benefits.

Their home office is in McKinney, Texas, but they are licensed in all 50 states. They overwhelmingly focus on individual life insurance policies but offer annuities and supplemental health insurance products. Globe life insurance has mixed Globe life burial insurance Review about their policies.

Globe Life’s principal products are No medical exam term life insurance and whole life insurance for children and adults. However, to enroll in any of the Globe life insurance policies, you won’t need to sit for any exam, however, you will need to answer some health questions excluding their accidental death policies. As for life insurance, Globe does not have a guaranteed life insurance policy for its clients.

A few of the things that are prohibited in the application and policies of Globe Life are as follows; Adults with severe or chronic health conditions will be locked out from getting approval from Globe Life. According to globe life burial insurance Review Several customer complaints regarding pre-existing conditions like diabetes (and many others) have raised claims that Globe rejected their application.

Globe Life uses several different underwriting companies:

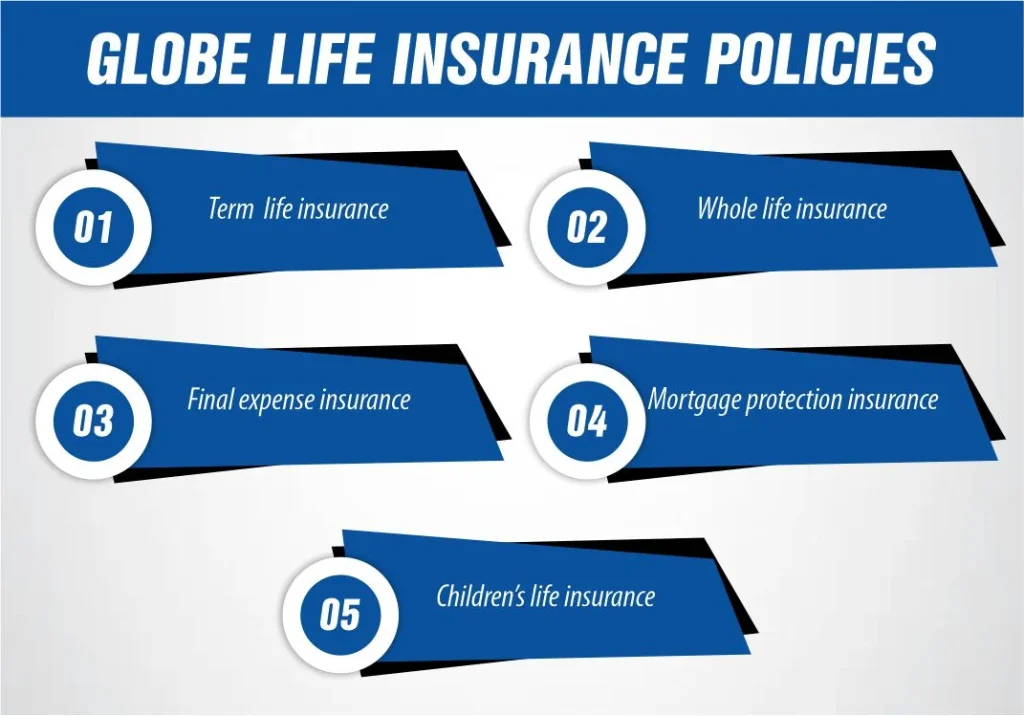

The offered insurance plans of Globe Life are of several types of life policies including term, whole, and final expense. It may take a few minutes to get a life insurance quote and it is obtained online or through a call to a local life insurance agent.

When it comes to term life insurance companies it is possible that you are interested in Globe Life. Globe Life’s term coverage allows you, for example, to buy a policy directly from the company’s website — although you can still deal with an agent — and without a physical examination. Well, there is certainly a downside to not having a medical exam: There is limited financial coverage offered in terms of coverage of up to $100,000; this is rather lower than most insurers who provide term life insurance.

Globe Life provides whole life insurance, which is a form of permanent insurance, that pays a death benefit to your heirs in the event of your death provided that the policy premiums are paid continuously. Globe Life’s whole life insurance cannot be bought online; instead, you have to engage an agent or complete a form to get the coverage. However, there is a health questionnaire, but it does not require a medical exam on Globe Life’s whole life coverage. Globe Life also provides whole life insurance with benefits ranging from $10,000 to $50,000.

Final expense is a whole life insurance product that provides funds to pay for burial or cremation, funeral services, and anything associated with the last days of the policyholder’s life. The final expense coverage offered by Globe Life can be bought online and there is no medical exam required. Preparing for final expenses may be a widely preferred life insurance product for individuals who have no dependents to support, but are still alive during the time of the policy since it tends to be more costly and has restrictive coverage limits, which are quite low.

Like most of the Globe Life policies, you might not need to submit a medical exam, but it does not mean that your application cannot be rejected. However, Globe Life’s Mortgage protection insurance is different as it is guaranteed. However, it must be understood that this product refers to an accidental death and dismemberment insurance policy, which implies that it only provides benefits when an incident occurs and not due to sickness or disease.

One of the most important considerations when assessing a life insurance policy based on the age of the policyholder; therefore it is beneficial to purchase coverage for your children when they are still young so that they can lock themselves into a lower rate for the future. Most of Globe Life’s policies are offered without medical examination and the coverage can be bought through the Internet. It has a death benefit that ranges from $500 to $ 30,000.

If you require a term life insurance policy of a lesser amount ($20,000 or less), then Globe Life Insurance is a good company. They also provide some of the most competitive life insurance policies for children.

Apart from those instances, many other life insurance companies include selling both term and whole life insurance at a relatively cheaper rate. Most importantly, if you require term life insurance, you are provided with the policy for a lesser price and have a fixed rate for the entire period of the policy.

Globe Life may be a good life insurance company for many, but it’s not likely to fit everyone’s needs. Life insurance is intensely personal, so finding the right company is important. According to globe life burial insurance Review If you aren’t convinced that Globe Life is the right fit, consider these other options:

MassMutual was also recognized as the best whole life insurance company in the Bankrate Awards 2024. It might be more useful in the case of an individual who requires a lot of coverage from the company. Apart from the mentioned life and long-term care insurances, the company also offers a wide range of investment and retirement products that comprises 529, IRA, mutual funds, and various types of annuities. MassMutual ranked 3rd in the 2023 J.D. Power Individual Life Insurance Study and has the highest AM Best financial strength ranking of A++ (Superior).

This well-established company secured the 2024 Bankrate Awards in the Term and Universal Life Insurance categories. The customer satisfaction ratings may be attractive to viewers seeking an efficient and convenient policy process with State Farm. The company has many opportunities to contact local agents, a phone number for customer service, an application for mobile devices, and online access to the customer’s account. In addition to life insurance, State Farm provides auto, business, owners, and renters insurance as well as banks, home loans, and investment products.

Globe Life insurance may not fit everyone’s needs, as each life insurance company caters to different types of needs. Here’s some information that may help you decide:

Pros

Cons

Globe Life is indeed a real-life insurance company that has an A (Excellent) rating to it from AM Best but it has more complaints than an average insurance company. As per the NAIC, globe life burial insurance Review has an average consumer complaint ratio of 6. complaints five times more than the average of a life insurer.

Many of Globe Life’s customers said they experienced delays during the claims process, as well as billing issues. The company’s sales team, on the other hand, is incredibly persistent about calls and sending materials.

If you have a life insurance policy, make sure your beneficiary has the information necessary to file a claim and the details of your payments. Some Globe Life customers said their parents failed to make payments because of illness or dementia, and they had trouble reinstating coverage after the policy lapsed. You don’t want to spend years paying for benefits your family doesn’t receive once you die.

Reference:

https://choicemutual.com/blog/globe-life-burial-insurance-review/

https://www.marketwatch.com/guides/life-insurance/globe-life-insurance/

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes