Last Updated on: November 7th, 2024

Reviewed by Kyle Wilson

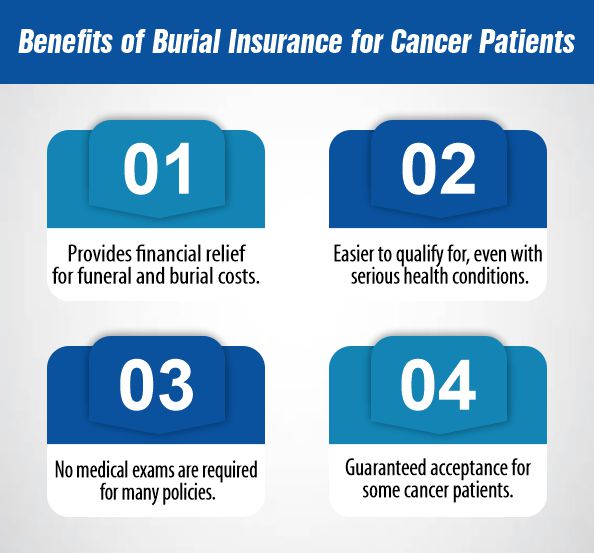

The process of getting burial insurance for a cancer patient becomes complicated if the patient already has other health conditions. However, this kind of insurance can be very effective. For cancer patients, life insurance and burial insurance can help cover some essential funeral and burial costs; thus, lessening the burden on their loved ones during trying times. The following guide explains how such burial insurance for cancer patients can help families become more financially secure during challenging moments.

Get Free Quotes

Customized Options Await

Burial insurance for cancer patients, more popularly called “final expense insurance,” is life insurance coverage tailored to pay costs at the end. While traditional life insurance pays a lump sum, burial insurance pays less, but this amount has been calculated to pay all funeral, burial, and cremation expenses of dead bodies. It helps ease the pressure on families of cancer patients to cover these expenses, so they will not worry about anything else but grieve and heal at the time.

Burial insurance and traditional life insurance are both designed to help financially after someone’s death, but they serve different purposes and have distinct features. Below, we’ll explore the key differences between these two types of insurance.

Burial insurance, also known as final expense insurance, is a type of insurance policy meant to cover funeral and burial costs. It is typically a smaller policy than traditional life insurance, providing just enough coverage to pay for end-of-life expenses, including:

Burial insurance is ideal for those who want to ensure their family isn’t burdened with funeral expenses. It is especially beneficial for older adults, who may want a simple, no-fuss policy with a smaller death benefit.

A traditional policy, sometimes referred to as life insurance, is the bigger policy aimed at securing your family financially after death. Money from a life insurance policy can be used to cover several expenses, such as:

Life insurance is mainly taken in much bigger coverage amounts, which can range from thousands to millions of dollars based on the type of policy. They are meant to replace lost income and keep the family financially stable when you are gone.

Treatments, medical care, and medications for patients diagnosed with cancer can add up very quickly, making it challenging for patients and their families to save for the final costs of life. Burial insurance for cancer patients is a special kind of insurance designed to cover funeral or cremation expenses. The presence of burial insurance takes away from the cancer patients and their families the financial stress of preparing for these funeral expenses so that they can all spend quality time together rather than worry about the financial burdens of final arrangements.

The advantage of burial insurance is pretty significant, mainly for an individual affected by cancer. It enables a person not to think of money if a member of his or her family dies. Tumor treatment and visiting the doctor charge huge amounts. Thus, the money saved will cover burial or funeral charges. The family will thus not struggle hard to come up with some extra cash. It gives the cancer patient peace of mind: knowing that their funeral has already been paid for, ensuring everyone can spend some last moments together and cherish good memories without worrying about costs.

With burial insurance, if one applies with cancer, then the company will view the stage and so on. In general, the better options are seen in the early stages of this type of cancer. A person in the final stages of cancer will have limited options and higher prices that might skyrocket. However, there is coverage for patients suffering from cancer; hence, they sleep peacefully knowing they are paid for the funeral preparations.

There are safety nets involved when making payments for funerals or burials. It changes according to cost and will depend upon many factors, especially with cancer. But let us first know how cancer influences the cost of burial insurance and why is it relatively cheaper than term life insurance.

Age | Coverage Amount | Estimated Monthly Premium |

50 | $5,000 | $30 – $80 |

50 | $10,000 | $60 – $150 |

60 | $5,000 | $40 – $100 |

60 | $10,000 | $80 – $200 |

70 | $5,000 | $60 – $150 |

70 | $10,000 | $120 – $300 |

The cost of burial insurance depends on several key factors, including:

Coverage Amount: The greater your coverage amount, the greater will be your premium. However, the amount paid out on a burial insurance policy is generally much smaller than life insurance.

Burial insurance for cancer patients would be more expensive compared to an average healthy person, mainly because cancer is a high-risk health issue. This is why:

Although cancer patients have to pay a higher premium to get burial insurance, the latter is cheaper as compared to traditional life insurance due to the following reasons.

One of the types of insurance that many cancer patients prefer is guaranteed issue life insurance because it is easy to get. The best part is that everyone who applies gets accepted, regardless of their health. This means that cancer patients do not have to worry about a medical exam. No obstante, existen algunos aspectos que necesitamos tener en cuenta. The cost is usually higher than other types of life insurance. There may also be a waiting period, meaning the person has to wait before they can use all the benefits. Even with the higher cost and waiting period, guaranteed issue life insurance helps cancer patients get coverage.

Generally, applying for burial insurance is easy, especially if a person has health issues like cancer. When the cancer patient wants burial insurance, he or she should seek policies that are easy to get. Some policies require no medical exam, hence fast for cancer patients when applying. Other policies are quite lenient and are approved without perfect health. These policies enable patients who are affected by cancer to get a greater chance of being insured. If the patient who is affected by cancer chooses a policy with fewer medical questions, then he gets the burial insurance stress-free. This becomes a safety net for him since all his funeral expenses will be covered.

The selection of life insurance when a patient suffers from cancer is a very important decision between term life insurance and whole life insurance. Both guarantee coverage, but they are different in many ways when it comes to cost, duration, and benefits. Below, we explore how term life and whole life insurance work for cancer patients and what to consider when choosing between the two:

It also has a particular name: it provides cover for a specified duration that is typically ten, twenty, or thirty years. In the event of a policyholder’s death in that duration, there are death benefits paid out to beneficiaries. If he or she lives through that period without dying, no money is paid.

Whole life insurance would pay a person’s entire lifetime of their lives as long as the premiums were paid. Over and above the death benefit feature, whole life insurance also accumulates a cash value that may be withdrawn or borrowed against.

More time needs to pass since the patient’s treatment for them to secure life insurance. The greater the period since the time of treatment, the greater the chances of finding an excellent plan. Insurance firms consider factors such as age, time elapsed since the treatment, and health status. Younger people or those who have been longer cancer-free may find it relatively easier to get a good plan. They may pay lower costs. The good health year in the process of survivorship enhances better opportunities for survivors to have appropriate life insurance.

Many cancer patients wonder whether the burial insurance funds could be used to treat the cancer. Burial insurance is more about paying the cost of the funeral and the burial of a person when he dies. This allows families to take care of the expenses when one has passed on since this can be such a difficult time. In most cases, medical and treatment costs are usually not paid by burial insurance; however, some burial insurance policies offer much flexibility. In some policies, they would allow the use of a portion of the money to be used for treatment. Not all policies allow it, so cancer patients need to discuss this with their insurance provider. They could ask whether their policy allows them to use money on treatment. This way, they will know what to do with their insurance money.

To find the best burial insurance for cancer patients, start by looking at trusted insurance companies. Make sure they are reliable. Then, look at what each policy covers. Some might pay for funeral costs only, and others might offer more options. Finally, compare prices and see which one gives the best value. By comparing various companies, benefits, and prices, a patient or his family can find the right policy according to their needs and budget. This helps them in making an informed decision.

In conclusion, cancer patients and their families are protected by the burial insurance plan. They pay for expensive final expenses, including a funeral or burial. With this help, family members do not have to shell out that money. During a bad time, the policy helps. The research of other policies by a cancer patient will enable the best available support for such a condition. Such preparation can alleviate the tension about having taken care of family in the future.

Access the best rates and coverage as early as possible after diagnosis or while in remission.

Yes, through guaranteed issue policies, though premiums may be higher.

Most policies have a waiting period of 1-2 years before full benefits apply.

Usually, it is intended for funeral costs, but some policies may allow flexibility.

Yes, certain states may offer specific providers or benefits for high-risk individuals.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes