Last Updated on: March 10, 2025

Reviewed by Kyle Wilson

The Colonial Penn $9.95 Plan Reviews are generally sold as an inexpensive life insurance plan, but here are several things that you may not have discovered. The beauty of this plan is that the premium is cheap but the actual coverage offered may be far from this plan. Several reviews suggest that the policy may be relatively useful, particularly in the first years of the policy, and very costly with various exclusions. To make the best decision when thinking of opting for this plan, it’s advisable to demystify it and other competing plans to determine their pros and cons.

Get Free Quotes

Customized Options Await

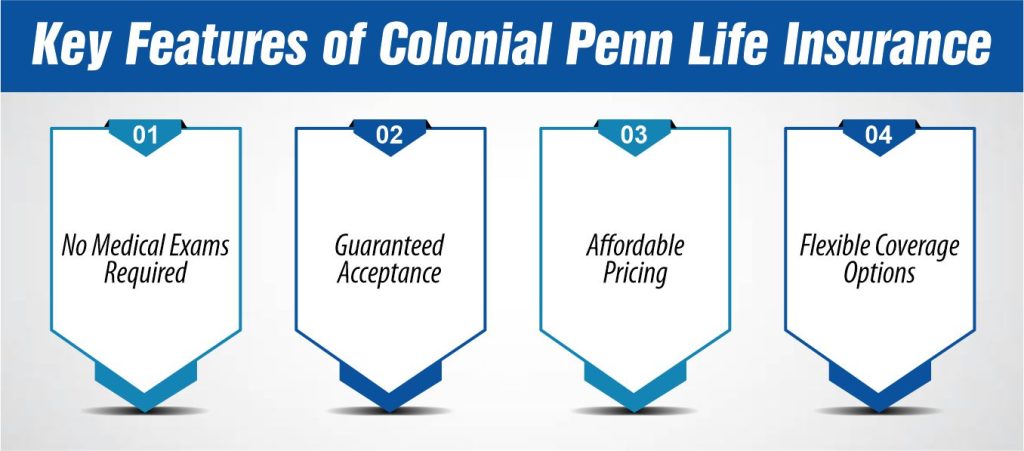

Colonial Penn Life Insurance has no-nonsense and low-cost death benefit coverage products solely meant for people who want to get a good insurance plan without jumping through hoops. It becomes easy for potential clients to embrace their proposals as their strategies narrow down many hurdles that come with the purchase of life insurance policies such as medical examinations and long underwriting procedures.

In many cases, you do not need a medical examination to purchase a Colonial Penn policy which makes it a good choice for the elderly or anyone with any prior medical conditions that would make getting traditional insurance difficult.

Endurance plans presuppose that you automatically qualify for an insurance policy once you satisfy the age criteria regardless of your existing healthy status or otherwise, fitness levels, or habits. It also guarantees the population who might have a hard time finding insurance cover, a relief that they need.

Colonial Penn Insurance has a highly promoted $9.95 plan which is quite popular among their clients. They assist in making it possible for individuals with little income or cash to afford the product as well as for those who wish to cut their expenses.

Colonial Penn offers multiple policy classes, guaranteeing that you choose an option that fits your situation and preferences. While some may require insurance for burial expenses, others may need a small amount to be left behind for their family members, and that’s why their range of solutions is tailored to meet different needs.

Colonial Penn Life Insurance was created to make the process of protecting one’s close ones as easy as it can be. Here’s how it works:

The life insurance plans available through Colonial Penn include traditional whole life insurance as well as other products. That is why you can choose a policy according to your wishes – either to provide money for the funeral or to leave it to your relatives.

Nowadays, if you have selected a certain plan, you will have to pay a standard monthly cost to keep protected against any misfortunes. Colonial Penn life insurance monthly premium options include $9.95 that are considered cheap in the market today.

Based on the type of policy, your beneficiaries will receive a guaranteed amount or an amount that can be determined by your age, gender, or health status. These are intended to pay for funerals, to pay off outstanding bills, or to offer any other financial assistance.

Colonial Penn cuts out complexities of life insurance such as thorough surveys of the health of the applicant and stabilized prices. This format is quite practical, It assists you to build a sound financial future with less effort and fuss.

Here there is an account of how Colonial Penn Life Insurance Company differentiated coverage per policy through the use of “units” especially for the preferred Colonial Penn $9.95 plan. This system should therefore ensure that coverage is possible, easy to understand, and should cost as much as possible.

Here there is an account of how Colonial Penn Life Insurance Company differentiated coverage per policy through the use of “units” especially for the preferred Colonial Penn $9.95 plan. This system should therefore ensure that coverage is possible, easy to understand, and should cost as much as possible.

The rate chart by age of Colonial Penn Life Insurance is very useful in determining Social Security level or coverage cost. This chart assists the policyholders in understanding a logical relation between their age and the value of each…unit of the life insurance claimed for them to understand the number of units to claim.

Age | Coverage Per Unit | Monthly Cost (1 Unit) | Coverage for 3 Units | Coverage for 5 Units |

50 | $1,786 | $9.95 | $5,358 | $8,930 |

60 | $1,214 | $9.95 | $3,642 | $6,070 |

70 | $810 | $9.95 | $2,430 | $4,050 |

80 | $418 | $9.95 | $1,254 | $2,090 |

Example Breakdown

By carefully analyzing the rate chart, you can:

Undoubtedly, this chart makes it easy for consumers to choose the best rate from the Colonial Penn to suit their needs. Always, request the current chart when thinking through your policy.

Nevertheless, all kind of life insurance plan has its benefits and drawbacks. Mainly, the $9.95 plan is the most attractive in terms of pricing, but such a package may not meet the requirements of every user.

However, before opting for this plan we need to consider these pros and cons.

Customer feedback is an essential aspect of the choice of life insurance. Potential policyholders can read about colonial Penn’s $9.95 plan to get an idea about its relevance and usefulness. Below is a breakdown of the most common positive and negative feedback shared by customers:

Colonial Penn insurance claim is very easy to file and has been structured in a way that allows the beneficiaries to get the funds they need without many hitches. The firm also ensures that it respects the client’s time by making the claims process as smooth as possible in times of awful circumstances.

The next step is to obtain peace which in its crucial sense means gathering the material that would attest to the truth of your potential claim. These typically include:

You can send all or any of the following documents through the means allowed by Colonial Penn, which may include mail, email, or via the Internet by using a suitable link provided by the company.

Colonial Penn has developed a good standing as regards claims where it has been noted to be both quick and reliable. Here’s why their process stands out:

Being a life insurance company Colonial Penn has a good record of catering to its users’ needs and providing full support to their families during the sad period by paying out the claimed amount as soon as possible.

Colonial Penn’s Medical and Health insurance products are valuable and affordable for persons and families who want to address their healthcare needs. Even though such plans are generally considered very cheap and easy to use, it is worthwhile to learn more about the potential high and low points to discover that indeed such plans will suit you.

Most plans have prescription drug benefits whereby policyholders can address the issue of the cost of the drugs they need. It still doesn’t cover every drug, but it can help cut down the amount of out-of-pocket expenses in the cost of most prescribed medications.

Some of the general routine wellness check-ups and immunizations as well as regular health screening usually form part of Colonial Penn health insurance packages. This can assist in finding out whether one is developing an ailment early enough so that it doesn’t land him/her many health bills in the later years.

Although sometimes one may complain of being restricted to a certain network of doctors, Colonial Penn’s health insurance allows many customers to get treatment from some of the best-known and respected health facilities. This will help policyholders to have adequate choices when it comes to their treatment.

Colonial Penn has various forms of health care acknowledged as medical plans, special and fundamental acknowledging general care, and others acknowledging larger varieties of medical needs. Based on your requirements, there are several plans available and you can choose which one will have a lower premium cost but more coverage or a higher premium cost with extensive coverage.

It can now be impressively noted that Colonial Penn health plans have one of the most honest forms of fee structure. As there are no concealed charges, the holder can easily plan for his or her health expenditure without additional costs.

When choosing Colonial Penn Life Insurance, consider these helpful tips:

Thanks to this very Colonial Penn Life Insurance company, you have an opportunity to offer your near and dear ones protection that won’t cost you too much. From their $9.95 plan up to colonial insurance claims and colonial health insurance reviews the company makes insurance easy for everyone.

If you know the rate chart based on age and how the Colonial Penn units function, the strengths, and weaknesses of the program, you’ll be adequately equipped to make a positive decision regarding life insurance.

Yes, there is always a waiting period when a client wants to take Colonial Penn’s life insurance policies especially the ones they refer to as guaranteed acceptance policies. This makes it so that if the policyholder dies during the waiting period, the death benefits paid to the beneficiaries are only the amount that has been paid in premiums.

There is whole life insurance provided by Colonial Penn; this policy offers policyholder coverage for the entire life when the premiums are being paid. The common policies of the company include policies with known premium amounts and accumulated cash values on the policyholder.

Yes, Colonial Penn does sell burial insurance or what is now referred to as final expense insurance. This type of policy assists in paying funeral and burial expenses because it can be expensive when a family member is buried.

At Colonial Penn, clients can make payments for their life insurance policies on a monthly, quarterly, or annual basis. The particular choices available vary according to the type of policy chosen.

The Colonial Penn $9.95 Plan is cheap for senior citizens, though the scope of coverages they provide is very low with a waiting period included. However, it may not fully provide for all the final costs, and therefore the seniors need to go through the terms of the policy before buying.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes