Last Updated on: March 19th, 2025

Reviewed by Kyle Wilson

Ethos burial insurance specifically ensures that families can afford the costs of burying a loved one when they die. Looking for peace of mind when it comes to final expenses? Ethos Burial Insurance might be the solution you need. But how do you know if it’s the right choice for you? In this review, we’ll explore the ethos burial insurance Reviews,benefits, coverage options, and customer experiences with Ethos Burial Insurance. Let’s dive in and see if this policy fits your needs and provides the security you’re looking for.

Customized Options Await

Peter Colis and Lingke Wang, started Ethos in 2016 to make life insurance affordable, accessible, and straightforward. Ethos was developed due to a bad experience with the traditional forms of life insurance. Another time, Lingke was in college and he was sold an unnecessary and costly life insurance policy that he could not afford. The two concluded that this was not the first time Lingke had come across such a situation. Some Americans are still not aware of life insurance or do not have proper coverage for their loved ones. Ethos has positive ethos burial insurance Reviews from all companies.

The insurer earned points for its online application process, term life coverage, and added benefits of including free will and estate planning tools with eligible policy purchases. It offers instant term life coverage that does not require a medical exam or blood testing — applicants only need to answer a few health questions.

However, Ethos Life is not clear about the policy upgrades and riders it offers, which can make it a less viable choice if you also need terminal illness or accidental death add-ons. Its age cutoffs, especially for whole-life policies, are also strict and can make coverage less valuable for younger customers shopping for permanent life insurance.

It offers coverage limits from $20,000 to $2 million and is also offered in various terms. Although pre-employment medical examinations are not mandatory, it can be believed that some illnesses may lead to different options for obtaining health insurance. The application is entirely online and Ethos says it can provide an answer to approval very quickly.

In addition to a term life product, Ethos also offers whole life insurance. Coverage amounts are relatively small. However, this type of life insurance is more of a final expense product. This means that once a policyholder secures a contract before the age of 85, they will from that position be covered into their lifetime provided they continue to pay the requisite premium charges. This whole life insurance accumulates cash value and has graded death benefit options whereby the beneficiaries may receive back the premiums in certain situations. For Better coverage check ethos burial insurance Reviews.

Overall, Ethos has credible ethos burial insurance Reviews from its customers. According to the data obtained, as of January 2024, the company will have 4.7. They use some rating systems that allow them to present the result to consumers; they got 89 % on Trustpilot which is a consumer review site. Currently, there are a total of 1,105 reviews on Trustpilot, and out of them, 86% are five-star reviewers.

Most Ethos policies are underwritten by Legal & General, an insurance provider with an “A+ superior” financial strength rating from AM Best. S&P has categorized it as stable and expected to fulfill its financial commitments.

Ethos is also a member of Better Business Bureau (BBB) and holds an A+ rating. In ethos burial insurance Reviews it appears to have a positive rating from customers who have posted comments on the BBB with 4.67. The current Consumer rating is 61 stars out of 5 that have been achieved until the beginning of January 2024.

In addition to life insurance, After analyzing ethos burial insurance Reviews, Ethos also offers estate planning services and products.

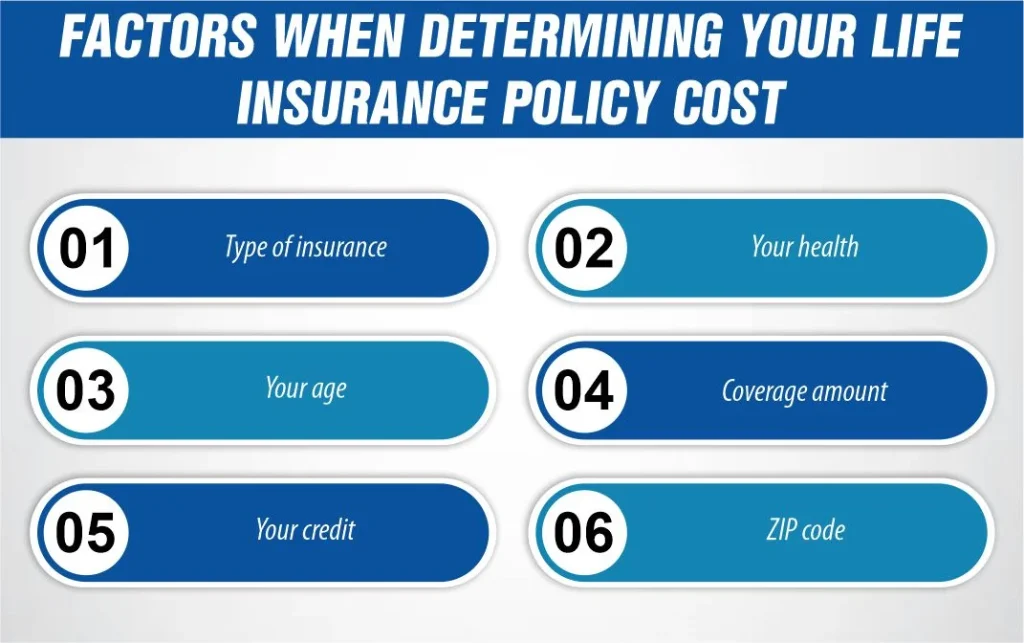

Ethos Life considers the following factors when determining your life insurance policy cost:

There are several types of life insurance offered by Ethos Life, although the probability of a payout can differ between the offered products. In general, whole life costs more than other types of insurance and this is because it is valid for the life of the insured, provided premium is paid. When choosing term coverage, costs are a little higher with the term lengths of a given policy.

Indeed, Ethos Life does not require you to take a medical exam for a policy but you may be required to provide some details about your health and medical history. Therefore, if you are in good health and do not use nicotine, you should easily find the best rates.

When in this stage, the risk of early death is even higher than before, not that you cannot die at any age. Therefore, the individuals in this older generation will be charged higher premiums for life insurance than those who are young. If you are sure of your need for whole life insurance coverage, it is advised that you get life insurance quotes at an early stage since the insurance rates are cheaper when you are young. Thus, term life insurance rates upwardly rise each time one renews his contract since the person or applicant will have aged.

If you decide to get a life insurance policy, you will select a payout amount that will go to your beneficiaries in the unfortunate event of your death. Sometimes, it is true that a higher death benefit of a policy increases the amount of money paid for insurance.

Ethos Life wants you to input your estimated credit score in your application, and the company saves the best rates for those with high scores.

| Policy Type | Age Range | Term Length | Monthly Estimate |

| Term life with a $100,000 death benefit | 25–34 years old | 10 years | $8–$11 |

| Term life with a $100,000 death benefit | 25–34 years old | 30 years | $12–$19 |

| Term life with a $1 million death benefit | 35–44 years old | 15 years | $58–$102 |

| Term life with a $1 million death benefit | 35–44 years old | 30 years | $121–$226 |

| Whole life with a $5,000 death benefit | 65–70 years old | Not available | $43–$75 |

| Whole life with a $12,500 death benefit | 80–85 years old | Not available | $196–$354 |

Extras are defined as customizing an existing policy by adding extra features. Sometimes they are completely free but most of the time, they do come with a price. Rider is often a confusing type of insurance; contact the direct agent to discuss if you need it in your policy.

As we wrap up the ethos burial insurance Reviews. Ethos is a reputable and trustworthy company for life insurance policies and offers multiple plans with high financial ratings. They have an instant-term life insurance policy with no medical exam or blood test; Free will and an estate planning kit with the purchase of the qualifying policy.

However, Ethos’s whole-life policies are only available to those between 66 to 88 years and the death benefits are lower compared to other market offerings. Compared to its competitors Ethos may not be the most affordable insurance company but their whole life products are very easy to purchase and do not require any medical examination. If you believe that you can be declined by standard life insurance companies but you want permanent life insurance that comes with an investment component, then an Ethos Life application can be a good starting point.

https://www.usnews.com/insurance/life-insurance/ethos-review

https://time.com/personal-finance/article/ethos-life-insurance-review/

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes