Last Updated on: April 4th, 2025

Reviewed by Kyle Wilson

When planning for end-of-life expenses, many individuals seek simple and reliable options to ensure their loved ones aren’t burdened with the financial costs of a funeral. No medical exam burial insurance offers an appealing solution for those who may not qualify for traditional life insurance due to health conditions or age. This type of policy eliminates the need for medical exams, providing fast and accessible coverage. In this guide, we’ll explore what no medical exam burial insurance is, how it works without a waiting period, and who qualifies for this type of coverage, helping you make an informed decision for your future.

Get Free Quotes

Customized Options Await

No medical exam burial insurance is a life insurance policy that provides coverage for funeral and end-of-life expenses without requiring a medical exam as part of the application process. It offers an easier and faster way to secure coverage, making it an attractive option for individuals.

No medical exam burial insurance is a type of life insurance that provides coverage without requiring a health exam. It is designed to help cover funeral and end-of-life expenses, ensuring financial protection for loved ones. This policy is ideal for individuals who may have pre-existing health conditions or those looking for a simple and fast approval process.

Unlike traditional burial insurance policies that may have a waiting period before full benefits are available, this policy provides immediate coverage. That means if the policyholder passes away right after the policy is issued, the full death benefit is paid to the beneficiaries. Insurers offering no waiting period coverage typically approve applicants based on a simple questionnaire rather than a detailed medical history.

No medical exam burial insurance with no waiting period is best suited for:

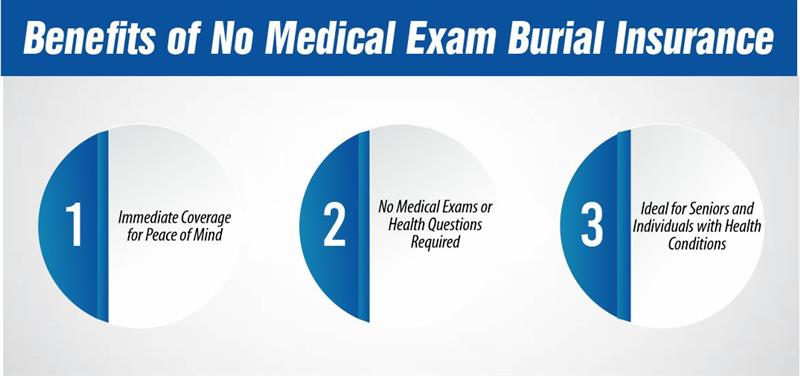

No medical exam burial insurance offers a straightforward and accessible way to secure financial protection for end-of-life expenses without the complexities of traditional life insurance. This type of coverage comes with several key benefits that make it an attractive option for individuals seeking peace of mind and simplicity in their financial planning.

One of the biggest advantages of no medical exam burial insurance is that it provides immediate coverage. With no waiting periods involved, you can rest assured that your beneficiaries will receive a payout as soon as the policy is in force. This eliminates any financial uncertainty surrounding funeral and burial expenses, ensuring your loved ones won’t face additional stress during a difficult time.

Another key benefit is the lack of medical exams or health questions required. Traditional life insurance policies often require applicants to undergo medical screenings and provide detailed health information, which can be a barrier for individuals with existing health conditions. No medical exam burial insurance removes this requirement, making it accessible to a wider range of individuals, regardless of their health history.

No medical exam burial insurance is especially ideal for seniors and those with health conditions who may find it difficult to qualify for traditional life insurance policies. This type of coverage provides a much-needed safety net for individuals in this demographic, ensuring that they can secure financial protection for their funeral expenses without the stress of medical qualifications or long approval processes.

Understanding the cost of no medical exam burial insurance is crucial when deciding whether it’s the right choice for you. While it offers peace of mind and easier access to coverage, the premium rates can vary depending on several factors. Here’s a breakdown of what influences the cost and how you can compare pricing across different insurance providers.

Several factors influence the premiums of no medical exam burial insurance. These include the amount of coverage you need, the insurance company you choose, and your personal details. For example, younger individuals typically pay lower premiums, while those seeking higher coverage limits may see increased costs. Additionally, the type of policy you choose (such as guaranteed issue or simplified issue) can also impact your premium rates.

It’s important to shop around and compare rates from various insurance providers before making a decision. Different insurers offer varying premium rates, and the coverage limits may differ as well. Some companies may offer lower premiums with certain policy options, while others may include additional benefits like a quicker payout or extra riders. By comparing quotes, you can ensure you are getting the best value for your coverage.

Age and health are two of the biggest factors that impact your policy pricing for no medical exam burial insurance. Typically, older individuals will pay higher premiums due to the increased risk associated with aging. Likewise, individuals with existing health conditions may face higher rates as insurers factor in the potential for higher claims. However, no medical exam burial insurance offers a significant advantage by eliminating health questions or medical exams, though these factors still affect the overall cost.

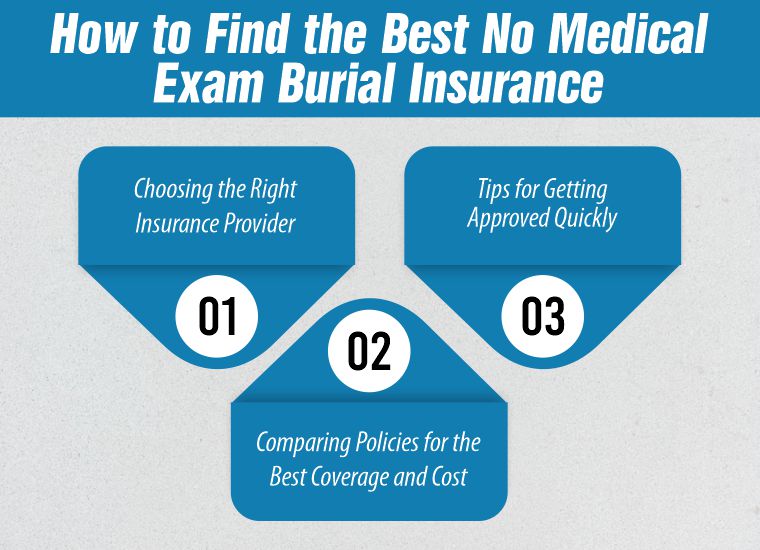

Finding the best no medical exam burial insurance involves careful research and comparison. With various providers offering different policies, it’s essential to focus on what meets your needs in terms of coverage, cost, and approval speed. Follow these steps to ensure you get the best policy that fits your budget and requirements.

When selecting an insurance provider, it’s important to look for a reputable company with a strong track record of customer service and claims satisfaction. Choose a provider that offers transparency in pricing and policy details. A company with a good reputation will ensure your beneficiaries receive their payout without complications. Check online reviews, ratings, and testimonials from other customers to find a trustworthy insurer.

To find the best policy, compare multiple no medical exam burial insurance plans. Focus on the coverage amount, premium rates, and policy terms. Ensure that the coverage aligns with your funeral and end-of-life needs, while keeping the premium affordable. Some insurers may provide additional benefits such as faster payout or flexible coverage options. By comparing several policies, you’ll be able to find a balance between affordable premiums and sufficient coverage for your family.

Getting approved for no medical exam burial insurance can be fast, but it’s important to meet all the eligibility criteria. To speed up the process, ensure that all required documentation is in order. Be honest about your age and any medical conditions when filling out your application, as some policies might ask for basic health information. Some insurers may offer quicker approval with fewer questions, so it’s helpful to inquire about streamlined processes with your selected provider.

No medical exam burial insurance is a great option for individuals who may have difficulty qualifying for traditional life insurance due to health concerns. If you’re looking for a straightforward way to ensure your loved ones are taken care of after you pass, this type of insurance can offer a solution with fewer requirements and quicker approval. Here’s a look at who should consider no medical exam burial insurance.

The ideal candidates for no medical exam burial insurance are seniors, individuals with pre-existing health conditions, and those who have trouble getting coverage due to past medical history. This type of policy is designed for people who want to avoid lengthy approval processes, complicated medical exams, or health questionnaires. If you’re looking for a simple and quick way to secure coverage for your final expenses, no medical exam burial insurance could be an excellent option.

Immediate coverage is a key benefit of no medical exam burial insurance. It makes sense to choose this type of policy if you need quick financial protection without delays. If you’re facing urgent health concerns or have limited time to secure insurance, this policy type can offer peace of mind with coverage that starts right away. Immediate coverage ensures your loved ones won’t be left with the burden of funeral and burial costs.

While no medical exam burial insurance offers convenience and quicker approval, it’s important to compare it to traditional burial insurance plans. Other policies may require a medical exam or have a waiting period before full benefits are available. No medical exam burial insurance usually has higher premiums, but for those with health issues, it may be the best option for securing coverage quickly. Compare the costs, benefits, and approval times of each option to find what suits your needs and budget.

No medical exam burial insurance with no waiting period offers a fast, convenient way to secure coverage for end-of-life expenses without the hassle of medical exams or lengthy approval processes. It’s an excellent option for those with health concerns, seniors, or anyone in need of immediate coverage. However, it’s important to compare different policies and providers to find the best coverage and rates for your situation. Weigh the pros and cons, and ensure the policy aligns with your needs and budget to make an informed decision.

Yes, one of the key benefits of no medical exam burial insurance is that it’s often available for individuals with serious health conditions. Since these policies don't require a medical exam, they're more accessible for people who may have difficulty qualifying for traditional life insurance due to their health.

In most cases, the premiums for no medical exam burial insurance are fixed. This means the amount you pay will generally stay the same throughout the life of your policy. However, certain insurance plans might have increasing premiums as you age, so it's important to confirm this with your provider before purchasing.

If you miss a payment, your policy could lapse, meaning you lose your coverage. Most insurers will offer a grace period for missed payments, allowing you time to catch up without losing benefits.

The coverage amount for no medical exam burial insurance can vary depending on the insurer and the specific policy. Typically, these policies offer coverage amounts ranging from $5,000 to $50,000. The exact amount you can get will depend on your age, health, and the provider’s terms.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes