Last Updated on: March 18th, 2025

Reviewed by Kyle Wilson

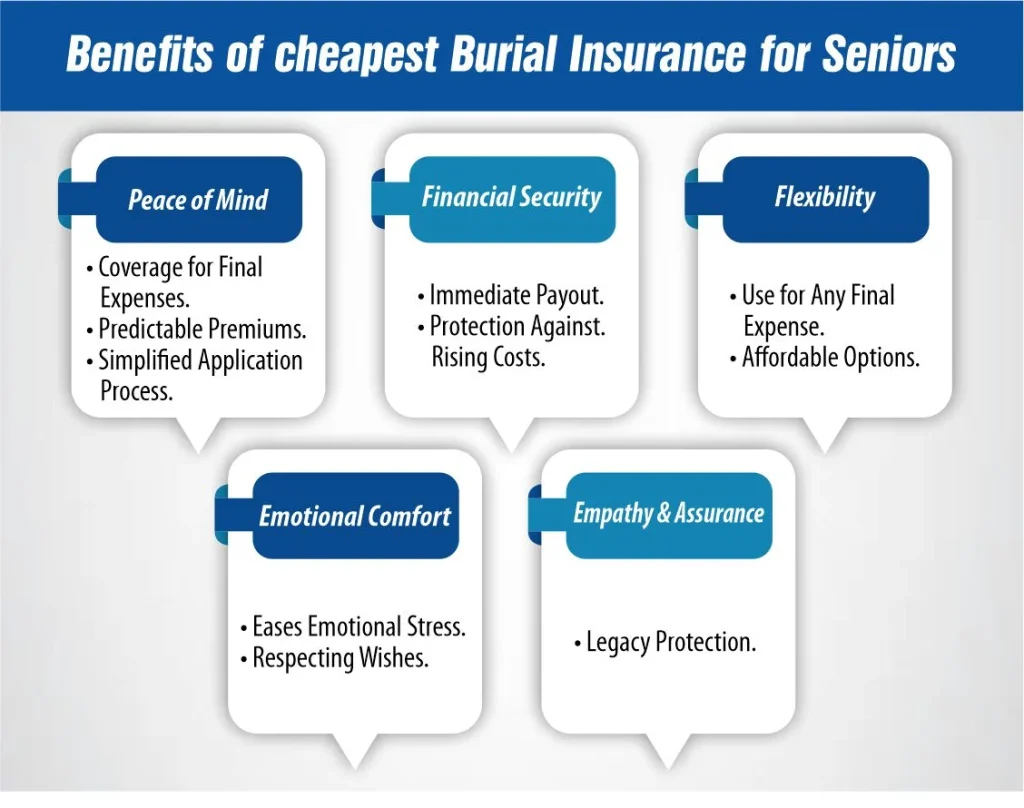

Looking for the Cheapest Burial Insurance for Seniors? Are you concerned with how funeral costs may affect your family or loved ones in future? Burial insurance doesn’t have to be expensive to provide comfort knowing your loved one’s final arrangements won’t burden them. So, let’s discover how one can get the required coverage for seniors at the lowest price ?

Customized Options Await

When it comes to purchasing any particular item, people know that they should compare offers provided by different companies.

The same applies when searching for cheapest burial insurance for seniors.

Finally, if you are interested in a life insurance policy that has no waiting period and is cheaper than all the other ones, you will have to contact an agent.

So, it is also worth mentioning that most final expense insurance companies if they offer their policies directly to the consumer through the Internet or through the mail have a rule that if you are buying life insurance through them you will not be insured for the first two years because you are going to buy guaranteed issue life insurance which always comes with this waiting period. Plans like Colonial Penn are a perfect example.

In most cases, only professional agents can offer the lowest rates and options that allow the policy to pay out the whole amount of the death benefit right away.

But do not talk to any random insurance agent.

Here are the criteria you should look for when selecting an agency to work with:

Whenever you are in the process of sourcing for an independent insurance agency that will handle your policy, ensure that it has direct access to at least ten insurance companies. It will identify affordable providers for you from different telecoms and connect you to the best one for a cheaper price. So it is recommended not to use “attached” insurance companies. Captive insurance companies restrict their agents from presenting policies of any other insurance company. State Farm is an example of a captive company. Independent State Farm agents can only offer you insurance from State Farm.

So, always make sure that you select a broker who has an array of insurers to sample before selecting the best one for a client.

One should take time and search for some of their previous clients to confirm whether or not they were satisfied with the services offered to them. A bad image usually points to the fact that the insurance company has low-quality insurance products and equally poor customer relations.

Ensure that you find one that focuses on funeral insurance services for seniors. That way, you understand that you are dealing with a professional and not any untalented beginner in the sector.

An honest independent agent is your surest bet for getting the best life insurance for seniors.

A cheapest burial insurance for seniors policy can cover all the expenses associated with your funeral plans, including:

Cheapest burial insurance for seniors is a sort of complete life insurance that does not require a health exam. It’s designed to cover final costs like burial, cremation, and funeral charges. The payout, known as a dying benefit, is going at once to your family and can be used for any fees they pick out, no longer just funeral expenses.

The coverage gives permanent coverage with fixed charges, that means your costs won’t exchange through the years. The coverage quantities normally decrease, frequently below $50,000, but they could offer peace of mind by way of overlaying essential costs.

One advantage of affordable burial insurance for seniors is that it’s less difficult to qualify for, even when you have fitness issues. This makes it an awesome choice for seniors who may not be eligible for conventional lifestyle insurance regulations.

There are two types of policies that are common among seniors.

These plans are the least costly and can provide an instant death benefit because the face amount is paid out from the first day (no grace period). You are not required to do a medical exam; however, you have to answer health questions. Simplified issue policies are also referred to as ‘no exam funeral insurance.

Often called “guaranteed acceptance”, these plans have no health questions because you cannot be turned down. They cost more than the simplified issue policies, and there is always a two-year exclusion on non-accidental death. During the waiting period, if you die, then the insurance company will only return the premiums that you’ve paid plus some interest.

You can get best free burial insurance for seniors, but there are a few important things to know:

This ensures that the process is clear and your loved ones are protected.

There are several aspects that explain why burial insurance is more expensive than other types of policies.

While numerous burial insurance policies promise seniors they will be protected, the average cost is not the same for all. An insurance provider uses several factors to determine your insurance cost, such as:

Age: Seniors especially pay more for premiums because there is more risk in insuring you.

Gender: Usually, male policyholders pay more for their life insurance as compared to females.

Health: Although you may not be required to take an exam normally, many burial insurance companies will ask health questions to determine your health status.

Amount of coverage: In general, higher coverage would mean a higher amount you have to pay for your car insurance.

Policy premiums could range between $50 per month to $100 per month depending on the insurance company, age, sex, the amount of coverage, and the overall health of an individual. It’ll be cheaper than other quotes if your health is good and you can respond “No” to all health questions on the form.

However, some insurers may ask for a medical examination to qualify for a policy, although this is not very common. If you have experienced some health complications in the past or are on some medications, then you are likely to be put in a modified or sub-standard plan and will therefore be charged more because of your health status.

Age and Gender | $5,000 | $10,000 | $25,000 |

Female age 40 | $12 | $21 | $47 |

Male age 40 | $14 | $25 | $57 |

Female age 45 | $13 | $23 | $52 |

Male age 45 | $15 | $27 | $63 |

Female age 50 | $14 | $24 | $55 |

Male age 50 | $17 | $31 | $71 |

Female age 55 | $15 | $28 | $64 |

Male age 55 | $20 | $36 | $84 |

Female age 60 | $18 | $33 | $76 |

Male age 60 | $23 | $43 | $103 |

Female age 65 | $22 | $41 | $97 |

Male age 65 | $29 | $54 | $130 |

Female age 70 | $28 | $53 | $127 |

Male age 70 | $37 | $70 | $169 |

Female age 75 | $37 | $71 | $172 |

Male age 75 | $50 | $97 | $238 |

Female age 80 | $50 | $98 | $241 |

Male age 80 | $69 | $135 | $332 |

Female age 85 | $70 | $136 | $335 |

Male age 85 | $91 | $178 | $440 |

Female age 89 | $131 | $260 | $651 |

Male age 89 | $180 | $357 | $888 |

Picking the one that offers the cheapest burial insurance for seniors that will be sufficient for your needs. Make sure you know the terms, coverage details and conditions, and look for insurance providers to get a quote. Seniors can identify a policy that provides their families with the much needed financial help during the time of need without being a burden to the family.

Most seniors between 50-85 can get it, usually without a medical exam. Even with health issues, it’s easy to apply.

Look at funeral costs and any debts. Usually, $10,000 to $25,000 is enough.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes