Last Updated on: February 17th, 2025

Reviewed by Kyle Wilson

Choosing between burial insurance vs life insurance can be confusing, especially when planning for future expenses. Both options provide financial support for loved ones, but they serve different purposes. Burial insurance provides financial protection specifically for funeral expenses as well as end-of-life costs but Life Insurance serves for broader financial protection. The knowledge of important distinctions helps seniors together with their family members determine appropriate solutions that balance their needs with financial constraints.

Get Free Quotes

Customized Options Await

Burial Insurance and Life Insurance benefit beneficiaries differently in their coverage functions although they both offer payment upon death. The main purpose of burial insurance is to pay for end-of-life costs; however life insurance provides protection through multiple benefits that include dependent care and debt repayment and estate management. The distinction between these policies becomes clear when you aim to select a suitable policy that matches your requirements and spending capability.

Burial insurance consists of small whole life coverage which helps pay for funeral and interment costs. Seniors with or without health conditions can access this policy because it offers simple approval protocols and small insurance amounts.

Life insurance establishes a substantial financial safety network which supports beneficiaries by paying for various costs including income replacement and mortgage payments and long-term financial security needs. The insurance industry offers two main policy types among which term and whole life stand out.

The financial support provided by burial insurance differs from life insurance coverage because they have distinct price structures and entry criteria. Final expense insurance serves its purpose at death whereas life insurance coverage extends beyond final expenses.

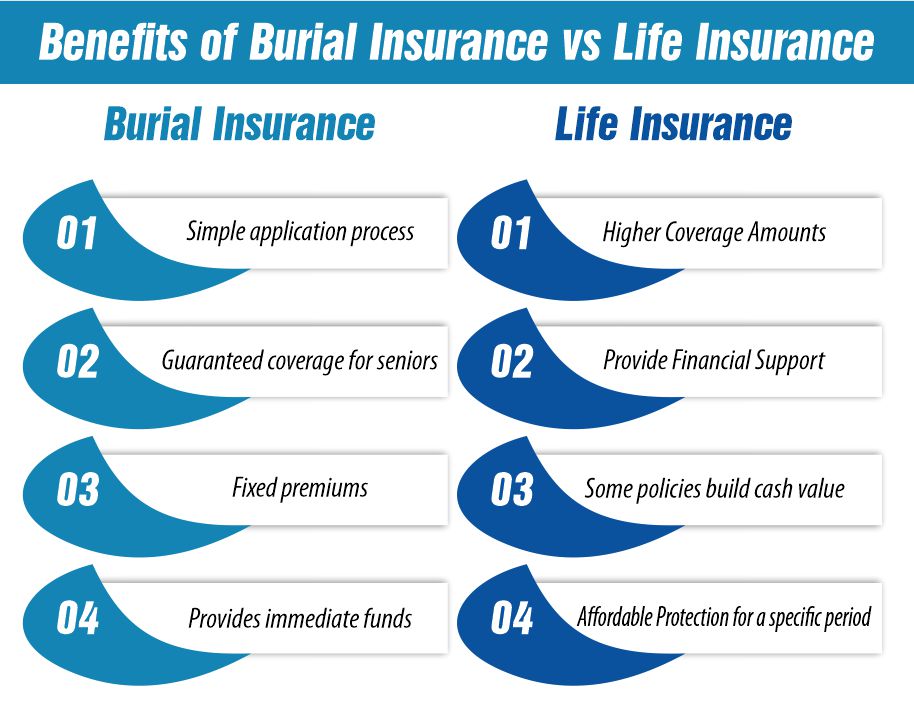

Burial insurance offers policyholders a specific range of monetary benefits between $5,000 and $25,000 to pay for funeral expenses and burial costs and essential end-of-life expenses. Burial insurance serves as the best choice for people needing limited financial protection because it provides enough funds to support their family through funeral expenses.

The coverage amount provided by life insurance policies stretches from $50,000 to numerous millions of dollars. The purpose of life insurance is to protect beneficiaries financially so they can handle house payments and pay off debts and maintain income during tough times as well as address other extended financial requirements.

Burial insurance maintenance costs remain fixed so policyholders do not face increasing expenses over time. Policies provide lifetime benefits to policyholders when they keep paying their premiums and reject medical assessments to ensure broad accessibility for seniors and persons with health issues.

Life insurance, on the other hand, offers different types of coverage. Whole life insurance creates a growing cash value reserve that policyholders can take loans from or make withdrawals from whenever necessary. Term life insurance exists as a less expensive option yet it only protects policyholders during limited periods of time such as 10, 20 or 30 years without accumulating cash value.

Burial insurance remains an accessible type of coverage because the majority of providers do not need medical evaluation for their policies. The majority of providers sell simple issue or guaranteed issue policies requiring minimal health questions from applicants or no questions at all. The minimal eligibility requirements for burial insurance create an excellent insurance opportunity for people who have existing health issues.

The underwriting process necessary to get life insurance policies extends much further than burial insurance requirements. Both term and whole life insurance policies need applicants to pass medical examinations so their age, health background and lifestyle choices and tobacco usage determine both premium costs and policy acceptance. Individuals in poor health would encounter elevated premiums or insurers may totally deny them coverage.

Burial insurance requires higher premiums compared to policy coverage because it gives automatic acceptance and performs minimal checks during the application process. The price range for burial insurance policies which offer coverage between $10,000 and $20,000 extends from $40 to $100 per month based on the applicant’s age and health condition.

Term life insurance offers the best affordability when people purchase high coverage policies because it starts at $20 per month for $100,000 of benefits for those in good health. The high cost of whole life insurance surpasses $100 per month in premiums because it provides enduring protection together with accumulating cash value benefits.

The decision between burial insurance and life insurance depends on various factors such as financial requirements and spending capacity along with long-term planning. Loved ones will stay financially unburdened by funeral costs when burial insurance serves your purpose. Life insurance provides better financial coverage for families when broader protection is what you require.

You need to examine how your current financial state along with your upcoming requirements will influence your choice between burial insurance and life insurance. Choose burial insurance or life insurance based on four essential factors: your age followed by health status and financial obligations as well as coverage needs. Burial insurance serves as an easy approach to cover funeral expenses while freeing your family from financial responsibility.

The protection you need depends on your family situation because dependents and debt or long-term commitments would benefit from the expanded coverage of life insurance. Examine both the premium costs and policy term as well as the type of benefit accumulation when deciding between insurance plans.

The purpose of burial insurance exists to protect funeral expenses and end-of-life costs for elderly people who want their family to avoid financially burdening their passing. Most burial insurance policies feature simplified or guaranteed approval terms which makes them a beneficial choice for people with health issues who cannot obtain traditional life insurance.

Burial insurance works for people wanting coverage which focuses on funeral expenses along with burial or cremation arrangements and medical debt payment.

Life insurance suits people wanting to give their family members major financial assistance following their death. The coverage type serves people who have dependents including children and spouses since it replaces their income stream and handles mortgage payments and debt obligations and provides monetary support for educational costs such as college tuition.

Working adults with an interest in long-term security choose term and whole life insurance policy options. Whole life insurance provides an additional benefit to policyholders by developing cash value that grows over time.

The financial protection available from burial insurance shares some characteristics with standard life insurance yet has specific advantages alongside restrictions. The different features of burial insurance and life insurance will aid your decisions based on your specific needs.

Both burial insurance and life insurance serve different financial purposes. Burial insurance exists as a straightforward option which helps seniors and others protect their last expenses. Such insurance provides limited payment coverage and a straightforward approval process. Life insurance provides extensive financial security thus making it the preferred option for people who need to protect dependents and substantial financial responsibilities. Comparing the important distinctions between these policies will assist you in selecting the most suitable policy according to your individual requirements and financial limitations.

Burial insurance serves as a particular form of life insurance which specifically addresses funeral and death-related costs. Life insurance policies provide greater coverage benefits which help families pay for dependents and uphold debts and other relevant expenses.

Burial insurance provides low-priced coverage through its limited benefit amounts. Purchasing term life insurance at a younger age will make it more affordable. Burial insurance costs substantially less money than whole life insurance policies that offer lifetime protection benefits.

The majority of burial insurance policies welcome potential applicants who have pre-existing medical conditions because guaranteed issue policies perform assessments without requiring health declaration questions. Life insurance needs either medical examinations or force higher premium costs because of your current health status.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes