Last Updated on: March 10th, 2025

Reviewed by Kyle Wilson

Finding burial insurance during senior life becomes easier for those with pre-existing health conditions than people assume. Several insurance companies provide pre-determined coverage plans for people with existing health problems who want to protect themselves from financial burdens post-mortem. Burial insurance policies serve to give customers comfort because they ensure family members will not be responsible to pay after you pass. In this guide we will explain burial insurance qualification rules for people with health conditions while discussing optimum policy options and cost-efficient plan acquisition strategies.

Get Free Quotes

Customized Options Await

Senior burial insurance serves as a functional choice to pay for end-of-life costs including funerals and related expenses. Senior citizens who worry about their health conditions preventing them from getting insurance can find plans that cater to people with medical problems.

Senior burial insurance offers life insurance protection through policies made specifically to pay final expenses such as burial costs and medical treatments. Through financial aid the policy ensures family members do not endure major financial stress when death occurs. Small policy coverages and easy application processes distinguish burial insurance from standard life policies which draw senior citizens through their affordable and straightforward coverage offerings.

Existing health conditions influence both the approval process and premium rates in addition to coverage options for burial insurance. Few insurance plans withhold coverage and charge additional fees for health issues but their insurance policies accept all applicants without performing tests or asking medical questions. Absence of medical exceptions like diabetes or heart disease or high blood pressure results in premium increases yet older individuals can still locate appropriate insurance coverage. Insurers base their premium determinations on health risk evaluations which enables you to select the right policy for yourself.

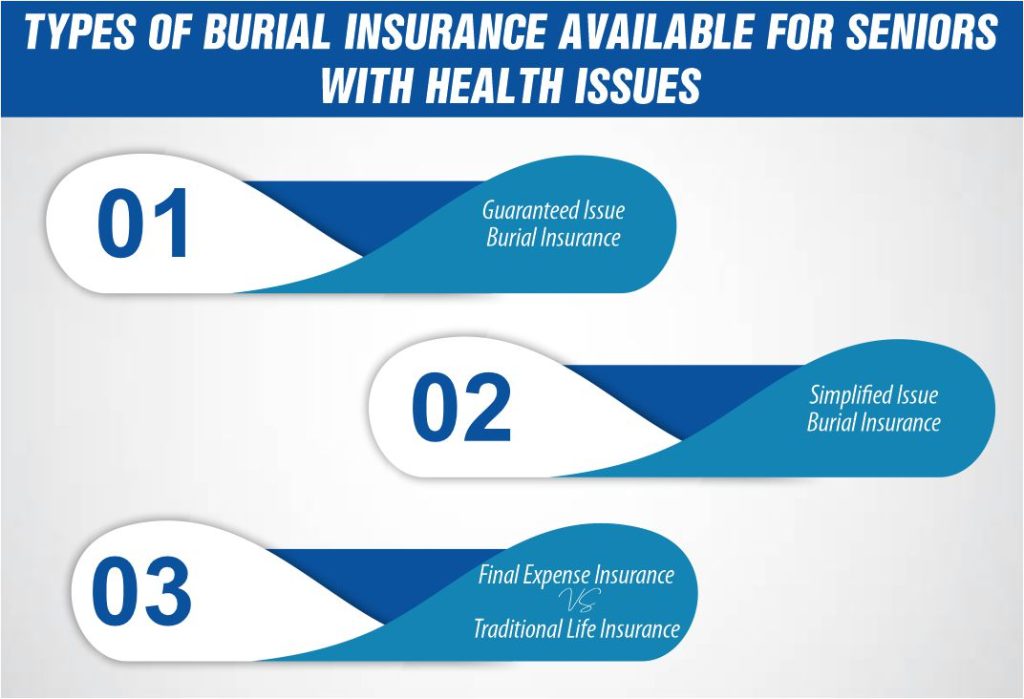

The insurance market provides seniors with pre-existing conditions multiple burial insurance plans which do not need detailed medical checks. The policies were created to guarantee funding for survivors while bypassing medical screening and long waiting periods. The choices available to seniors help them select burial insurance according to their health condition and financial capabilities.

The insurance policy of guaranteed issue burial provides coverage to seniors irrespective of their health condition. Burial insurance policies under guaranteed issue status do not demand medical tests or health questionnaires for approving coverage no matter the existing health conditions of the applicant. The higher insurance rates and possible graded benefit duration do not prevent this insurance option from protecting those who face obstacles in getting standard coverage.

The simplified issue burial insurance plan serves applicants by offering coverage without examinations yet requires respondents to answer health-related queries. The premiums for this type of insurance policy remain lower than guaranteed issue options but insurers may set specific immediate or limited waiting periods. This insurance policy provides a good solution for older individuals maintaining good health.

The primary purpose of final expense insurance covers funeral expenses together with their associated costs so it appeals to seniors who have health issues. Due to its simplified approval system the final expense insurance provides limited coverage at affordable premium rates instead of demanding lengthy underwriting processes which characterizes traditional life insurance. Senior citizens requiring affordable end-of-life coverage during their last years typically choose final expense insurance as their best solution.

Seniors who have pre-existing health conditions can buy burial insurance even though their eligibility depends on their medical condition as well as their age and the specific policy design. Different insurance policies utilize immediate coverage for benefits but require a waiting period before beneficiaries can access complete coverage benefits. The right burial insurance policy becomes accessible for seniors once they understand the criteria that determine their eligibility.

The requirements for medical tests vary among burial insurance policies since some accept applicants who meet basic health criteria whereas others approve everyone. A history of diabetes and high blood pressure alongside heart disease or stroke experience may lead to premium increases or forced waiting periods during the application process. People with serious conditions such as cancer, kidney failure and advanced dementia typically face limited burial insurance choices to accept policies free from medical questions but carrying potentially expensive premiums.

Most burial insurance providers establish age boundaries for qualification which normally span from age 50 to age 85 years old. Certain insurers provide coverage greater than the standard age range limitations. Burial insurance qualifications are influenced by residency requirements and your ability to maintain premium payments besides age restrictions. Seniors need to review individual provider requirements to verify their qualification standards.

Policyholders who die during a waiting period receive limited or no death benefits because most burial insurance plans apply waiting periods spanning two years. Without waiting periods in place insurance policies begin with complete coverage immediately although they make potential policyholders answer health questions or demand higher premium payments. Individuals with manageable to good health status receive immediate coverage from burial insurance policies but serious condition sufferers must look into graded or guarantee of issue coverage options.

People who already have pre-existing medical issues create incorrect assumptions that burial insurance will be hard to find and expensive to buy. People who investigate their options properly can obtain economical coverage that offers financial safety for their family members. Seniors who want affordable burial insurance should research provider options, determine correct coverage levels and examine payment savings methods to find a policy within their budget.

Burial insurance providers have different rates together with coverage options when it comes to seniors who have existing medical conditions. Companies exist which insure applicants who have medical issues yet there are other providers who offer coverage through elevated prices and extended waiting times. Seniors should compare multiple providers, focusing on factors such as:

By evaluating different options, seniors can find the most affordable and reliable burial insurance plan.

People need to choose insurance coverages that match their budget requirements while providing adequate protection. Seniors need to evaluate future end-of-life costs together with funeral expenses while checking for existing debts but also wanting to provide financial support for their family before choosing their coverage amount. When selecting an insurance coverage amount one should aim for no more than what is needed to pay essential expenses at affordable premiums.

Many burial insurance providers offer flexible payment options to help seniors manage costs effectively. While monthly premiums are a common choice, some insurers provide discounts for annual payments. Additionally, seniors should look for policies with:

By carefully selecting a provider, policy, and payment plan, seniors with pre-existing conditions can secure burial insurance that is both affordable and comprehensive.

Seniors who face challenges in finding burial insurance because of pre-existing health issues can still get coverage through appropriate selection methods. Insurance providers supply tailored coverage plans to individuals with health conditions which enables them to get insured through policies that exclude medical examinations and elongated waiting periods. Seniors can acquire affordable burial insurance by weighing different options and selecting the right coverage amount while using payment plans to make the policy more affordable.

Yes, most burial insurance providers make their policies available to seniors who have serious health conditions. Since guaranteed issue burial insurance performs assessments without health questions or medical exams it serves as a beneficial option for people with pre-existing medical conditions.

The expenses for burial insurance depend on several elements including age of the policyholder and defined coverage value and selected policy kind. People with prior health conditions can find reasonable burial insurance rates through guaranteed issue and simplified issue policies despite their higher premiums.

The coverage benefits from burial insurance policies may take two to three years before the policyholder can access them completely. Those who satisfy qualification requirements receive immediate coverage when their burial insurance policy approval is granted.

People should choose burial insurance based on their personal requirements. People with serious health conditions should consider guaranteed issue policies yet simplified issue policies provide better rates to those who successfully pass health question assessments.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes