Last Updated on: March 13th, 2025

Reviewed by Kyle Wilson

Burial Insurance Arkansas is merely life insurance that covers any burial or funeral cost, and many Arkansas families invest in such policies for security, just in case a serious thing happens so they won’t burden family members when it hits them. Now, even with affordable terms, the funeral expenses will not stress families much. There are varied comparisons of options from providers that help determine the best Burial Insurance Arkansas plan to suit one’s needs and budget.

Customized Options Await

Burial Insurance Arkansas is one of the leading sources to protect loved ones from unexpected costs. A funeral can run into multiple thousands of dollars quickly, so it can put a heavy burden on grieving families. Burial insurance in Arkansas offers peace of mind and covers these costs, so families aren’t burdened financially. Lincoln Heritage is among the best-known. They have final expense insurance, ranging from a variety of policies especially dedicated to funeral and burial expenses. Having plans available that cater to the flexibility of aged individuals, Lincoln Heritage is quite excellent among its clients who wish to consider burial insurance in Arkansas.

The Arkansas Insurance Department Funeral Services Division regulates all types of Burial Insurance in Arkansas from application to finalization. It has standard requirements that every provider has to meet, ensuring consumers have equal benefits without losing the protection and controls funeral services practice and burial insurance Arkansas plans across the state, including the likes of Lincoln Heritage. These rules keep the policies of Burial Insurance Arkansas cheap and hassle-free. Additionally, they will also help protect consumers from the companies charging more than is necessary thereby making available to Arkansas residents some of the cheapest burial insurance in Arkansas. Before buying the policy, it may be useful to refer to the guidelines by the Arkansas Insurance Department for a better understanding of your customer rights.

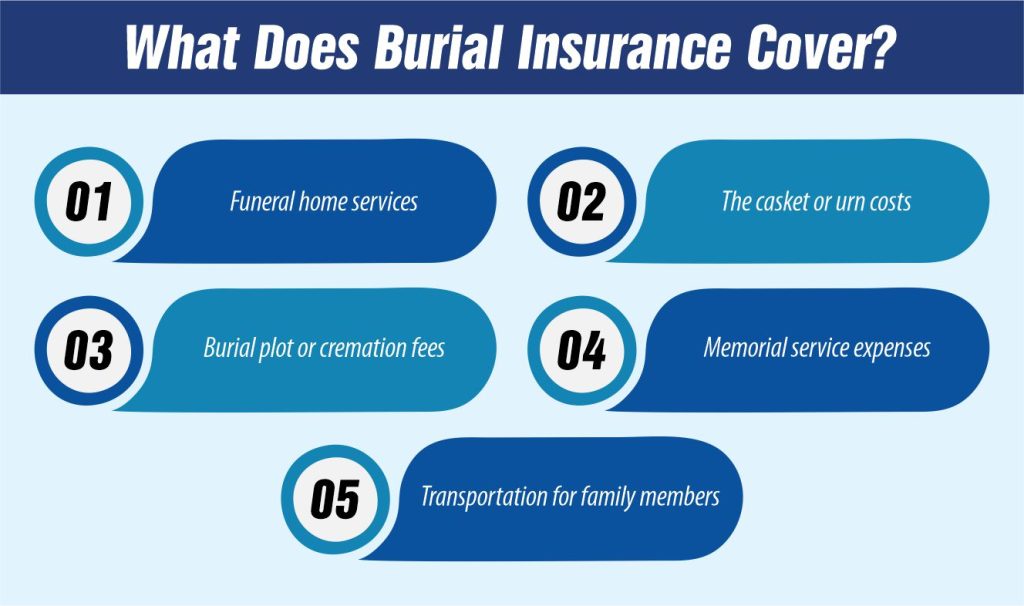

Many funeral-related costs are usually covered by burial insurance coverage. These may include:

Unlike standard life insurance policies that cover larger amounts and require extensive underwriting, burial insurance is usually easier to obtain. Policies are often approved with minimal health questions, and most residents over 50 can qualify.

Key Point | Details |

Low-Cost Burial Insurance in Arkansas | Many providers offer competitive quotes for burial insurance in Arkansas. |

Comparison of Lowest Cost | To ensure the lowest cost, comparisons and rate calculations should be made across various providers. |

Special Plans for Seniors | Many insurance companies offer special plans for senior citizens, making it easier to find affordable final expense coverage. |

Simplified Application Process | Providers like Lincoln Heritage offer simplified application processes and quick approval without medical exams. |

Free Burial Insurance in Arkansas | Some companies offer free burial insurance for those who qualify based on financial need or special assistance programs. |

Availability of Free Insurance | Free burial insurance may be offered through local agencies or nonprofit organizations that have allied with the Arkansas Insurance Department Funeral Services Division. |

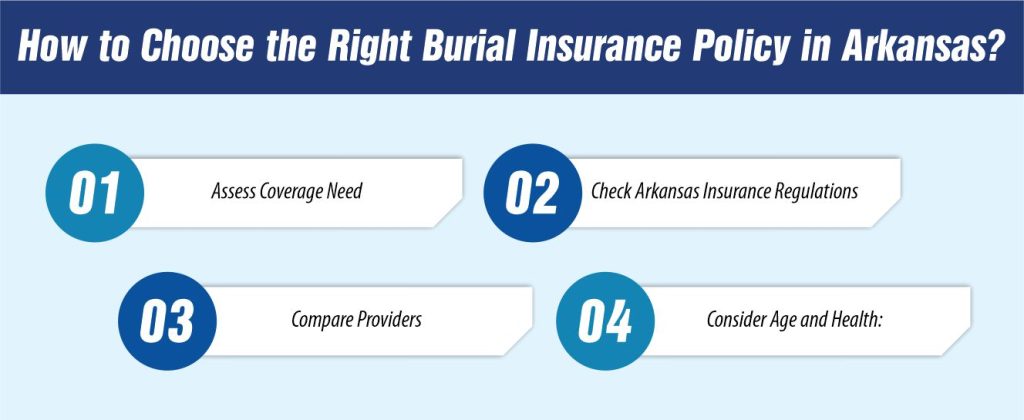

The right choice of burial insurance, its coverage amount, and the provider’s reputation, among several other factors, should all things to be calculated. Here are a few tips for selecting the policy that needs your attention:

The funeral costs in Arkansas may easily reach from $7,000 to $10,000. That is a huge expense one’s loved ones may not be ready for. When one does not have adequate coverage, it is left to their loved ones to pay for the funeral services, the grave lot, the headstone, and all the other expenses associated with funerals when they are still grieving. In Arkansas, particularly, it is through this type of insurance that money will be able to lift the burden of these costs and ensure families are spared hassling with death on their economic terms. Why burial insurance is important for Arkansas Residents, especially with consideration of Arkansas Insurance laws and the availability of inexpensive plans such as Lincoln Heritage.

The ability to quickly cover funeral costs is one of the biggest benefits of obtaining burial insurance. When a person dies, a family usually gets instant financial demands to cover the cost of the funeral service, burial plot, and other final expenses. This type of insurance gives comfort in that all of these bills can be covered as soon as possible, saving the family from huge sums to be generated within a short period.

Providers like Lincoln Heritage offer affordable burial insurance options that are designed to provide immediate financial assistance, ensuring that families have the funds they need without delay. Their policies are specifically tailored to cover all these essential costs.

One of the critical motivations behind purchasing burial insurance in Arkansas is for peace of mind. Burial insurance, therefore, means resting easy knowing that all final expenses will be taken care of and that their family will not be burdened with large funeral costs after their passing. This peace of mind is important particularly for seniors or those whose health issues cause worry, hence being able to ensure that their loved ones are not financially compromised upon their death.

Additionally, knowing that burial insurance policies are regulated under Arkansas Insurance regulations helps ensure that the coverage is legitimate and will be paid out as promised, offering additional reassurance to both the policyholder and their family.

One of the attractive features of affordable burial insurance for residents in Arkansas is having cheap burial insurance available for purchase. The cost of the burial insurance policy premium has been set so that it falls within most budgets. Funeral costs are sometimes considered too high for some people; however, these plans are designed to pay for funerals without the customers spending too much. To many Arkansas residents, low Lincoln Heritage burial insurance premium allows them to be able to afford this type of coverage.

Lincoln Heritage is one of the well-known companies offering burial insurance plans with very affordable coverage options for people dwelling in Arkansas. As the company follows the Arkansas Insurance standards, its policies are quite reasonable in terms of prices, and Arkansas residents can get appropriate burial insurance in Arkansas within their budget.

This is especially a crucial consideration for the long-term care benefits for the residents of Arkansas as they connect to burial insurance and Medicaid. There are some regulations regarding burial insurance that applicants must take care of so that they do not get disqualified from receiving Medicaid. Luckily, Arkansas law offers some flexibility in the matter by allowing applicants to exclude some amount of burial insurance from their asset calculations, thus protecting their eligibility for Medicaid. This is especially important for seniors and those with limited resources.

Let’s get to the heart of the matter, comparing the current Arkansas law on burial insurance and its interaction with Medicaid access and the role of the Arkansas Insurance Department Funeral Services Division in regulating this policy.

A second program is Medicaid, which helps the poor client pay for their medical bills, including long-term care. To qualify for Medicaid in Arkansas, one goes by income and one’s assets. Notable, however, is that Arkansas has made provisions for burial insurance to protect Medicaid applicants from getting penalized because such applicants usually have policies in place to be used for funeral expenses.

For many seniors and low-income individuals, Lincoln Heritage offers burial insurance policies that can be tailored to fit the $1,500 exclusion limit, ensuring they remain eligible for Medicaid while also providing the necessary coverage for funeral expenses.

The Arkansas Insurance Department Funeral Services Division monitors the AR burial insurance policies, but it verifies if the low-cost burial insurance in Arkansas providers are regulated under state law and protect consumers. It verifies how the policies meet Medicaid standards, meaning it is eligible for the rules. This will divide the options so that there are no false terms and the cheap Arkansas burial insurance is kept within affordable rates and is fair, hence giving the Arkansas residents the ability to obtain the most affordable funeral insurance in the state while still abiding by state regulations.

It is final expense insurance, which pays only for the cost of dying at the end. Generally, it comes in the amount of lesser dollars, ranging from $5,000 to $25,000, usually good enough to cover funeral services and burial expenses in Arkansas. Here’s how it works:

Lump Sum: The benefit policy pays a single sum of money to the beneficiary, which can include funeral expenditures burial plots, or other outstanding medical bills.

Burial insurance in Arkansas is usually reasonably priced. Premiums depend on age, health, and the amount of coverage desired. Most of its policies fall between $20 to $100 per month and average coverage amounts between $10,000 and $20,000. Arkansas residents who want affordable or even the cheapest burial insurance can be able to have flexible options that fit into their budget.

Burial insurance quotes can now be accessed online for Arkansas residents, who will be able to know the costs of different firms. With such comparisons, people will find policies offering the right cost and coverage level. Some policies even have guaranteed acceptance options, which allow people to get coverage without any health restrictions.

Final expense insurance is more than just a burial plan—it provides Arkansas families with financial support for a range of costs associated with end-of-life planning. Benefits of final expense insurance include:

You can purchase burial insurance in Arkansas in several different ways. For instance, there are online comparison tools that will let you compare different plans offered by different companies and figure out what would be the best rate for you. You may also approach a local agent licensed in Arkansas to guide you through choosing the right burial insurance plan that meets your specific needs. For a reliable burial insurance program in Arkansas, you may turn to trusted organizations such as Lincoln Heritage. The Arkansas Insurance Department can give you a list of licensed insurance companies and help you determine affordable and respectable providers of burial insurance.

Buying Burial Insurance Arkansas has several modes, one being online comparison tools that enable you to view various plans by different companies and find the best price. You can also consult local insurance agents; they are licensed in Arkansas and will help you pick the right Burial Insurance Arkansas plan suited to your needs. Companies to be trusted are Lincoln Heritage. Burial Insurance in Arkansas shall be reliable for all the residents of the state. If licensed, the Arkansas Insurance Department shall give you the list of available insurance providers for Burial Insurance Arkansas.

This depends on age, health, and coverage amount. Some carriers offer pretty cheap options starting at $20 a month. Lincoln Heritage and similar companies provide reputable, budget-friendly burial insurance.

Although there is no free burial insurance, some other programs can be found that provide either veterans or low-income people with assistance to take care of the funeral costs. If one may need further information on such a resource, they may contact the Arkansas Insurance Department.

Most providers can give instant online quotations. Arkansan homeowners interested in finding great deals can compare quotations for great policies.

Burial insurance proceeds are not taxed, and thus a full payout is left to the beneficiaries for funeral or end-of-life expenditures.

No, it does not pay for funerary expenses. It will have to come from a separate policy-burial insurance.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes