Last Updated on: March 15th, 2025

Reviewed by Kyle Wilson

Are you looking for a way to help ease the financial burden on your loved ones after you’re gone? Aetna’s burial insurance offers a simple and reliable way to cover final expenses, so your family isn’t left handling unexpected costs. But what does Aetna’s burial insurance cover, and how can it give you peace of mind? Let’s explore the benefits and how it works to provide that extra layer of security.

Customized Options Await

Aetna is a top choice for burial insurance. It helps ensure that final expenses are covered, not leaving a financial burden on loved ones. Aetna is known for great customer service, fair prices, and strong financial health.

Aetna has many policies for final expenses, fitting different health needs and budgets. This variety offers many benefits, easing worries about funeral costs. Companies like Continental Life Aetna and American Continental, part of Aetna, have top ratings from A.M. Best for their insurance coverage.

Exploring Aetna’s options, we see a range of policies. From level benefit plans to modified ones, they aim to cover burial costs. Knowing these details helps people make smart choices about their final expense insurance.

It can include virtually everything, including paying for funeral services. There are so many expenses when one dies apart from the funeral costs that are associated with it. Your family also has to pay unpaid bills such as car loans and credit cards. Parents understand that relatives may spend money on transportation and will have to stay in a hotel at their own expense and food expenses. Sometimes, you might want to ask yourself whether you will assist your family to pay for those things when you purchase a policy. Determining the real price for a funeral may also mean paying for the casket, embalming, pick up of the body, the funeral service, and other services that you may have not known existed.

Aetna Inc. is among the biggest insurance companies in the United States of America that was established in 1853. Originally operating in the healthcare sector, Aetna has been a financially strong company for many years and has fulfilled its obligations. What many people may not be aware of is the fact that Aetna offers an affordable solution while creating a funeral and burial expenses fund. They will ensure you they will pay up your claim the one time you find yourself on the receiving end.

To clarify, Aetna has two affiliates that actually write their burial policies: continental life insurance and American continental insurance.

Continental Life Insurance Company (CLI) began in 1983 and was a support team of Aamp; E senior supplemental coverage. ACI was incorporated in the year 2005. They got affiliated with the Aetna group of companies in the year 2011. CLI was given an A (Excellent) by A.M. Best together with ACI.

Aetna’s three final expense whole life insurance plans help ease the financial burden. However, among the three plans, the most beneficial is the level-benefit plan. This plan comes with first-day coverage, and the pricing is competitive. The graded plan is best for some health issues.

We do not recommend the modified plan for seniors because it has a two-year waiting period. Seniors will be better off with a guaranteed issue of life insurance compared with this plan. A guaranteed issue policy will accept all applicants regardless of their medical condition.

The rates of Aetna final expense insurance depends on your date of birth, gender, medical history, tobacco usage, state of residence, and the sum of insurance. Here is the table showing some of the sample burial insurance quotes for their program.

Age & Gender | $5,000 | $10,000 | $25,000 |

Female age 45 | $15 | $26 | $59 |

Male age 45 | $17 | $30 | $70 |

Female age 50 | $15 | $27 | $63 |

Male age 50 | $19 | $34 | $81 |

Female age 55 | $19 | $34 | $81 |

Male age 55 | $24 | $44 | $105 |

Female age 60 | $22 | $41 | $96 |

Male age 60 | $27 | $51 | $123 |

Female age 65 | $26 | $48 | $114 |

Male age 65 | $31 | $58 | $140 |

Female age 70 | $31 | $58 | $140 |

Male age 70 | $38 | $73 | $178 |

Female age 75 | $40 | $76 | $184 |

Male age 75 | $52 | $101 | $248 |

Female age 80 | $52 | $101 | $248 |

Male age 80 | $72 | $140 | $345 |

Female age 85 | $70 | $137 | $336 |

Male age 85 | $100 | $196 | $484 |

Female age 86 | $87 | $171 | $423 |

Male age 86 | $120 | $236 | $585 |

Female age 87 | $104 | $205 | $686 |

Male age 87 | $140 | $277 | $686 |

Female age 88 | $122 | $241 | $596 |

Male age 88 | $160 | $317 | $788 |

Female age 89 | $139 | $275 | $683 |

Male age 89 | $181 | $358 | $889 |

Pros

Cons

Pros

Cons

Pros

Cons

Aetna burial insurance is a whole life insurance product which is underwritten by responses to the health questions and no medical exam is necessary. This is one of the simplest ways to qualify and the only thing that they expect out of you is that you answer a few health questions. It will be covered for life, the amount you will be charged for premiums will remain constant, and there will be cash value accumulation.

In the event of your death, specified beneficiaries of Aetna will receive a tax-free cash benefit. There are no limitations on how your loved ones spend the money by the end of the month. That means the money can be utilized to pay the outstanding funeral costs, medical bills, credit card bills or anything else. Moreover, in case there are remaining balances after final costs have been made, then they are entitled to it.

You still always have the right so they call it the “Surrender” policy. The insurance company will then cut you a check for the total cash value accumulation less loans or interest. If you do this, your policy ends, you don’t have any more premium payments to make and they don’t have any more coverage to offer.

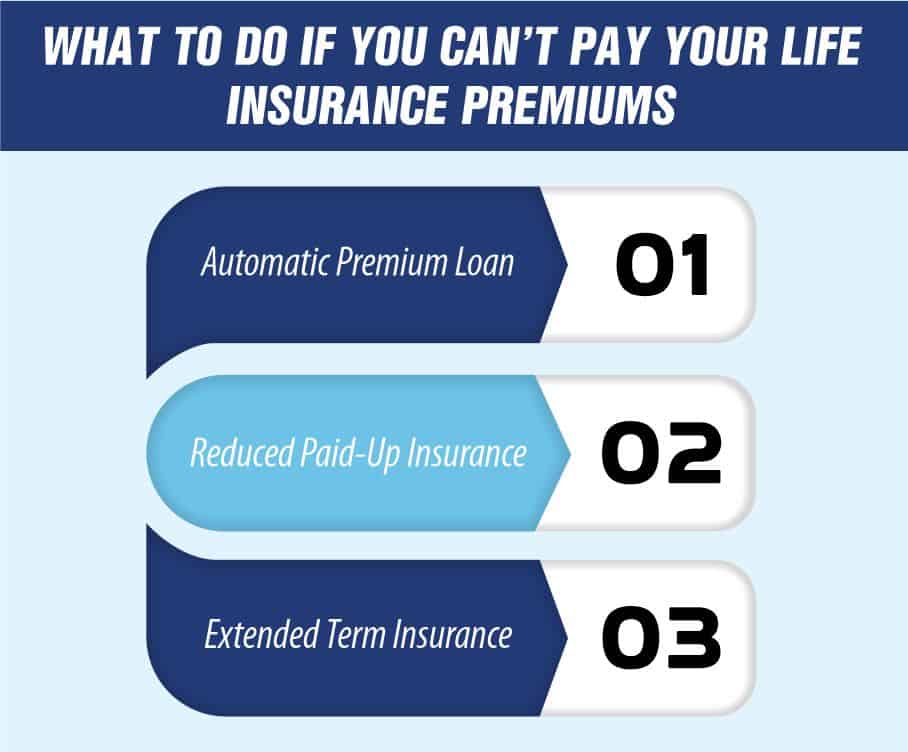

If you would like the money to continue some life insurance, you have the option of continuing your life insurance in three methods. These are called “Non-Forfeiture Options”.

Aetna will give you all three options at no additional charge.

The amount can be allowed to be used to pay for premiums – through the cash value of the policy. This option can be chosen while filling in the application form. If the premiums have not been paid Aetna will automatically use the cash value to pay the premiums to prevent this from lapsing and this will continue until all the funds are used up completely. At other times, a person may not even realize that the premiums are due. For instance, let’s assume that the individual caught an illness and has been confined in a hospital for part of two months. Not everybody has somebody else who can deal with it when she or he can not do it herself or himself.

If you don’t scrape together that amount and then die, the sum that you owe outstanding will cut down the payout to the amount you named your beneficiary. This feature is quite a useful one but it should be utilized sparingly and only in an emergency. If you buy a small whole-life policy later in life and depend on it for savings, be careful. To build up a fairly nice amount of cash value takes an extremely long time. As a rule, this strategy is applied when purchasing a whole life with children or purchasing a large amount of whole life insurance for future income and estate planning purposes.

Aetna will essentially take the cash in your policy and use the lump sum to purchase smaller death benefits. You will have that policy forever and never have to pay another premium.

This means your death benefit stays the same, but the policy will only last for a specified time.

Burial insurance through Aetna is a good investment that serves as a plan for the future so as not to burden your family financially. Given that it offers absolute information and simple options, it is very convenient to select a plan that would suit. Isn’t it comforting to be certain that a loved one will be taken care of when you are no longer there to provide for them?

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes