Last Updated on: February 25th, 2025

Reviewed by Kyle Wilson

Burial insurance with pre-existing conditions presents available options which enable your loved ones to prevent financial hardship upon your death. Some individuals with health problems discover burial insurance as a simpler alternative compared to standard life insurance examinations. This guide explores burial insurance policies focused on pre-existing medical conditions in regards to both acceptance criteria and available options and affordable purchasing approaches.

Get Free Quotes

Customized Options Await

Those with pre-existing health concerns should consider burial insurance as it provides financial protection for their death expenses without causing prolonged hardship to their relatives. This form of insurance provides simplified access to coverage for funeral expenses and this solution targets death-related expenses specifically.

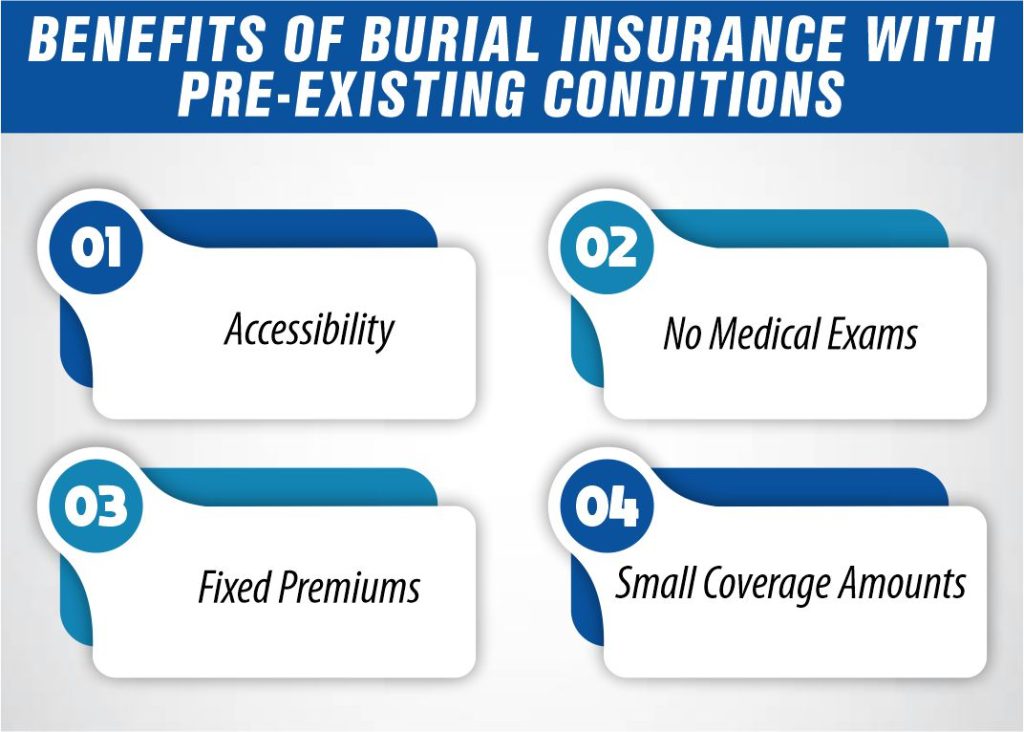

The insurance policy known as burial insurance works as final expense insurance to give a small death benefit which helps pay for funeral costs along with related expenses. Burial insurance exists for consumers who cannot secure standard life insurance so it welcomes people with health issues along with older adults. The policy limits of burial insurance generally range from $5,000 to $25,000 and insured persons can usually obtain this coverage without undergoing medical examinations.

Burial insurance costs and eligibility will be affected by previously diagnosed medical conditions. A few insurance providers extend guaranteed acceptance policies to people with health issues yet premium rates and coverage waiting times might differ based on provider policies. Burial insurance delivers greater flexibility than regular life insurance policies which means it works well for customers who have pre-existing conditions.

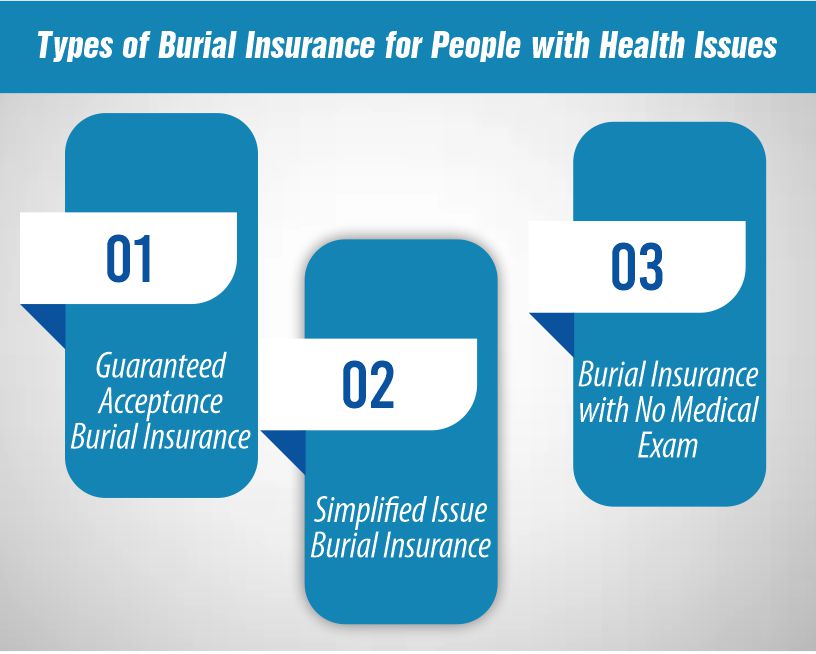

Multiple burial insurance policies exist specially designed to accommodate clients dealing with health issues. The policies include diverse terms and premium rates with specific enrolment criteria to serve people with different health conditions.

Burial insurance under guaranteed acceptance provides coverage to anyone without requiring any evidence of health status. The absence of requirement for medical exams or health questionnaires makes this policy suitable especially for individuals with challenging medical backgrounds. Burial insurance contracts usually mean increased premiums and their death benefit is delayed through a standard two-year waiting period.

The procedure for simplified issue burial insurance requires health-related questions instead of medical exams. A policy acceptance decision that also determines your premiums follows your completion of insurer-provided questions. People with manageably healthy conditions can obtain less expensive policy coverage through simplified issue burial insurance either quickly or within a brief waiting period.

Policyholders who want burial insurance coverage without undergoing medical tests can access this type of insurance which does not require examinations. The application process includes asking patients several health-related questions rather than conducting an exam. Fast and simple coverage without complexities stands out in such policies though their premiums can surpass those of fully underwritten policies. The complete benefit payments can have a waiting time before they are delivered.

You can obtain burial insurance with pre-existing medical conditions through proper examination of both your health status and available insurance plans. Specialized burial policies from insurance providers exist for people with health issues yet these policies work differently from standard coverage while having distinct insurance rates. The following instructions detail the qualification process for coverage alongside the essential considerations facing shoppers.

Among all burial insurance options you should carefully pick a policy which suits your medical condition. The guaranteed acceptance policy serves as the optimal choice for people with serious health issues due to its no-requirement for medical examinations. A simplified issue policy will present lower premiums to individuals who face mild or moderate health conditions. Study policy terms with focus on waiting periods together with health-related exclusions for particular medical conditions.

Eligibility for burial insurance together with premium expenses depend on your health condition severity and your age along with the selected policy type. The assessment process by insurers includes condition-related queries about heart ailments together with diabetes and cancer along with other long-term medical issues to evaluate coverage approval and price determination. When seeking burial insurance some providers adopt strict underwriting standards yet other insurers extend coverage opportunities to health-challenged beneficiaries through costlier premium rates.

Getting affordable burial insurance with pre-existing conditions requires a bit of effort, but it’s possible. Here are some tips:

Burial insurance stands as a suitable insurance option for people who suffer from health issues yet cannot secure traditional life insurance. Before adopting a policy individuals must evaluate both the positive aspects with potential negative aspects.

People who have pre-existing conditions can get burial insurance through proper evaluation of their health along with insurance options and examination of policy terms. Guaranteed acceptance and simplified issue burial insurance represent two policy types which you can evaluate to suit your personal requirements. The cost of your premium will be higher but your insurance policy will ensure that your family members avoid being responsible for your funeral expenses. You should review several insurance providers until you discover the cheapest policy which accommodates your individual health requirements.

Serious health conditions do not prevent you from obtaining burial insurance coverage. Insurance providers issue specialized guaranteed acceptance burial insurance without needing medical examinations.

Most burial insurance policies maintain a waiting period when medical exams are not necessary for policy approval. Burial insurance policies must wait for a time frame of 1 to 3 years before death benefits are paid. During the waiting period beneficiaries will not receive the full death benefit but policyholders can recover their premium payments upon death.

Costs for burial insurance coverage differ according to the severity of existing health conditions along with your age and necessary coverage amount.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes