Last Updated on: March 15th, 2025

Reviewed by Kyle Wilson

Have you ever thought about how your loved ones would handle costs after you’re gone? Funerals and cremation services may sound cheap, and yes, they are, but for many families, this can be a struggle. Cremation insurance is not very complicated, it just helps pay for expenses so your family is not burdened with it. But what is cremation insurance and how does it work? Let’s go through the various cremation insurance plans that are available and how they will help both you and your loved ones.

Customized Options Await

Cremation insurance is life insurance with special points that will help the family after death to pay for cremation. These costs can include:

Thus, with the purchase of a cremation insurance plan, one can be confident that these expenses are to be covered and thus, their families won’t be struggling with money when dealing with this pain.

Despite the fact that cremations are generally cheaper than burials, they are still expensive to organize.

Cremation services cost, on average $3,000 depending on the number of services offered, if added to the price of the funeral or memorial service and an urn, columbarium niche, or burial plot cost it sums up to than $10,000.

Cremation Related Expenses:

Cremation insurance enables easy payment of expenses and ensures that your family members will not suffer financially when you are gone. With cremation insurance covering your end-of-life bills, you are financially protecting your nearest and dearest against your death expenses.

Even with these optional costs, cremation services are markedly cheaper than a traditional burial because it does not require:

These are costs that are usually required during a traditional burial.

Memorial services for people who are cremated don’t usually require a hearse or limousine, items that are favored by families planning a traditional burial.

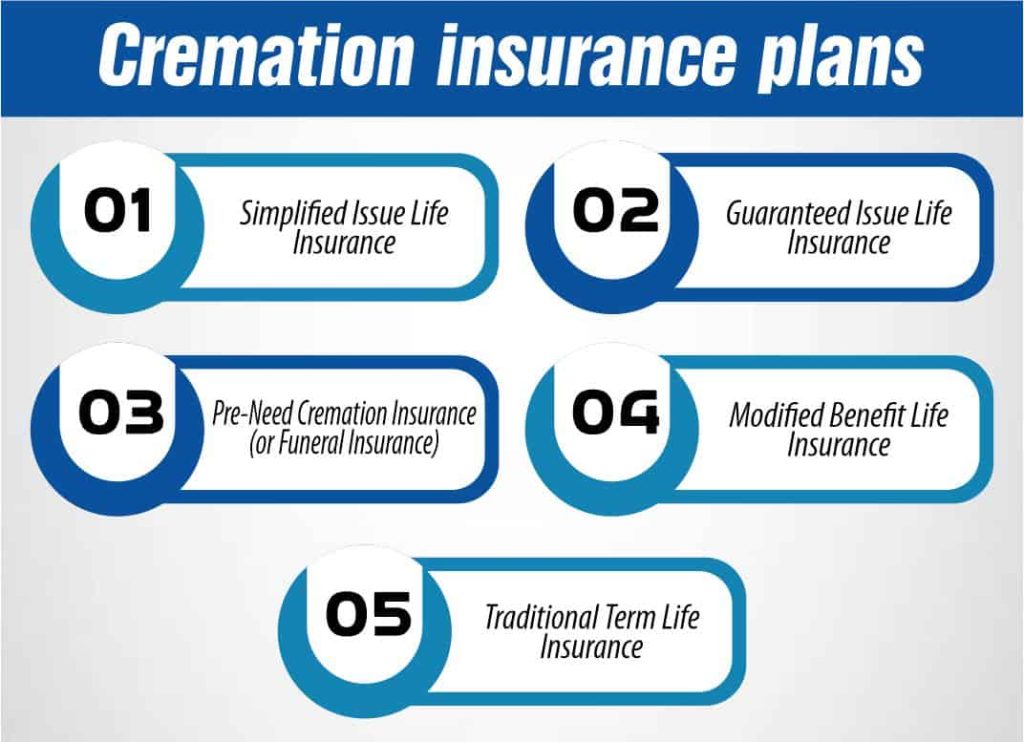

Provides coverage for burial and funeral expenses without needing any medical examination but only the health questions. It offers fast processing of applications and is suitable for healthy persons who need basic policy.

Ensures coverage without health questions or medical exams, making it accessible to people with pre-existing conditions. It often includes a waiting period before full benefits are active.

Purchased through funeral homes, this insurance lets people freeze the price of current cremation services and pre-set their preferences, thereby avoiding inflation.

This type has low benefits for those with moderate health risks whereby it provides restricted benefits first before switching to full benefits after a probation period.

Pays out a more significant amount that can cater to different funeral expenses. It may involve a medical examination and is perfect for young and healthy people.

Try to picture your family, which surely already experienced the Feeling of loss, to add yet another burden, which is Funeral expenses. Isn’t it reassuring to learn that they are financially looked after? Cremation insurance is financial protection so that family members and friends can grieve without worrying about the costs. It is such a classic approach that can make their work a bit lighter.

What if you could lock in an affordable monthly payment that never changes? That’s what cremation insurance offers. With fixed premiums, there are no surprises down the road—just a steady, manageable cost that allows you to plan confidently, without worrying about future increases.

Concerned about health issues getting in the way of coverage? Many cremation insurance plans skip the medical exams and health questions, making it easy to qualify. Isn’t it reassuring to know you can secure this protection, even if your health isn’t perfect?

Your final wishes are unique, and so is cremation insurance. Want basic coverage for cremation, or something extra for a memorial service? You can pick a coverage level that aligns with exactly what you want. This way, you know your plan is tailored just for you.

What if you could arrange everything now and take the weight off your family? Pre-need plans can also include specific details and many of the aspects of the plan are locked in. It goes beyond how the money will be spent—it’s about having instructions followed to the letter, and providing comfort to your loved ones because they know they are doing it right for you.

When it comes to any major repeated cost, the most common question posed is simply, “Is Cremation Insurance worth it?”

This question should logically be directed to the purchase of cremation insurance.

Yes, cremation insurance should be taken if your family will not be able to afford your funeral and will require life insurance to cover the expenses. However, if one has sufficient savings that he or she believes will be available to his or her beneficiaries at the time of his or her death, and the beneficiary can comfortably use the money to bury him or her through cremation; then, one most probably does not require cremation insurance.

If you are undecided, try to consider if having cremation insurance will be more comforting for you. At times, just having that is a big plus of the cremation insurance policy and one that you can enjoy when you are still around alive.

Cremation insurance is a thoughtful way to plan ahead, ensuring that your loved ones are financially supported when they need it most. By choosing the right cremation insurance plans, you can help ease their worries and make a challenging time just a little bit easier. Isn’t it comforting to know you’ve taken steps to care for them, even from afar?

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes