Last Updated on: March 20th, 2025

Reviewed by Kyle Wilson

Every year, scammers across the world target unsuspecting, vulnerable populations to extort money, information, and personal data they can use. Unfortunately, this occurs in the funeral industry as well. Imagine planning for peace of mind, only to discover you’ve been swindled. Scary, right?

We understand the frustration and anxiety that come with trying to navigate the confusing world of funeral, burial, and life insurance.

We’ll guide you through each step, ensuring you find a plan that perfectly fits your financial needs and budget to avoid the scam. Also, we will discuss funeral insurance scams and how to protect from these scams. Let’s start with us.

Customized Options Await

A pre-paid funeral package scam happens when you pay in advance for funeral services, but the company doesn’t deliver or vanishes. They offer what appears like cheap prepaid funeral products but offer few or no services when these are required most. The scammers are the ones who get paid and are never seen again. These funeral insurance scams take advantage of people trying to plan.

Pre-paid cremation package scams are similar. You pay upfront for cremation services, but the services aren’t provided, or the company disappears. Criminals use this technique to lure unsuspecting families by offering cheap prepaid cremation services compared to other standard market prices. Nevertheless, when a cremation service is required, they do not offer any services and take the money with them.

Like every business, frauds are also common in the funeral insurance market. Here is the most common funeral insurance scams that you will probably come across:

This is one of the oldest funeral insurance scams that are around and common in the insurance industry. The funeral insurance scam is one where you receive a call or an email that offers to sell you insurance on the phone without asking a single question. It’s all low price that you agree to sign up. However, coverage does not start until you are sixty-five; the premium increases every five years, or even earlier; either you cannot afford the insurance, or your family gets significantly less than initially agreed.

Do not agree to work with an unknown company that contacted you randomly or an email you received from their spam mailbox. However, if you are to undertake the purchase of funeral insurance from a reputable company, make sure to look at the fine print to find out what is being offered to you. Before enrolling in any of these plans ensure that you get to know the waiting periods, the time your premiums will be increased, and the amounts you will be paid in case of an accident. Realistic funeral insurance can be of great help, but beware of the frauds that exist currently. Do your research.

I’m not a fan of the phrase ‘Everything’s possible’, or its opposite ‘Nothing is impossible’ I think that people should learn how to say ‘No’

If you believe a funeral director or cremation provider scammed you, stay calm and take the following steps:

Contact the funeral director, it is the best way to get to the funeral director. Please describe, and where necessary, explain in detail how you think you were let down or tricked. Any decent funeral home will have no qualms about correcting a mistake if that is what happened here. This would involve noting the identity of the person you talked to, as well as the mutually accepted course of action.

If the firm remains difficult to deal with or refuses to make corrections, file formal complaints with consumer protection groups:

The Consumer Protection Agency in Your state. The majority of the states have a functional and active consumer complaint procedure in place.

One of the organizations is the Funeral Consumer Alliance. As advocates, they keep records of the complaints most frequently received by funeral homes.

The Federal Trade Commission, commonly known as FTC, is the main regulatory body that oversees the enforcement of antitrust laws. FTC is the agency responsible for consumer protection and fraud investigation.

Before seeking the help of a lawyer, it is advisable to try and solve the matter directly with the funeral establishment. This is the overview of all the unfair, deceptive, or fraudulent practices that need to be documented. An attorney may also assist in defining whether your consumer rights have been violated and whether legal approaches such as arbitration or legal action are possible.

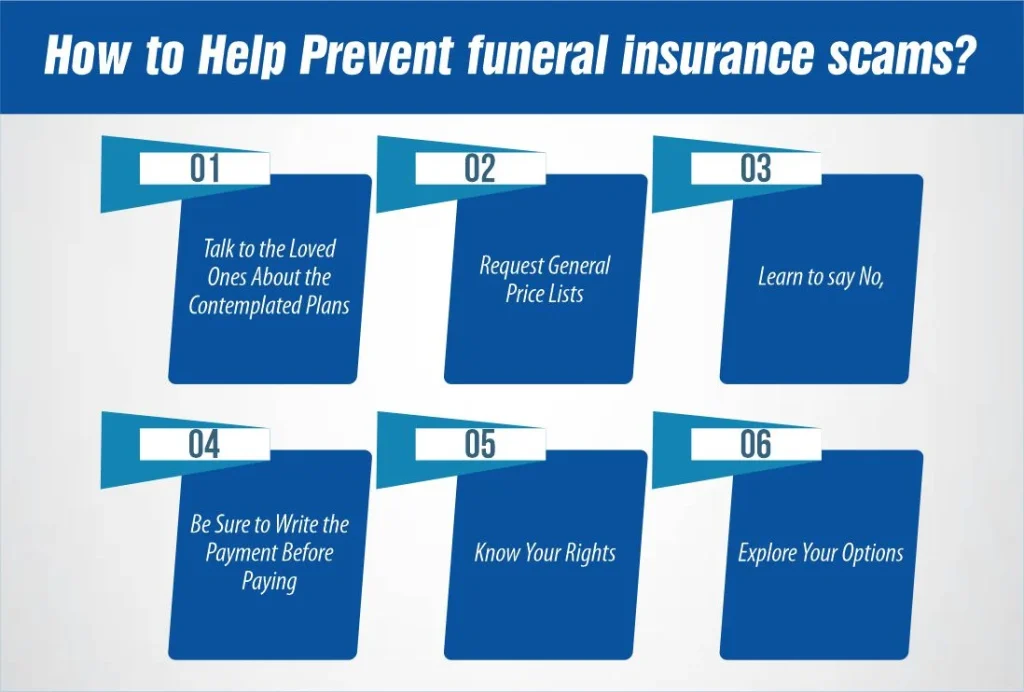

Funeral planning is a sensitive process, most people are vulnerable in the sense that they are mourning and want the funeral to be done as soon as possible therefore some people can take this chance and overcharge for their services or even force one to purchase things that are not needed. Here are some tips to avoid funeral insurance scams:

Trying to find an insurance policy if you want to avoid funeral insurance scams to preplan your funeral needn’t be a frustrating process; working with an independent agency like Burial senior insurance will make the process easier and quicker.

We’ll assist you in finding a plan that fits your financial needs and budget. With our help, you won’t need to spend time searching for various insurance providers.

We secure the coverage you need at a price you can afford. If you’re looking for a funeral, burial, or life insurance to cover your funeral, contact us. We’ll make the process easy and stress-free.

Wondering how to protect yourself from funeral insurance scams? With our expertise, you’ll get the coverage you need without the hassle. Let us take the stress out of the process, so you can focus on what matters. Ready to get started? Reach out today.

References:

https://titancasket.com/blogs/funeral-guides-and-more/8-common-funeral-scams-and-how-to-avoid-them

https://funeralfunds.com/funeral-scams-to-watch-out-for-how-to-protect-yourself/

https://amac.us/blog/finance/funeral-scams-and-how-to-avoid-becoming-a-victim/

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes