Last Updated on: February 25th, 2025

Reviewed by Kyle Wilson

Selecting appropriate burial insurance requires customers to face decisions between guaranteed issue and simplified issue coverage types. The two insurance choices protect funeral costs yet each policy has separate entry standards and cost structures and financial levels. Knowledge about existing differences between insurance products helps users find suitable coverage. This guide explores the comparison between guaranteed issue vs simplified issue Burial Insurance to assist users in their decision-making.

Get Free Quotes

Customized Options Await

While seeking burial insurance options you will typically discover both guaranteed issue and simplified issue insurance policies. Both insurance types cover expenses for funerals and end-of-life needs however they operate differently through their issuance methods and their pricing systems and the respective approval paths. Understanding these policies’ different features will help you select one that matches your financial situation and health needs.

Guaranteed issue burial insurance represents a policy system which provides coverage without needing medical examinations and free from health questions during approval. Insurance approval comes automatically to anyone who satisfies the age criteria established by their insurer. People with severe medical circumstances who cannot obtain standard life insurance coverage find this particular policy to be their best option. Insureds must pay higher premiums together with facing delayed coverage benefits under this insurance product.

Simplified issue burial insurance forces applicants to respond to short health questions instead of medical examinations. Simplified issue policies give their beneficiaries cheaper coverage than guaranteed issue insurance while granting instant coverage to eligible applicants who qualify under their health criteria. Burial insurance stands as a suitable option when purchasers maintain reasonable health status but seek to circumvent both higher prices and policy initiation delays of guaranteed issue insurance.

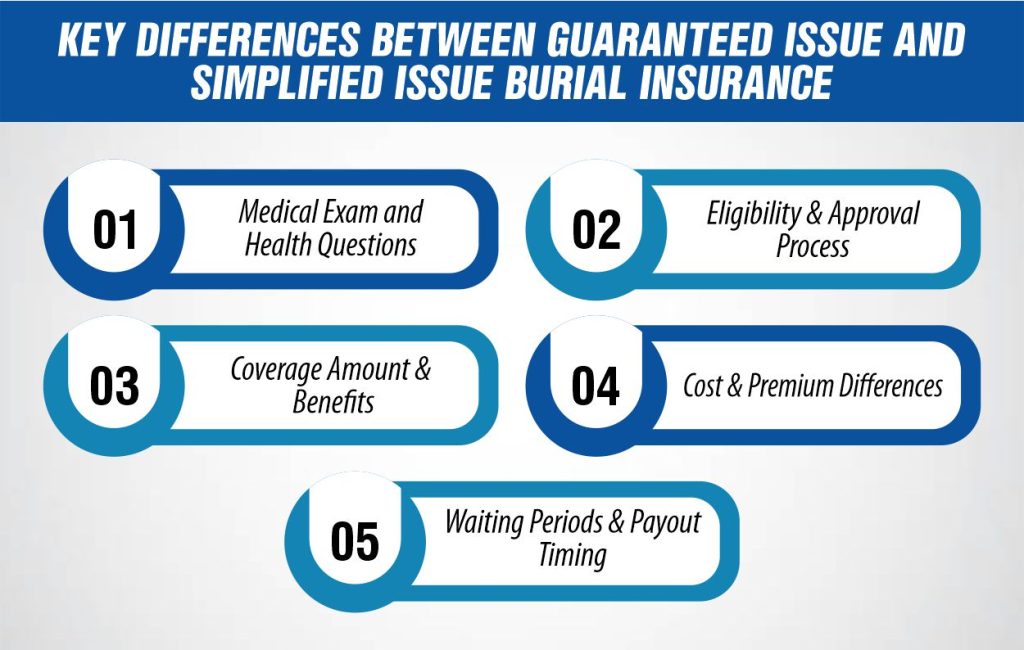

Both policies serve the same purpose but differ in eligibility, costs, and coverage terms. Below are the primary distinctions:

Understanding these differences can help you select the right burial insurance policy that aligns with your health condition, budget, and coverage needs.

The selection between guaranteed issue or simplified issue burial insurance depends on both your current health condition and financial resources as well as the required coverage amount. The multiple policies serve unique purposes because they suit different situations. Your personal situation needs to match one of these policies for you to make an informed decision.

Guaranteed issue burial insurance is ideal for individuals who:

Simplified issue burial insurance is best for individuals who:

When deciding between these two types of burial insurance, consider the following:

Both types of burial insurance have their advantages and disadvantages. Understanding these can help you make an informed choice based on your specific needs.

The selection between guaranteed issue and simplified issue burial insurance depends on both your health status and your financial ability and your desired insurance coverage. The approval process for guaranteed issue policies guarantees anyone with serious health conditions despite their medical history while these plans have increased premiums as well as waiting periods before benefits activate. Healthy applicants are best suited for simplified issue policies because they provide cheaper policies with higher coverage amounts and immediate cash benefits.

Understanding the key differences and weighing the pros and cons of each option can help you select the best burial insurance policy for your specific needs.

The primary distinction exists within the eligibility standards. Guaranteed issue burial insurance provides instant acceptance and does not need medical exams or health evaluations. Applicants seeking burial insurance through simplified issue policies must respond to fundamental health inquiries.

The cost of burial insurance through simplified issue policies tends to be more affordable compared to premiums of guaranteed issue policies. Insurers can charge lower monthly premiums when they accept applicants whose health condition puts them at reduced risk.

Burial insurance gives eligibility to people with severe health conditions to secure coverage. Guaranteed issue burial insurance provides an opportunity for coverage to persons who experience rejection from other insurance carriers because it lacks medical screenings or health-related inquiries.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes