Last Updated on: March 13, 2025

Reviewed by Kyle Wilson

Burial insurance with pre-existing conditions, for most people, might sound like the last thing one needs to get life insurance. However, it may be the best final expense alternative. Burial insurance also commonly known as final expense insurance is created for people who cannot qualify for standard policies due to old age or some pre-existing health issues. These insurances pay the expenses of a funeral and burial so that if another family member dies, he or she is not shocked to discover the costs of something that he or she never anticipated.

Get Free Quotes

Customized Options Await

A pre-existing condition is a medical condition you have at the time you enter an insurance program. Examples include diabetes, heart disease, cancer, and liver disease. Pre-existing conditions can be required in determining if you are qualified to purchase or continue to have a traditional life insurance plan, and what your premiums will be. Burial insurance companies, however, are more open-ended since most people want such policies because they always have some kind of health issues.

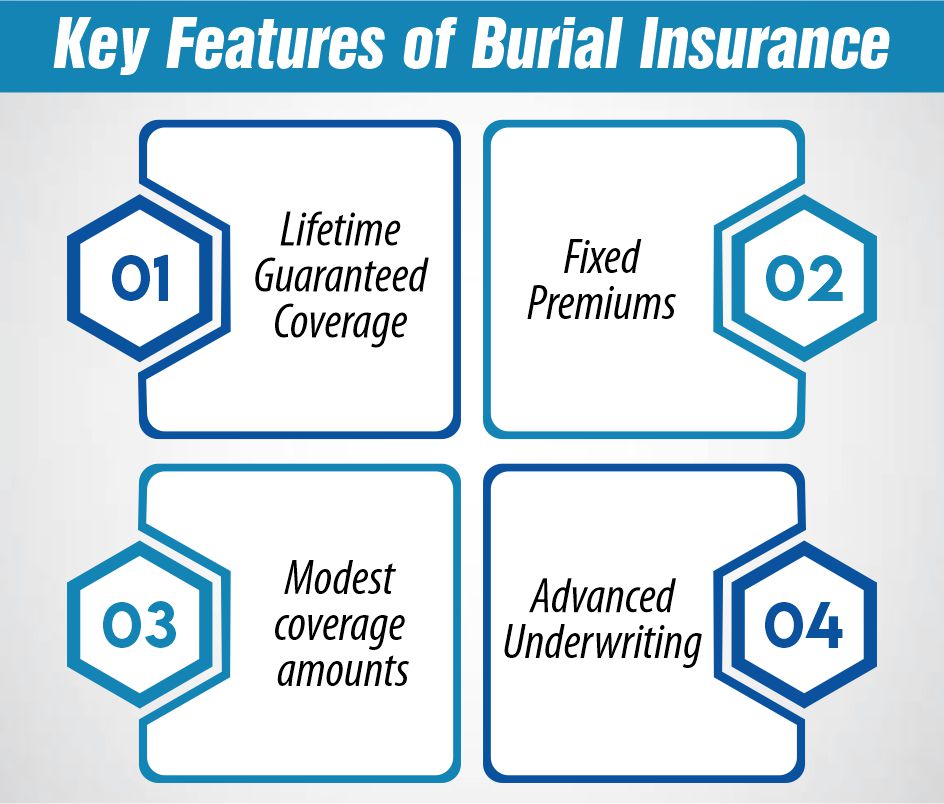

Burial insurance is typically a whole-life policy, albeit one that only lasts as long as the person is insured-that is, as long as the premiums are paid. It’s marketed mainly to older adults, requires no medical exam, and only a few questions about health status in some cases. The amounts available for coverage are limited, often $2,000 to $40,000, which may be peanuts for financing final expenses and thus the expense of a funeral.

Since burial insurance is whole-life coverage, the cover does not expire and the premium rates are consistent throughout life. A tax-free amount is paid to the beneficiaries in a lump sum that is given to them with no restraint from the insurance company on how it is to be used for funeral expenses, unpaid medical bills, or other financial obligations to be fulfilled following a loss.

To help clarify what burial insurance entails, let’s look at some of its main characteristics:

Such insurance is most targeted at elderly persons, especially those with health concerns that would see them disqualified from traditional life insurance. It also offers assistance to people who would want something simple, little, and less burdening, covering the minimum end needs without extensive medical scrutiny. This will be insurance that helps a person and his family know help will be there when they need it to pay for funeral and burial costs.

Two types of life insurance, which are traditional and burial. Traditional tends to be quite strict, where they would ask for a medical exam plus detailed information from the health questionnaire of the policyholder. Burial insurance is not that tight, however, on this regard. For them, the underwriting process would be simplified, with just a few questions, usually on a short questionnaire.

Let’s first look at two of the major types of burial insurance policies and their approaches to underwriting.

Simplified issue burial life insurance plans involve answering a short series of health questions. Once you qualify, there is no waiting period, and the coverage comes into force immediately after the first premium payment. So, this type of plan is very often available if you have mild pre-existing conditions, such as controlled diabetes or high blood pressure. In such plans, the insurance company has some information about you related to health and so has somewhat less risk. This makes the policy cost-effective.

Guaranteed acceptance policies do not require any health questions or medical examination. Approval is guaranteed; however, a waiting period usually exists. This two-year period means that if the insured dies of natural causes within the first two years, only a portion of the death benefit is paid out unless the death is accidental. Because insurers lack health information for these applicants, these policies come at a higher premium. This option usually suits people with grave medical conditions who are very likely to be disqualified from other related covers.

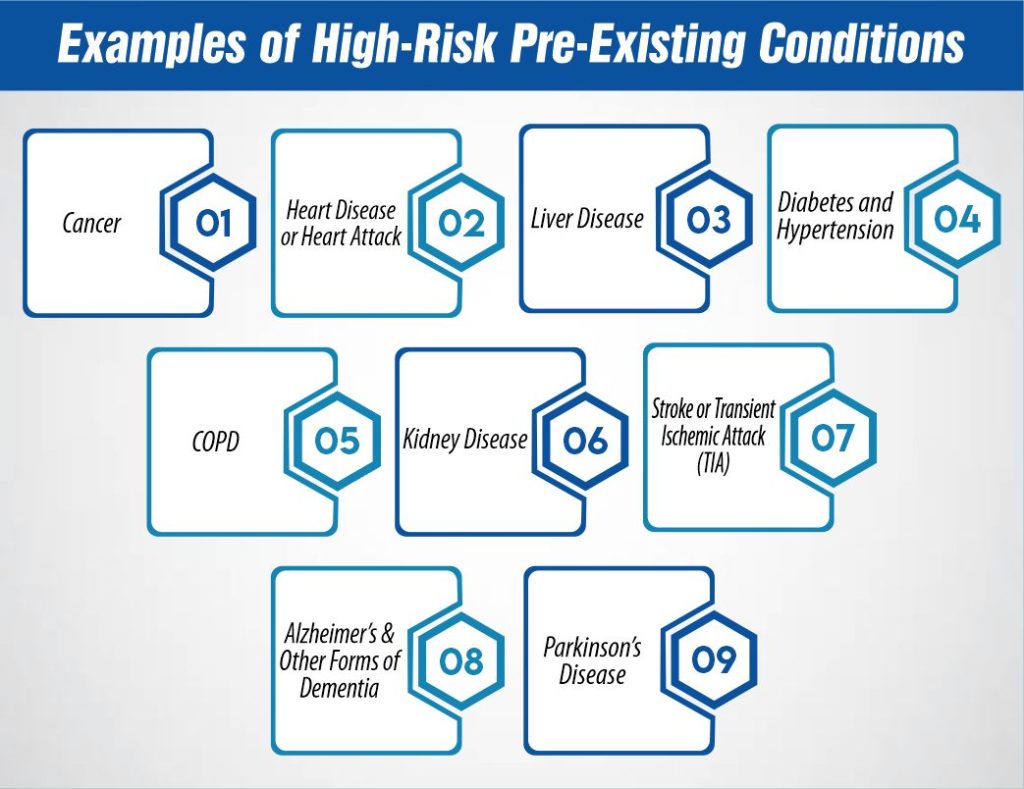

There are also certain health conditions that insurance companies might classify as “high-risk” in the context of burial insurance, therefore further limiting your chances or putting in additional risk when other factors are used to determine eligibility. Premiums for such insurance products also go up in the case of high-risk conditions. Many people with health challenges, however, find coverage with designed policies. These are some additional more common high-risk pre-existing conditions and how they could impact your burial insurance options.

Applicants who have survived cancer tend to be considered high-risk. On the other hand, though, certain burial insurance programs do offer coverage to people who have recently had cancer treatments. In some cases, insurers can even offer a return of premium benefit which means, that if you go cancer-free for some specified duration, you will be able to get a percentage of your paid premiums.

You get categorized under high-risk criteria; heart disease gets you into that category, more so if you already had a heart attack. You can be sure that your premiums are going to be higher, but usually, most companies will still sell you a policy. However, it will come with a waiting period. If you have a well-managed heart condition, then you are likely to find one of these plans with more relaxed restrictions.

High-risk signals are mainly conditions like hepatitis or cirrhosis. The liver disease would significantly impact cost and eligibility, but there is also special coverage for one with liver conditions coming from specific insurers, and this may include the waiting period to balance the risk for the insurer.

These are very common medical conditions. With the right medication and lifestyle modification, diabetes and hypertension are quite easily managed. A lot of underwriters do offer to cover these conditions if controlled and well-managed. Nonetheless, one should always check with the providers, as how bad these conditions are may determine the rates and waiting periods.

COPD is a chronic lung disease, and finding affordable burial insurance for an advanced case is pretty tough. However, some insurance companies are willing to go with such persons, but they do have a waiting period attached to it. Those with relatively less severe COPD can even manage to find a slightly more flexible option.

Another condition often associated with a high risk is kidney disease, especially if you’re on dialysis. Some insurers do sell plans to individuals with kidney problems, but you’d likely pay a higher premium or possibly experience a waiting period.

If you suffered a stroke or TIA, many insurance companies would view this as high-risk since it increases the possibility of relapse. Most burial insurance providers offer stroke survivors coverage; however, they often apply a waiting period, especially for those whose cases are recent.

Cognitive conditions include the likes of Alzheimer’s disease and other forms of dementia, which are generally considered high risk because they normally deteriorate with time. Such conditions usually imply that you will not qualify for most policies; however, some insurance companies may offer minimal or even guaranteed issue coverage.

People with Parkinson’s disease are at a considerable disadvantage with respect to ensuring that they have burial insurance owing to this disease’s progressive nature. Nonetheless, most insurers are relatively willing to cover it if the condition is early enough.

Different burial insurance companies, such as Family Heritage or Guardian, provide plans that cover high-risk health persons. You should think of several plans and compare the costs with your health profile and budget. So, for a high-risk condition, there could be some waiting periods, and, sometimes, benefits are limited; however, you can still take care of your family and cover their well-being by picking the right plan.

Understanding the options and careful comparison of burial insurance policies will therefore be able to enable high-risk applicants to obtain a scheme that balances both affordability and peace of mind.

For one person who possesses already present medical conditions, eligibility into the scheme of burial insurance can be smoother than expected. There are ways in applying to it, which have to be considered as a step-by-step process when applying:

These are some of the pre-existing conditions and how common ones affect burial insurance.

The most important thing that any individual can do is to get quotes from a couple of insurance companies. Already, there is a difference in the rates that companies like Chesapeake and Conseco charge for burial insurance. Plus some providers are more lenient than others with pre-existing conditions, so by getting a quote from a couple of different places you can find the best rate based on your health profile. You’ll find that some will offer you more flexibility over your age or even some extra benefits to suit your needs.

The first thing any person needs to do is compare quotes from a few different insurance companies. Already, there is a difference in the rates that companies such as Chesapeake and Conseco offer for burial insurance. Also, some providers are more lenient than others with pre-existing conditions, so by getting a quote from a few different places, you can find the most affordable rate for your health profile. You will also find out that some of them provide you with more flexibility over your age or even offer some extra benefits to suit your needs.

There are a variety of burial insurance policies, and it matters which one you settle for. If you need coverage without a waiting period, a “simplified issue” policy would be best. They mainly ask a few health questions and may carry some more premiums compared to others. However, if you are not healthy and do not mind waiting for a few minutes before being covered, “guaranteed acceptance” plans may best fit the bill for you. These plans don’t require health questions or exams, so they can qualify more easily.

Consider the amount of coverage your family may require. In case you are targeting minimal funeral and burial expenses, a smaller policy will be sufficient for you. If you want to leave at least something to your family when you die, then consider policies that have a higher amount. There are various kinds of add-on benefits of burial insurance policies. Some of the extra funds pay for your medical expenses before you die, while others help your family pay for immediate expenses after your death.

Many of these burial insurance policies carry a waiting period, especially if for high-risk applicants. A waiting period simply means the coverage won’t be at full capacity immediately; usually, it takes two to three years. In case you die while under the waiting period, the insurance may only pay partial benefits or refund premiums. Always ask about the waiting period so you would exactly know when the full benefits will kick in.

Moreover, consider the long-run cost of your plan. Some policies have low premiums but increase with time. Other policies might be a little more costly initially, but the premium remains constant until the end of the policy. If budget is what you are concerned about, then fixed premiums would be better because you will be aware of exactly what to expect in monthly costs.

An insurance company with a good record of customer service and reputation is the best. Companies such as Family Heritage and Guardian are successful in working with those who have pre-existing conditions, but make sure you’re comfortable with their level of customer service. This can be especially pertinent when your family needs to get in touch with the company to get help with claims.

It’s also useful to know how quickly an insurance company will pay out the benefits. Of course, some are quicker than others; however, this is crucial for families who’ll need to cover some immediate bills. Some providers include plans with an advanced benefit, meaning that they pay out part of the death benefit up front to facilitate some funeral-related expenses. This feature takes the financial weight off your family’s back at a very sad time.

Some burial insurance policies contain extended coverage provisions, such as counseling support for family members, travel arrangements for family going to the funeral, or inflation protection whereby the payout keeps up with rising costs. All these extra features could make a plan more valuable and give your family even greater peace of mind.

If you have no idea which may be the best for you, think of an independent insurance agent or broker who specializes in burial insurance. This will help to walk you through policies that will fit both your health and financial needs. In most cases, as an independent insurance agent, he may have access to a myriad of providers. This will enable him to explain more in-depth policy details such as limitations or benefits specific to your choice.

Carefully read and understand all the terms in the policy of your insurance, including any exclusion, limitation, or change that could influence your coverage over time. It will help avoid any surprises later on, and when that time comes, your family will get all the benefits they deserve.

Burial insurance is more practical for people who do not want to be covered and for those with health conditions as their limitations. It is less complicated and more accessible than traditional life insurance, providing vital funds at the time of death to cover final costs. While pre-existing conditions may affect premiums or even come with a waiting period, there is hardly an insurance category as important for achieving peace of mind for the policyholder and the people he cares for as burial insurance. You can even get a plan that is suited to your particular needs by comparing quotes, reviewing options of policies, and consulting advisors.

Yes, many insurance companies provide burial coverage to people with cancer. The ratings and eligibility vary based on the type and stage of the cancer.

Yes, people who have had a heart attack qualify for burial insurance. The premium of the policy or sometimes even the waiting period may be higher.

Absolutely. Burial life insurance is created for the elderly, even for those with pre-existing health conditions.

Some companies like Family Heritage do offer a return of premium if you are cancer-free.

No. This varies. Some simplified issue policies may require health questions, but guaranteed acceptance policies will not.

Senior Writer & Licensed Life Insurance Agent

Iqra is a dynamic and insightful senior writer with a passion for life insurance and financial planning. With over 8 years of hands-on experience in the insurance industry, Iqra has earned a reputation for delivering clear, actionable advice that empowers individuals to make informed decisions about their financial future. At Burial Senior Insurance, she not only excels as a licensed insurance agent but also as a trusted guide who has successfully advised over +1500 clients, helping them navigate the often complex world of life insurance and annuities. Her articles have been featured in top-tier financial publications, making her a respected voice in the industry.

Burial Senior Insurance provides information and services related to burial insurance for senior citizens, including policy options and end-of-life support services.

Copyright © Burial Senior Insurance 2025. All Right Reserved.

Get Free Life Insurance Quotes