Last Updated on: March 15th, 2025

Reviewed by Kyle Wilson

Are you worried about the high costs of funerals? Discover the best free burial insurance options for seniors. It’s always comforting, for seniors and their families, to know that they have an insurance policy to cover expenses such as a casket, funeral, and burial plot. To answer the question of whether the best free burial insurance for seniors is available, or which policy is the most beneficial for seniors, this article compares the insurance policies available.

Customized Options Await

Free burial insurance does not exist. To get insurance, you need to pay for it if you want insurance to meet your funeral expenses.

Fortunately, final expense policies were created especially for seniors with a limited income, thus, they are cheap.

People should be wary not to fall for these faked ads that you see so often in the mail and on Facebook.

It is crucial to note that there is no free burial insurance for senior citizens but there are ways that can be accessed to finance burial costs or lessen the load on the families.

Although there is no best free burial insurance for seniors, considering such opportunities is to maintain costs and ensure that the remainder does not impose significant expenses on the remaining family members.

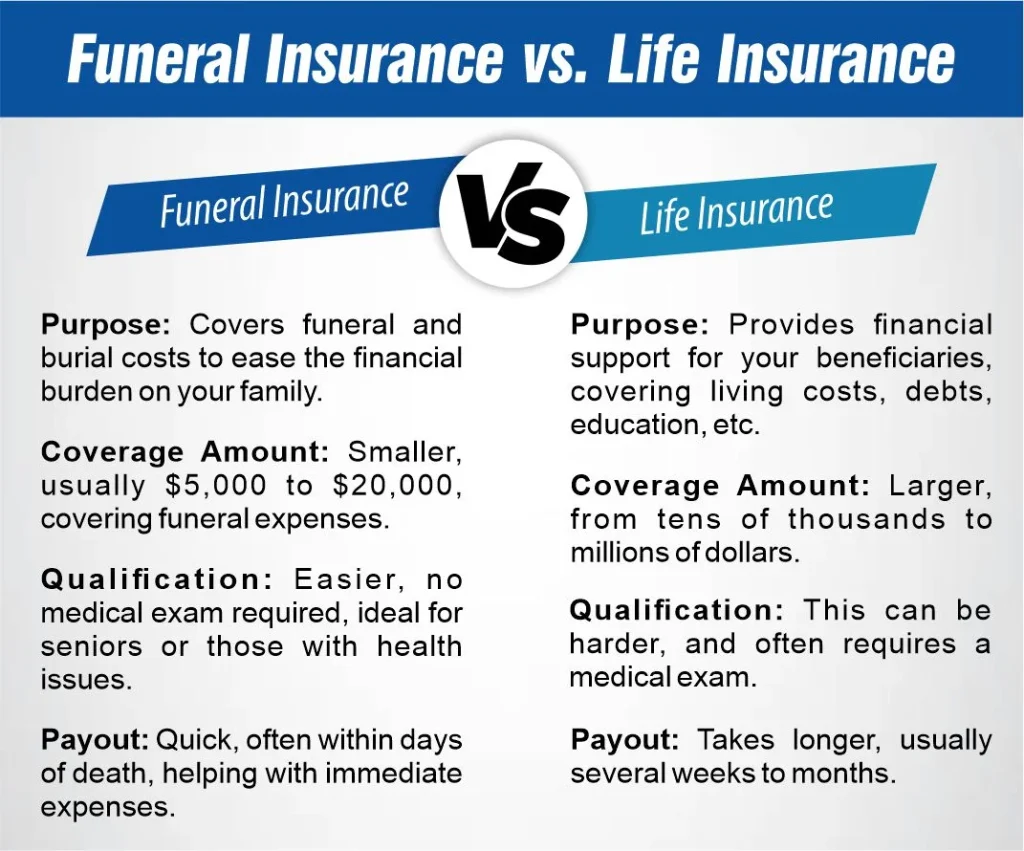

Final expense or burial insurance is another type of life insurance that is suitable for seniors. The insurance assists in paying for any funeral-related expenses to relieve financial and planning stress on the survivors. Insurance plans cost between $18 and $286 per month for the elderly depending on the senior’s age, gender, health status, and desired level of coverage.

As is the case with ordinary life insurance, these funds can be used to pay for any other debts that the person left behind had when they died.

Depending on the insurance company, the policy type, and your health profile, the monthly premium could range between $18 to $286. Your rate will be cheaper if you’re in good health and can answer no to the health questions that appear on the application form. Some insurance companies may ask for a medical test when applying for the policy while others may not. If you have lost weight or have had some chronic illnesses or are on some medication, the insurance company may put you on a modified or even a sub-standard plan, and hence, your rates will be higher due to health problems.

In summary, funeral insurance is for covering immediate funeral expenses with quick payouts, while life insurance provides broader financial support for your family with higher coverage amounts and longer processing times.

Burial insurance coverage is available in many forms and seniors have a wide array of choices. When it comes to that assurance, it’s wise to compare quotes from at least two or three suppliers to get the best suited for your needs and pocket. You can also consult with an insurance agent who will look for the options on his initiative and present you with those he or she thinks are the most suitable for you.

It is therefore advisable for every senior citizen to consider funeral insurance when planning for their funeral. Funerals are costly and will leave your family in a very expensive position if you don’t make adequate preparations, this is not something anyone should have to experience especially during the time of mourning a family member or friend. To help ease the burden for your family member, it’s important to consider funeral insurance as one of the planning things to do when other preparations for the end of life are being done:

Our company helps to find the best free burial insurance for seniors without the hassle. Here’s what we do:

We’re here to make sure you get the right insurance without stress.

It is very difficult to find the best free burial insurance for seniors, however, there are a lot of cheap policies, governmental aids, and ways of payment that can reduce the costs. For seniors, burial insurance may be an option if they have very little income and few assets; it pays for expenses. This is why seniors should plan for the future so that they can have 10% of their money set aside to cater for burial costs as this will enable them to get the best burial insurance that will meet their needs.

A final expense policy can offer peace of mind and ease the financial burden on your family while they’re grieving. And since it usually doesn’t require a medical exam, it’s a good option if you have a pre-existing condition that prevents you from getting a traditional term or whole life policy.

The cheapest funeral options are usually direct burials or cremation without embalming or a funeral service. These options can be thousands of dollars cheaper than traditional funerals.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes